Gmail's latest feature, personalized smart replies, aims to enhance your email experience by mimicking your unique writing style. This update promises to make your responses feel more authentic and tailored, simplifying communication while preserving your voice.

Nike stock has shown resilience, indicating a potential turnaround. With innovative product launches and a renewed focus on sustainability, the brand seems poised for growth. Investors might just witness the mother of all comebacks unfold.

Looking to save on your next Uber ride in 2025-2026? Using a referral code can help you grab discounts and perks. Simply enter the code during sign-up or in the app to enjoy your rides at a fraction of the cost while sharing the benefits.

Ford remains committed to its battery factory plans despite potential Republican efforts to eliminate related tax breaks. This decision underscores the company's dedication to sustainable innovation and long-term growth in the electric vehicle market.

In a recent interview with Hard Fork, OpenAI's Sam Altman shared invaluable insights on AI's future, emphasizing safety and collaboration. He highlighted the importance of responsible development, urging a balanced approach to tech innovations for society's benefit.

Goodyear's stock soared 28% in 2025, sparking conversations about its growth potential. Investors are intrigued-will this momentum continue? With innovation and market demand driving the tire industry, the future looks promising. Stay tuned!

In today's banking landscape, several regional banks are making waves with significant buyback initiatives. Institutions like First Horizon and UMB Financial are not only reflecting confidence in their financial health but also signaling strong investor returns.

Brookfield has officially acquired Barclays’ payments business, marking a significant expansion in its financial portfolio. This strategic move highlights Brookfield's commitment to tapping into the growing fintech sector and enhancing payment solutions.

In a surprising move, a major bank has announced the closure of 20% of its locations, a shift reflecting changing customer habits and digital banking trends. While this may streamline operations, it raises concerns about accessibility for many longtime clients.

Condo sales have plummeted to their lowest levels in recorded data, while supply has surged to heights not seen since the housing bust. Single-family home sales are also trailing behind 1995 figures, with inventories at a peak since 2016.

In evaluating the FBY strategy for holding META, it's clear that this approach may not align with optimal investment practices. While it offers potential short-term gains, the inherent volatility and lack of long-term stability make it questionable for serious investors.

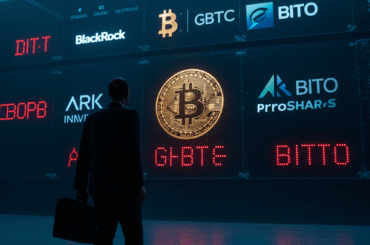

The Senate has approved a landmark bill establishing rules for cryptocurrency and stablecoins, signaling a significant step towards regulation in the digital finance sector. This new framework aims to enhance consumer protection while fostering innovation.

While VGT tech has shown promise in improving user experience, the lack of a high-quality display remains a significant hurdle. A better screen is essential for fully realizing the potential of passive technology and enhancing visual clarity.

Analysts predict Meta could soar to $800 as it continues to innovate and expand its portfolio. drivers include advancements in AI technology and an increase in advertising revenue. Investors should watch for these developments to fuel potential growth.

In the digital age, exploring diverse perspectives is essential. Here are six thought-provoking links I found particularly insightful. Each offers a unique lens on current events, culture, or personal development. Dive in and enrich your understanding!

Vertiv is experiencing robust growth, driven by the increasing demand for data centers. As businesses shift towards digital solutions, Vertiv's innovative infrastructure products ensure reliability and efficiency, positioning the company for continued success.

In Q1 2025, the AMG GW&K Municipal Bond Fund navigated a dynamic market landscape, focusing on quality issuers and strategic allocations. With engaging performance and a keen eye on interest rates, we remain committed to delivering value to our investors.

In the intricate dance of political finance, many Californians may wonder if they're inadvertently footing the bill for Trump's ventures. From campaign expenditures to inflation's impact on taxes, understanding where their money flows is crucial for informed citizenship.

Devon Energy stands out as a compelling capital return play. With its strong focus on shareholder returns through dividends and share buybacks, the company effectively balances growth and income, making it an attractive option for investors seeking reliable returns.

Hogs are marching higher as we head into the weekend, buoyed by fresh enthusiasm in the market. With contract highs being reached, it's an exciting time for producers and investors alike, signaling potential for continued upward momentum.

In a surprising turn, institutional Bitcoin ETF holdings have recorded their first quarterly decline, according to recent reports. This shift raises questions about market sentiment and the future of crypto investments. Investors will be watching closely.

When choosing between Dollar Tree and Dollar General, consider their growth potential and business models. Dollar Tree focuses on a single price point, enticing budget shoppers, while Dollar General offers a wider range of products and price tiers. Both have strengths!

Four states are urging the FDA to remove special restrictions on the abortion pill, mifepristone. Advocates argue that lifting these barriers would enhance access to safe and effective reproductive healthcare, reflecting growing demand for reproductive rights.

More people are using self-directed IRAs for real estate to diversify retirement savings. These IRAs offer tax benefits, rental income, and investment control. Investors can choose between residential and commercial properties. Choosing the right IRA custodian ensures compliance with IRS rules. Beginners can access information on how these IRAs work and what to avoid.

Owning a home comes with unexpected expenses that Realtors may not highlight. From property taxes and insurance to maintenance and utility bills, these hidden costs can add up quickly, making it essential for buyers to budget wisely before committing.

The revamped Chase Sapphire Reserve is making waves with its limited-time offer, featuring a generous 100,000-point bonus and a $500 travel credit. This makes it an enticing choice for frequent travelers looking to maximize rewards and experiences.

New York's PubBitcoin bar has become a haven for crypto enthusiasts, but its mission doesn't stop there. Next, it aims to spread the Bitcoin ethos to Washington, D.C., inviting policymakers to engage with the transformative potential of cryptocurrency.

In recent years, the Port of L.A. has felt the jolts of Trump's trade war, swinging from bustling activity to sudden slowdowns. Importers grapple with tariffs while exporters face retaliation, leaving a lasting impact on this vital gateway for commerce.

The House Agriculture Committee has taken a significant step by advancing a crypto market structure bill. This move aims to establish clearer regulations for digital assets, reflecting a growing recognition of the need for oversight in this rapidly evolving market.

After years of maintenance headaches, I decided it was time for a change. Buying a new car provided reliability, updated technology, and improved fuel efficiency. The peace of mind that comes with a warranty made the investment worthwhile. A new journey begins!