This article may contain references to products or services from one or more of our advertisers or partners. We may receive compensation when you click on links to those products or services. Nonetheless, our opinions are our own.

Updated by Albert Fang

- Key Highlights

- Introduction

- Understanding Personal Finance Management Tools

- Getting Started with Monarch Money

- Step-by-Step Guide to Transitioning from Mint to Monarch

- Maximizing Your Use of Monarch Money

- Conclusion

-

Frequently Asked Questions

- Can I use Monarch Money for free?

- How does Monarch Money secure my financial data?

- What should I do if I encounter issues importing data?

- Can I track investments with Monarch Money?

- How often should I update my financial information in Monarch Money?

- How does Monarch Money differ from Mint in terms of budgeting and financial tracking?

- Are there any specific steps I need to take to successfully transition from using Mint to using Monarch Money?

- What are the key features of Monarch Money that make it a desirable alternative to Mint?

- How can I ensure that all my financial data is securely transferred during the transition process?

- Recommended Reads

Key Highlights

- Easy Move: Getting your financial data from Mint to Monarch Money is straightforward and simple.

- Better Budgeting: With Monarch’s flexible tools, you can have more control over your budget. You can set up custom categories, group your budgets, and use rollovers.

- Overall Financial View: Monarch offers a full view of your finances. It tracks your net worth, including your accounts, investments, and real estate.

- Simple Sharing: You can easily share your financial path with your partner. Monarch has features that help you work together and set shared goals.

- Helpful Help: If you have any questions or issues, Monarch Money’s support team is ready to assist you.

- The referral code MONARCHVIP currently offers the highest Monarch Money referral discount opportunity. For a limited time get 50% off your first year.

Introduction

How we manage our money is changing. Picking the right budgeting app is really important. If you are using Mint and want a better option for financial planning, consider Monarch Money. This guide will help you switch from Mint to Monarch. It will give you the tools to easily take charge of your financial journey.

Understanding Personal Finance Management Tools

Personal financial management means taking care of your money in a smart way. It includes tasks like budgeting, saving, investing, and managing debt. Tools like budgeting apps can be very helpful. These apps work like digital assistants. They help you track your income, expenses, investments, and net worth all in one spot.

These tools are helpful because they make hard financial tasks easier. They automate work like data aggregation. They also offer useful visuals. This helps people understand their spending habits better. They can find areas to improve and aim for their goals.

The Evolution of Financial Tracking Apps

Financial tracking apps have changed a lot over the years. At first, they were simple apps just for tracking expenses. Users needed to type in each transaction by hand. Now, with better technology and data aggregators, these apps are much more advanced.

Today’s apps connect easily with financial institutions. They gather transaction data from bank accounts and credit cards without any work from users. This helps people track their income and expenses as they happen. Users can see a live view of their finances.

Modern apps use data to show users how they spend their money. They can recommend ways to save. Some apps even offer personal tips based on users’ past actions.

Why Choose Monarch Money Over Mint?

Monarch Money is a good choice for managing your finances. Mint is well-known, but Monarch offers unique benefits. It helps you set and track your financial goals clearly. This makes it simpler to stay focused on your money management.

Monarch Money shows you your net worth in a clear way. You can track all your assets, like bank accounts, investments, and real estate. This helps you understand your full financial picture.

Monarch wants to get better and grow. Their team listens closely to what users say. This helps keep the app helpful, easy to use, and ready to change with the needs of the people who use it.

Getting Started with Monarch Money

Making the change to a new platform can be hard. But Monarch Money makes it easy. They focus on user experience. So, everything you do, from signing up to adding your data, is fast and simple.

Monarch Money is simple to use, whether you are a tech expert or just starting with budgeting apps. Let’s look at how to begin using this helpful financial tool.

- The referral code MONARCHVIP currently offers the highest Monarch Money referral discount opportunity. For a limited time get 50% off your first year.

What You’ll Need Before Making the Switch

Before you begin the change, ensure you are ready for an easy process. First, collect your login details for all your financial institutions. This means gathering information for your bank accounts, credit card accounts, and investment accounts. You will need this information to connect them to Monarch Money during the setup.

It is not required, but it is helpful to know your money situation. This means you should understand your income. You should also know what you spend. Make sure to keep track of any debts, like credit card bills or loans. Finally, pay attention to how much you save.

Think about your budget and check out the pricing plans from Monarch Money. They have a free trial available. By understanding their annual plan options, you can find the best subscription to fit your needs.

Creating Your Monarch Money Account

The first step is to create a Monarch Money account. You can go to their website or download the mobile app on iOS and Android. Signing up is easy. You can make a new login with your email address or use your existing Google or Apple account.

After you create your account, Monarch Money gives you a free trial. This time allows you to check out the features of the platform. You can link your financial accounts and see how it functions.

You should know that you don’t need to make a choice immediately during the free trial. After you try out Monarch Money, you can choose the subscription plan that fits you best.

Step-by-Step Guide to Transitioning from Mint to Monarch

Transitioning from Mint to Monarch might seem like a lot of work. But if you know what to do, it can be quick. This guide will keep you focused. You can still manage your money without any breaks.

- Break it down into simple steps.

- This will help your move go smoothly.

Step 1: Exporting Your Financial Data from Mint

- First, save your data from Mint.

- This provides you with a record of your financial history for later use.

- Mint allows you to export your data as a CSV file.

- This type of file works well with most other budgeting tools.

Here’s how to export data from Mint:

- Log in to Mint and go to your account settings.

- Look for the option to “export data” or “download transactions.”

- Select the date range you want (ideally your entire transaction history) and start the export process.

After you download the CSV file, make sure to keep it safe. If you decide to use new budgeting tools, you won’t lose your transaction history. Having a backup can also give you more security and comfort.

Step 2: Importing Your Data into Monarch Money

Monarch Money makes it simple to add your financial information. They use services like Plaid or Finicity for aggregation. This allows them to link with various financial institutions. Your account details update automatically.

To start the import process, open the “Accounts” section in Monarch Money. Click “Add Account.” Next, search for your bank or financial institution. Follow the steps on the screen to link your accounts safely.

Monarch Money will bring in your transaction history, account balances, and other important information. You need to check the details that were imported to ensure they are correct. It’s important to link all your accounts accurately and make sure they are updated all the time. Here is a simple table to show you how to connect your old bank account:

|

Field |

Description |

|

Institution Name |

[Name of your bank or credit union] |

|

Account Type |

[Checking, Savings, Credit Card, etc.] |

|

Username/Account Number |

[Your login credentials for that institution] |

Step 3: Setting Up Your Budgets in Monarch Money

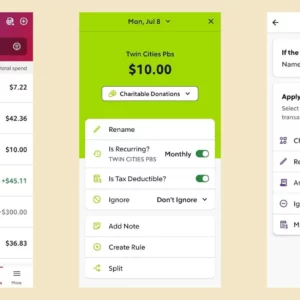

With your accounts connected, you can now check out the easy budgeting features in Monarch. Just open the app and go to the “Budgets” section. Monarch Money lets you change categories to match your spending habits.

The app has different options to help you budget. You can choose the traditional envelope method or a more relaxed style like zero-based budgeting. Pick a method that fits your financial goals and suits you best.

Monarch Money helps you set your goals. You may want to save for a house, pay off debt, or invest for retirement. Just write down your goals and create realistic targets in the Monarch app. This way, you can track your progress easily.

Step 4: Customizing Your Financial Goals

Monarch Money does a lot more than help you reach financial goals. It lets you create your plans just as you like. You can save for your dream trip, build an emergency fund, or plan for a big purchase. Monarch Money is there to support you with all of these.

In the “Goals” section of the app, you can make and change your goals. For each goal, you can set target amounts and deadlines. You can also pick helpful trackers to follow your progress and stay on track.

Monarch Money offers useful insights and predictions that relate to your goals. These insights can motivate you. They help you see how your saving and spending habits can support your financial dreams.

Maximizing Your Use of Monarch Money

Transitioning to a new platform is just the beginning. Monarch offers tools and features to help you manage your personal finances more effectively. When you learn what Monarch can do, you can make the most of it and improve how you handle your money.

Let’s see how you can make the most out of your Monarch Money experience. Smart money choices can really help you a lot.

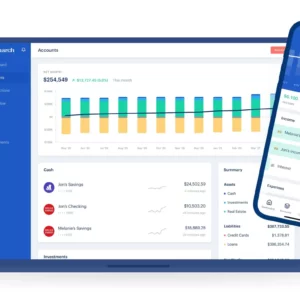

Monarch Money has a simple design that is easy to use. When you log in, you see the home screen. This screen gives you a fast look at your finances. It shows important details like your net worth, cash flow, and budget progress. You can check your financial health quickly.

The platform lets you customize your experience. You can pick different widgets for your home screen. This helps you focus on what matters most to you. If you want to monitor your investments, see your upcoming bills, or check your budget, Monarch Money allows you to build a dashboard that works for you.

Monarch provides a great experience on all your devices. You can easily switch between the web platform and their mobile apps for both iOS and Android. This lets you manage your finances at any time and in any place without any trouble.

Utilizing Monarch’s Unique Features for Better Financial Management

Monarch has more than simple budgeting tools. It includes a cash flow feature that helps you view your future income and expenses. This lets you manage your finances better. You can find out if you might run out of money soon or if you will have extra cash. This helps you make smarter decisions about spending and saving.

Monarch Money is a great tool to track your net worth. It lets you see more than just your bank balances. You can add details about your assets, like investments, real estate, and valuable items. This way, you get a full view of your finances and how they change over time.

Monarch Money provides tools for your investments. You can check your portfolio easily. It lets you see your investments in different accounts. You can also look at your allocation and track how well your portfolio is doing.

Conclusion

In conclusion, switching from Mint to Monarch Money can help you manage your money more effectively. Monarch Money offers better features and custom budgeting options. You can easily transfer your data from Mint to Monarch Money for a smooth change. Check out the tools and layout of Monarch Money. They can help you take better control of your finances. If you want a safe platform that you can adjust to your needs, consider Monarch Money. Its simple design makes managing your money easy.

- The referral code MONARCHVIP currently offers the highest Monarch Money referral discount opportunity. For a limited time get 50% off your first year.

Frequently Asked Questions

Can I use Monarch Money for free?

Monarch Money gives you a free trial. This lets you try out its features before deciding on a subscription. After the trial ends, you can pick a subscription plan to keep managing your personal finances.

How does Monarch Money secure my financial data?

Monarch Money aims to protect your data and keep it private. They use strong bank-level encryption. They also team up with trusted data firms like Plaid and Finicity. This ensures that your financial information stays safe at all times.

What should I do if I encounter issues importing data?

If you struggle to add your financial data, Monarch Money has a support team ready to help you. You can reach out to them for assistance with any issues you face during setup.

Can I track investments with Monarch Money?

Monarch Money helps you follow your investments easily. You can put them into your total net worth. It shows you a clear picture of your portfolio. This shows your holdings, ways your assets are divided, and their historical performance.

How often should I update my financial information in Monarch Money?

Monarch Money connects with your financial institutions often. It gives you almost instant updates on your transactions and account balances. You don’t have to enter all the info yourself, but it’s a good idea to check your accounts now and then. This helps you make sure everything is right.

How does Monarch Money differ from Mint in terms of budgeting and financial tracking?

Monarch Money and other tools can help you manage your personal finance. However, Monarch Money stands out. It allows you to create a budget in many ways. You can also get a full picture of your net worth. Plus, it is easy to use.

Are there any specific steps I need to take to successfully transition from using Mint to using Monarch Money?

This guide will help you move from Mint to Monarch Money easily. First, you need to export your data from Mint. After that, you will import it into Monarch Money. Doing this lets you fully enjoy all the features of Monarch Money.

What are the key features of Monarch Money that make it a desirable alternative to Mint?

Monarch Money offers several benefits. It has easy-to-use tools to help you set goals. The user interface is fresh and simple. You can customize it in many ways. It also shows your net worth clearly.

How can I ensure that all my financial data is securely transferred during the transition process?

Monarch Money wants to keep your data safe. The platform uses strong encryption, like what banks use. This keeps your financial details safe during transfers. So, you can feel secure and relaxed when sharing your information.

Reviewed and edited by Albert Fang.

See a typo or want to suggest an edit/revision to the content? Use the contact us form to provide feedback.

At FangWallet, we value editorial integrity and open collaboration in curating quality content for readers to enjoy. Much appreciated for the assist.

Did you like our article and find it insightful? We encourage sharing the article link with family and friends to benefit as well - better yet, sharing on social media. Thank you for the support! 🍉

Article Title: Monarch Money vs. Mint: How to Transition from Mint to Monarch Successfully

https://fangwallet.com/2024/11/23/monarch-money-vs-mint/The FangWallet Promise

FangWallet is an editorially independent resource - founded on breaking down challenging financial concepts for anyone to understand since 2014. While we adhere to editorial integrity, note that this post may contain references to products from our partners.

The FangWallet promise is always to have your best interest in mind and be transparent and honest about the financial picture.

Become an Insider

Subscribe to get a free daily budget planner printable to help get your money on track!

Make passive money the right way. No spam.

Editorial Disclaimer: The editorial content on this page is not provided by any of the companies mentioned. The opinions expressed here are the author's alone.

The content of this website is for informational purposes only and does not represent investment advice, or an offer or solicitation to buy or sell any security, investment, or product. Investors are encouraged to do their own due diligence, and, if necessary, consult professional advising before making any investment decisions. Investing involves a high degree of risk, and financial losses may occur including the potential loss of principal.

Source Citation References:

+ Inspo