Losing a job can be overwhelming, especially when managing loans. Communication is key; reach out to lenders to discuss payment options. Consider options like deferment or forbearance, and revise your budget to prioritize essential expenses.

With a Self-Directed IRA, you can choose your own retirement investments, which can include a wider range of assets, such as real estate and commodities. You can make your portfolio fit your specific financial goals by making your own choices.

Traders are looking at a Broadcom bear put spread that could give them a huge 156% return over the next seven weeks. If the market conditions are right, this strategy could lead to big profits.

Colleges that don't require student loans are a great alternative to traditional financing because they let students graduate without debt. But be careful: it's important to look into accreditation, hidden fees, and job placement rates to make sure you're making a smart investment in your future.

Getting an inheritance can be good and bad at the same time. Know how taxes will affect you, take the time to weigh your options, think about how it will affect your financial goals, and talk to a professional to make smart choices about your future.

Don't give up if you want to get an auto loan but don't have any credit. Start by looking into lenders that give loans to people with bad credit. To make your application stronger, think about putting down a bigger deposit or adding a co-signer.

Semtech has positioned itself for significant growth as key market forces align. With increasing demand for IoT solutions and advancements in semiconductor technology, the company's stock shows promising potential for bullish movements in the near future.

Looking for the best pet insurance in Texas? You've come to the right place! In this listicle, you'll discover top-rated providers tailored to your furry friend's needs. Expect coverage comparisons, customer reviews, and tips to help you choose wisely!

In 2025, remote workforce software will bring together communication, project tracking, time analytics, and security so that teams that work from different locations can work together well across time zones. Slack, Asana, Zoom, Teams, Trello, Monday, ClickUp, BambooHR, Miro, and Time Doctor are some of the best tools for coordinating work in real time, protecting data, and making integrations that can grow with your business.

Looking for the best auto insurance in Georgia? You’re in the right place! In this listicle, you'll discover top-rated providers, key coverage options, and tips to save on premiums. Get ready to choose a policy that fits your needs perfectly!

Building an emergency fund is crucial to financial security. Aim for 3 to 6 months' worth of expenses to handle unexpected circumstances. Start small-set aside a portion of each paycheck, and watch your savings grow over time. Prioritize this safety net!

Ever feel overwhelmed by your monthly bills? A few strategic phone calls can help you save. Try contacting your internet provider for a retention offer, your insurance company for a better rate, or your credit card issuer to negotiate fees. Small steps can lead to big savings!

In this episode of the Wall Street Breakfast Podcast, we talk about how recent changes in tariffs have helped TSMC's stock. TSMC's future looks better now that investors are more confident, which could mean growth ahead.

Black entrepreneurs may find it hard to navigate the funding landscape. Using community networks, looking into grants for minority-owned businesses, and making strong pitches can all help you get important resources and grow your business.

Want to make sure your child's financial future is safe? You'll find the best ways for kids to invest their money that also help them learn and grow. Learn about money and build wealth with your kids by showing them how to use custodial accounts and stocks.

Renovating your home can be a smart investment in 2025. Focus on high-ROI projects like kitchen upgrades, bathroom remodels, and energy-efficient improvements. These enhancements not only build equity but also attract buyers, boosting resale value.

Swiss businesses are on edge as Trump's proposed 39% tariff looms. Many worry this could trigger a 'worst-case scenario,' jeopardizing trade relations and impacting the economy. The stakes are high, with jobs and investments hanging in the balance.

The One Big Beautiful Bill promises to reshape our tax landscape. For many, this shift could mean higher deductions and credits, while others may face new tax obligations. Understanding these changes is crucial for effective financial planning in the coming year.

When I decided to transform my basement, I envisioned a cozy retreat. By selecting the right furniture and fixtures, I created functional spaces for relaxation and entertainment. Each piece was carefully chosen to enhance comfort while reflecting my style.

Have you ever been angry because you couldn't get to your own money? Many people don't know about quiet laws that can limit their financial freedom, like fees for dormant accounts and complicated rules about inheriting money.

Want to find the right city that fits your youthful spirit? We'll look at the best cities for young people. These cities have lively cultures, lots of job opportunities, and active social scenes.

When refinancing a car loan, it's crucial to ask key questions. Inquire about the interest rate, loan terms, and any fees involved. Also, check if your credit score has improved and explore how it might impact your new loan options. Empower yourself with knowledge!

Ready to maximize your travel experiences without breaking the bank? In this listicle, you'll discover the best travel credit cards in Canada! From enticing rewards to unbeatable perks, let us guide you through options that fit your wanderlust and budget perfectly.

Looking for the best credit cards? You've come to the right place! In this listicle, we break down NerdWallet's top picks to help you find cards that suit your lifestyle-whether you're after rewards, cash back, or low interest rates. Your perfect card awaits!

A Norwegian Cruise Line employee is raising concerns about a sophisticated cruise scam targeting unsuspecting travelers. They warn that fraudsters are posing as official representatives, prompting guests to verify bookings and share sensitive information. Stay vigilant!

Navigating market volatility in defined benefit (DB) plans can feel daunting. Plans with a proactive de-risking strategy often experience less turbulence compared to those without, safeguarding assets and ensuring member benefits amid economic uncertainty.

As tariffs shift and supply chains waver, it's wise to stock up on essentials. Items like cleaning supplies, non-perishable foods, and personal care products can help you navigate potential shortages. Prepare now to ensure you’re covered later.

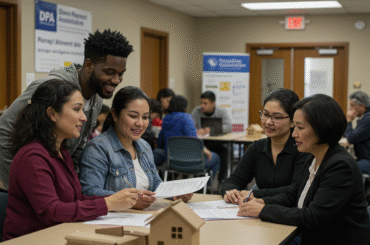

As the dream of homeownership becomes increasingly challenging, down payment assistance is stepping in as a vital resource. This growing tool helps aspiring buyers bridge the financial gap, making it easier to turn their homeownership dreams into reality.

Discovering free Pilates channels on YouTube has transformed my at-home workout routine. From beginner basics to advanced flows, I've compiled five of the best channels that offer clear instruction and motivating sessions. Get ready to roll out your mat!

Looking to maximize your business spending without the burden of annual fees? In this listicle, you'll discover the best no-annual-fee business credit cards that offer rewards, low interest rates, and valuable perks. Get ready to elevate your finances!