This article may contain references to products or services from one or more of our advertisers or partners. We may receive compensation when you click on links to those products or services. Nonetheless, our opinions are our own.

Your 30s are a pivotal decade in your life for various reasons. For many people, you’re likely settling into your career, perhaps growing a family, or just trying to enjoy a fast-paced life.

As it turns out, your 30s are just as critical to your financial journey as these other aspects. By making strong financial decisions, you can set yourself up for great success later in life.

Here are some of my top financial moves you should make in your 30s!

Avoid Lifestyle Creep at All Costs

As you advance in your career, your earnings are likely to follow suit. This increase in income is often paired with an increase in spending.

If you live in suburban America, you might be tempted to purchase a new car or upgrade your home to “keep up with the Joneses”. This can be a disaster for your finances. And while you might be able to “afford” these items, you need to think about them from another perspective.

There’s a good chance you’ve heard the saying “time is money” once before. And it’s certainly true. If you think about your money in terms of how much time it took you to earn it, you might not splurge quite as much.

For example, if the new car you want has a price tag of $80,000 and your annual salary is $75,000, it would take more than one year of work to purchase that vehicle. Is the car really worth one year of work? Probably not. To take it a step further, let’s transform it into the number of hours. Assuming you work 50 weeks out of the year for 8 hours per day, it would take over 2,000 hours of work to purchase your car. Now that’s what you call insanity!

To avoid lifestyle creep here are a few tips:

- Budget and track your money so you can see progress with your finances.

- Create a small reward system that allows you to make a smaller purchase after achieving select financial goals.

- Avoid surroundings that encourage lifestyle creep like certain people or places.

Invest Like You Mean It

I cannot preach enough about how important investing is for your future. And being in your 30s offers one distinct advantage when compared to other age groups: time.

Time is one of the greatest factors when determining how much your money can compound.

To display this, let’s do some quick math. Let’s say you’re currently 30 years old and want to invest $10,000 before withdrawing at the age of 60. We will assume a moderate 6% annual interest rate. In 30 years, your investments will be worth $57,434!

To compare, we’ll assume the same investment and interest rate, but with only 20 years to grow. After 20 years, your investments would be worth $32,071. That’s more than a $25,000 difference for just 10 additional years of growth.

This example showcases how vital it is to get started investing early and make your money work for you. So if you’re in your 30s and haven’t gotten started investing yet, now is your chance. Even if it’s just a few hundred dollars per year, this money will compound and grow exponentially.

How much should you invest?

There is no right or wrong answer when it comes to investing. Some people will choose to invest a good portion of their income, while others might limit investments to just 5 or 10% of their income. Depending on your financial goals, it’s a good idea to create a budget with investments built-in (more on this below!).

Increase Your Income

Your income is just one factor in your financial journey, but an important one at that.

By increasing your earnings, you can reach your goals much faster than a stagnant income. This will allow you to save and invest larger amounts, which grow exponentially.

There are many different ways to increase your income so there’s sure to be an option for you. I’ll explore some of my favorites below!

Switch Jobs or Careers

For many people, the easiest way to increase your income is by switching jobs or career paths. If you’re currently working in an underpaid position, try switching companies for a slightly better position or job title. This will typically come with a raise over your previous job.

If you work in a career with low earnings, you might think about switching careers altogether. This doesn’t apply to everyone, however. Some people love their career and do it for more than the money. For these people, focus on increasing your income through other methods like picking up a side hustle.

You’ll need to do some research to find a career path that suits your skills and goals. You might find you’ll need to further your education for some careers. When planning a career switch, you’ll want to account for all of the costs associated with it including both the time and money you’ll need to invest.

Pick up a Side Hustle

Side hustles are the perfect option for those with some extra time on nights or weekends. As a bonus, there are literally thousands of potential side hustles for just about anyone.

If you’re looking for a side hustle that pays you often, you might consider becoming a delivery or rideshare driver. These will allow you to make money whenever you’re available to work.

If you’re looking for something more passive, you might consider starting a blog or podcast. They can take a significant amount of time to grow, but they can also be very profitable.

If you’re looking for a side hustle that you could turn into a full-time business, you might consider domain flipping, candle making, or flipping furniture. These side hustles can expand rapidly once you get started and can transform into a full-time business.

Ask for a Raise

If you love your current job but need to make more money, asking for a raise is a great option. Many people fear rejection and therefore will never ask for a raise. But with the right preparation, there’s a good chance you might be one conversation away from making more money.

Perfect the Budget

At this point in your life, you’ve probably tried budgeting before you might have fallen off. But this is the time to really utilize its full potential. Many people get scared at the thought of a budget because it acts as virtual handcuffs that discourage what was once routine spending.

By creating and sticking to a well-organized budget, you can unleash the power of your income. By budgeting correctly, you can worry less about unexpected expenses because some of them will be budgeted in your finances. This will allow you to save and invest more of your money.

Establish an Emergency Fund

If you don’t already have an emergency fund, this should become a priority for your finances. An emergency fund is money set aside for completely unexpected expenses like a hospital bill, vehicle repairs, or a job loss.

Similar to how much you should invest, there is no exact number you need for your emergency fund. But there is a simple rule that many people follow. For most, an emergency fund of 6 to 9 months of your normal expenses will be sufficient. This will allow you to pay for your monthly expenses in the case of a job loss or large medical bill.

Some people will choose to have a larger emergency fund, and this is completely acceptable. Because you cannot predict what uncertainties will popup, having a strong savings will help to ease any financial pressures you might face.

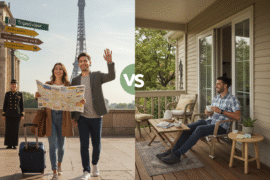

Bonus: Don’t Forget to Enjoy Life Along the Way

Some people might get caught up with life so much that they forget to live in the moment. Instead of wanting tomorrow to be here every day, don’t forget to enjoy today.

Burnout in your career and finances is extremely common. To avoid this, you’ll want to take time to yourself and slow things down. This might mean taking a vacation, setting up a time each night to reflect, or setting up routine nights out for a dinner. You don’t need to break the budget when you do these things either. By planning ahead you can build these breaks into your budget.

Conclusion

Your 30s can be some of the greatest years of your life and your finances play a pivotal role in it. By utilizing some of these financial moves, you’re sure to set yourself up for decades to come.

If you’re working to retire early, investing will play a critical part in reaching your goal and time is on your side.

It’s always important to remember that what you do with your money today can have an exponential impact on decades to come. The opportunity cost of new cars, large homes, and designer clothing can hamper any financial goals you might have down the road.

Is there something I missed? I’d love to hear what you think are financial moves you should make in your 30s below!

Reviewed and edited by Albert Fang.

See a typo or want to suggest an edit/revision to the content? Use the contact us form to provide feedback.

At FangWallet, we value editorial integrity and open collaboration in curating quality content for readers to enjoy. Much appreciated for the assist.

Did you like our article and find it insightful? We encourage sharing the article link with family and friends to benefit as well - better yet, sharing on social media. Thank you for the support! 🍉

Article Title: Top Financial Moves to Make in Your 30s

https://fangwallet.com/2021/02/25/top-financial-moves-to-make-in-your-30s/The FangWallet Promise

FangWallet is an editorially independent resource - founded on breaking down challenging financial concepts for anyone to understand since 2014. While we adhere to editorial integrity, note that this post may contain references to products from our partners.

The FangWallet promise is always to have your best interest in mind and be transparent and honest about the financial picture.

Become an Insider

Subscribe to get a free daily budget planner printable to help get your money on track!

Make passive money the right way. No spam.

Editorial Disclaimer: The editorial content on this page is not provided by any of the companies mentioned. The opinions expressed here are the author's alone.

The content of this website is for informational purposes only and does not represent investment advice, or an offer or solicitation to buy or sell any security, investment, or product. Investors are encouraged to do their own due diligence, and, if necessary, consult professional advising before making any investment decisions. Investing involves a high degree of risk, and financial losses may occur including the potential loss of principal.

Source Citation References:

+ Inspo