The USD/THB currency pair shows the exchange rate between the US dollar and the Thai baht. Knowing this exchange rate matters for travelers, businesses, and investors who use these currencies. Changes in the exchange rate affect purchasing power when exchanging or spending money. Many online tools are available to track the USD/THB rate and

Looking for the best joint accounts for couples? You're in the right place! In this listicle, we'll explore top options that cater to your shared financial needs. Get ready to find accounts with low fees, great rewards, and simple management features just for you two!

Looking for the best personal injury lawyer? This listicle highlights top attorneys who excel in compassionate service and proven results. You'll find essential info like their success rates, client testimonials, and unique specialties to help you choose wisely.

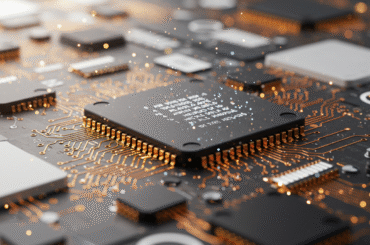

As Wall Street navigates the transformative wave of AI, job markets are feeling the strain, and stock valuations are becoming increasingly volatile. It's clear: the time to embrace this technology is now. The old rules are out, and the race to innovate is on.

In California, $2.3 million can open doors to diverse dream homes, from coastal retreats to urban hideaways. These properties often blend luxury, modern amenities, and unique architectural features, offering a glimpse into the state's vibrant real estate landscape.

As the relentless rise of AI reshapes market dynamics, I find myself questioning the wisdom of holding onto our S&P 500 position. The potential for volatility and disruption is higher than ever-sometimes, enough really is enough.

Introduction Cryptocurrency is no longer only for holding and waiting. There are ways to make your digital assets generate money over time. These opportunities are available to beginners and experienced users alike. By learning different strategies, you can increase your crypto earnings while managing risk. This article explores seven effective methods to generate passive income

Looking to invest in the booming healthcare sector? In this listicle, you'll uncover the best healthcare ETFs that cater to various investment strategies. Expect detailed insights on performance, fees, and potential growth—perfect for making informed choices!

As a stay-at-home parent, you can explore various passive income streams to boost your finances while juggling family life. From rental properties to print-on-demand services, these 9 ideas can help you earn without sacrificing precious time with your kids.

It's important to teach our loved ones how to spot scams as they get older. Talk to them often about the common tricks that scammers use, tell them to be suspicious of calls or emails that they didn't ask for, and help them set up financial protections to keep their money safe.

Feeling trapped by a Merchant Cash Advance? You're not alone. Many business owners face this burden. Here are six essential strategies to help you regain control, reduce payments, and explore alternatives that can alleviate the stress of high daily repayments.

In today’s market, finding undervalued dividends can feel like striking gold. Discover three standout stocks where you can buy a dollar's worth of dividends for just 60 cents. These bargains not only promise steady income but also potential for growth.

Looking to launch your LLC but unsure where? In our listicle, "Best States to Start an LLC," you'll discover the top states that offer favorable tax rates, business-friendly regulations, and a supportive environment. Get ready for valuable insights!

As December wraps up the year, it's the perfect time to reflect and celebrate. Consider sharing holiday traditions, year-in-review insights, or festive DIY projects. Engage your audience with seasonal recipes or cozy book recommendations to warm hearts this winter!

Elon Musk's support for DOGE could be good or bad for Americans. Some people save money by paying lower transaction fees, but the currency's volatility and uncertainty could cause others to lose a lot of money. It's important to find a balance between risks and rewards.

Looking for a getaway without the hassle of a passport? Discover 20 stunning island vacations right here in the U.S. - from the sandy beaches of Hawaii to the serene shores of the Florida Keys. Adventure awaits, and you won't need to leave the country!

The way people work from home is changing quickly as we look ahead to 2025. Flexibility is still important, and tech, finance, and healthcare jobs pay more. Companies are using hybrid models, which is changing the way work will be done in the future.

The Federal Reserve's decision to hold interest rates steady offers a unique opportunity for financial planning. Now is the time to reassess your budget, explore investment options, and consider how to optimize savings. Make informed choices to thrive financially!

Introduction A reliable budgeting plan can improve how you save money and reach your financial goals. The cash envelope method popularized by The Budget Mom offers a clear way to manage spending using cash and sinking funds. This system involves allocating cash into different envelopes for each expense category. This practice helps you see exactly

Introduction Zero-based budgeting (ZBB) is a budgeting approach where each expense must be justified and approved for every new cycle, rather than relying on previous budgets. This method requires detailed scrutiny of all costs and promotes more efficient money management. It helps businesses and individuals reduce unnecessary expenses and maintain closer control over their finances.

In an age where AI and automation threaten many jobs, certain side gigs remain resilient. Personal coaching, skilled trades, and creative arts thrive on human touch, empathy, and unique craftsmanship-qualities machines can't replicate. Embrace these opportunities!

Planning for long-term care costs is essential for securing your financial future. Start by assessing your potential needs, exploring insurance options, saving strategically, discussing plans with family, and staying informed about state aid programs.

Looking to maximize your savings on everyday spending? In this listicle, we break down the best credit cards for gas and groceries. You'll discover options that offer cash back, rewards points, and exclusive discounts-perfect for fueling up and stocking your pantry!

When it comes to securing your financial future, finding the best annuity rates is important. In this listicle, you'll discover top-rated options tailored to fit your needs, expert insights on each choice, and tips for maximizing your investment. Let's get started!

When considering the average stock market return, it's essential to note that historically, the stock market has yielded about 7% to 10% annually after adjusting for inflation. This figure can fluctuate, influenced by market conditions, economic cycles, and investor behavior.

When it comes to mutual funds, recognizing the right moment to sell can be crucial for your financial health. From consistently poor performance to changing investment goals, here are 14 clear signs that it may be time to reevaluate your investment strategy.

Looking for the best banks in California? In this listicle, we'll explore top choices tailored to your needs, from exceptional customer service to competitive interest rates. Discover which banks could help you achieve your financial goals!

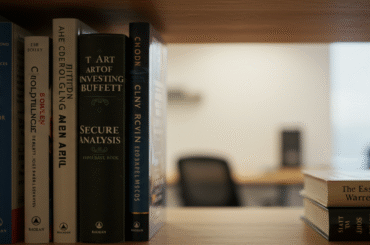

Ready to dive into the world of investing? In this listicle, you'll discover the best investing books for beginners that will guide you from basic concepts to practical strategies. Each pick offers essential insights to boost your financial knowledge and confidence!

For frugal retirees, Arizona offers many affordable gems, but some cities are surprisingly pricey. Avoid these 13 ultra-expensive locales to stretch your savings and enjoy a comfortable retirement without breaking the bank. Your wallet will thank you!

Starting a business with no money may seem daunting, but it’s entirely possible. I launched my first venture by leveraging my skills, building strong networks, and tapping into free online resources. With creativity and determination, you can turn your idea into reality.