This article may contain references to products or services from one or more of our advertisers or partners. We may receive compensation when you click on links to those products or services. Nonetheless, our opinions are our own.

Updated by Albert Fang

- Key Highlights

- Introduction

- Understanding Monarch Money for Beginners

- Getting Started with Monarch Money

- Step-by-Step Guide to Using Monarch Money

- Conclusion

-

Frequently Asked Questions

- How much does Monarch Money cost for beginners?

- Can beginners use Monarch Money for free?

- What are the typical costs associated with starting to invest in Monarch Money as a beginner?

- How does the cost breakdown of Monarch Money compare to other similar investment platforms for beginners?

- Are there any hidden fees or charges that beginners should be aware of when using Monarch Money?

- Are there any tips or strategies for beginners to manage their costs effectively while using Monarch Money?

- Recommended Reads

Key Highlights

- Monarch Money is a great app for taking care of your personal finance. It is easy to use, especially if you are a beginner.

- This budgeting app helps you track your net worth, check your investments, and set your personal goals.

- It connects well with many financial institutions so you can see your finances clearly.

- You can pick from two pricing options: a monthly plan for $14.99 or an annual plan for $99.99, which can save you money.

- If you are not sure about the commitment, new users can start with a free trial to test Monarch Money.

- Monarch Money keeps your data safe with strong bank-level encryption and two-factor authentication.

- The referral code MONARCHVIP currently offers the highest Monarch Money referral discount opportunity. For a limited time get 50% off your first year.

Introduction

Taking control of your personal finance can feel hard, especially if you are new to it. This is where Monarch Money helps. This useful budgeting app makes it easy to manage your finances. You can track your financial goals and make good choices about your money. Let’s look at Monarch Money, what it offers, how much it costs, and the benefits for beginners in 2025.

Understanding Monarch Money for Beginners

Monarch Money is an easy-to-use budgeting app. It helps you manage your money in a better way. With this app, you can track your spending, manage budgets, and keep an eye on your investments. You can also plan for your future. The simple interface lets you link your financial accounts. You can organize your transactions, see your cash flow, and check your net worth.

Monarch Money is not just for simple budgeting. It offers features that you usually see in more advanced financial planning tools. You can set your financial goals and see how you are doing. The app provides you with personalized tips. It helps you track your bills and plan for upcoming expenses. This way, you can make smart choices to meet your financial goals.

Why Choose Monarch Money in 2025?

In the fast-changing world of financial technology, Monarch Money is a great choice. What makes it unique? It’s easy to use and offers several features. It is committed to helping its users. Whether you are new to personal finance or seeking a full solution, Monarch Money has the tools and information you need.

The latest updates to the financial software have made Monarch Money better and easier to use. Its simple interface and customizable dashboards help you manage your finances easily. You can quickly view your spending habits, check your net worth, and see your progress over time.

Monarch Money is more than a budgeting app. It’s like having a friend for your finances. It guides you to make smart financial decisions. With its help, you will feel ready to manage your money. You can achieve your financial goals and build a strong financial future.

Key Features That Benefit Beginners

Monarch Money makes managing money easy for beginners. It provides simple ways to track what you spend and see your net worth. Here’s how it helps with your finances:

- Easy Expense Tracking: With Monarch Money, you can link all your financial accounts. This means your bank accounts, credit cards, and investment accounts. It automatically gathers your transactions. So, you don’t have to type in every purchase. You can also create custom categories for your spending.

- Net Worth Tracking: You can easily keep track of your financial health. Monarch Money displays your net worth in real time. This helps you understand what you own and what you owe. Knowing how your choices impact your net worth can inspire you!

- Goal Setting and Tracking: Setting financial goals is important, and Monarch Money is here to support you. Whether you are saving for a down payment, paying off debt, or getting ready for retirement, Monarch Money can help you set personal goals for yourself.

Getting Started with Monarch Money

Getting started is simple. Monarch Money makes setting up your account easy. You can quickly connect your financial accounts. It only takes a few clicks to link your bank account, credit cards, investment accounts, and more.

Monarch Money keeps your transaction history safe after you connect. It checks how you spend money. You can easily see where your money goes. This helps you make smart choices to improve your finances.

What You Need to Get Started

To start your journey with Monarch Money, you will need just a few things. It’s easy:

- The referral code MONARCHVIP currently offers the highest Monarch Money referral discount opportunity. For a limited time get 50% off your first year.

- Device and Connection: You can use Monarch Money on many devices. Access it with the mobile app on the App Store (iOS) and Google Play (Android), or you can go to the website on your computer. A strong internet connection is key for the best experience.

- Financial Information: You need to collect your financial details to connect your accounts. This means having your login info for online banking, credit cards, and other financial institutions you want to link.

- Email Address: An email address is needed to create your account, so be sure to have one. Monarch Money takes your security seriously. They will never ask for sensitive information like your bank account or credit card numbers in an email.

Account Setup and Security Measures

Monarch Money makes setting up your account easy:

- Download and Open: Get the Monarch Money mobile app or visit their website. After you have it, open the app and press “Get Started” to sign up.

- Provide Information: Add your name, email address, and create a secure password.

- Connect Accounts: Pick your banks from the list to link your financial accounts. Next, enter your online banking information. Monarch Money uses strong encryption to protect your details.

Monarch Money wants to keep you safe. They have strong ways to protect your information. The platform uses bank-level encryption to keep your financial details safe when you send or store them. They also use two-factor authentication to add extra security to your account.

If you have questions or need help, Monarch Money has good customer support. You can email their team for assistance. You can also read their FAQ section to get quick and helpful answers.

Step-by-Step Guide to Using Monarch Money

Once you make your account and link your financial accounts, you can start using the great features of the platform.

- Making A Budget: Create a budget that fits your earnings and spending. Divide your money into sections. Keep an eye on where you spend it and find ways to do better.

- Checking Accounts: Take time to look over your transactions. This keeps everything correct and helps you spot any mistakes.

- Following Investments: Keep track of your investments by connecting your investment accounts. Monarch Money shows how your portfolio is doing. This helps you make smart decisions.

Monarch Money makes budgeting easy. You can see your income and expenses clearly. This helps you make a budget that works for you and set financial goals. It allows you to check your cash flow too. The tools on Monarch Money are simple to use. They help you track your spending and find ways to do better. You can make good choices to reach your financial goals with Monarch Money.

Step 1: Creating Your Budget

Creating a budget is key to handling your money smartly. Monarch Money can help you with that. It’s simple to use, even for beginners.

Start by typing in your monthly income after taxes. Make sure to include all your income sources, like salary, wages, and any other money you receive. Next, look at your expenses. Monarch Money has standard categories like housing, transportation, food, and entertainment. You can change these categories to better fit your spending habits. After that, type in the usual amount you spend for each category.

After you are done, Monarch Money will give you a clear budget summary. This summary shows how much money you earn, how much you spend, and how much is left. You can change the amounts you set and make real limits for each category. This will help you stick to your budget and avoid spending too much.

Step 2: Linking Your Accounts

Linking your financial accounts to Monarch Money is key. It lets you track your transactions automatically and view all your finances in one spot. You can simply connect your checking account, savings accounts, credit cards, and investment accounts.

To start, go to the “Accounts” section on the Monarch Money platform. Look for your bank or credit union by name. When you find it, click on it and enter your online banking details. Monarch Money keeps your information safe with secure connections and strong bank-level encryption.

Once you connect your accounts, Monarch Money collects your transaction history safely. It automatically updates your account balances. You will not have to enter anything by hand anymore. You’ll get instant insights into your cash flow and how you spend your money. You can see all your transactions in one spot. This lets you easily track expenses, notice patterns, and make good financial decisions.

Step 3: Tracking Your Spending and Investments

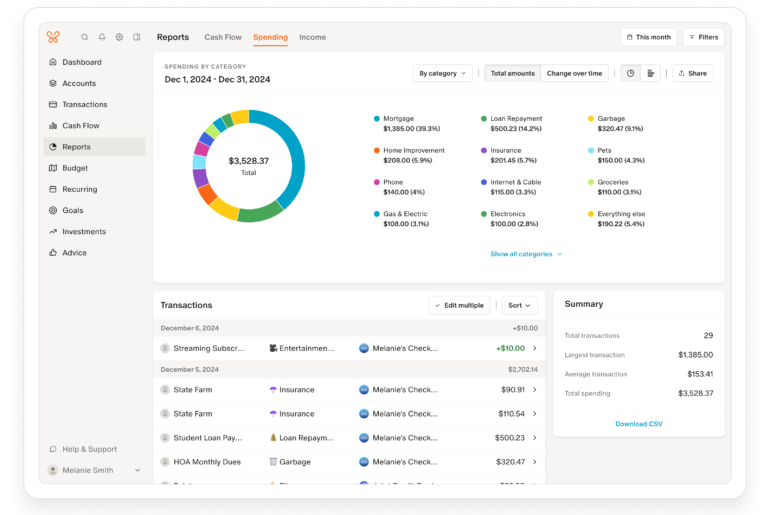

Monarch Money presents your financial data in a clear and simple visual format. This allows you to monitor your spending and review your investments easily. You can view colorful charts and graphs that illustrate your spending patterns. This helps you understand your financial health better.

The platform organizes your transactions automatically. If you’d like, you can edit them for greater accuracy. You can view your spending by category. This helps you spot areas where you overspend. You can also set reachable limits. Monarch Money helps you track your income too. This makes it easier to understand your cash flow.

Monarch Money helps you link your investment accounts. This lets you see how well your portfolio is performing. You can review your returns, keep an eye on what you own, and make smart decisions about your investments.

Conclusion

Starting with Monarch Money in 2025 is a smart choice for new users. This platform offers important features that help you manage your budget, track your spending, and make good investment choices. Using Monarch Money can teach you about money and help you aim for a better financial future. It’s important to set up your account and connect your finances. Check out the easy-to-use interface and use the tools in Monarch Money to achieve your financial goals today!

- The referral code MONARCHVIP currently offers the highest Monarch Money referral discount opportunity. For a limited time get 50% off your first year.

Frequently Asked Questions

How much does Monarch Money cost for beginners?

Monarch Money offers a monthly subscription for $14.99. If you want to save, you can select the annual plan for $99.99. This plan costs about $8.33 each month. New users can try Monarch Money for free with a free trial. However, there is no free plan available.

Can beginners use Monarch Money for free?

The Monarch Money app is not free on the App Store or Google Play. However, new users can get a free trial period to check out its features. After the free trial, you will need to pay for a subscription to access all the app’s functions.

What are the typical costs associated with starting to invest in Monarch Money as a beginner?

Monarch Money does not take extra fees when you link your investment accounts. It is wise to keep an emergency fund apart from your investments. This fund should cover your monthly expenses.

How does the cost breakdown of Monarch Money compare to other similar investment platforms for beginners?

Monarch Money offers a good price, especially for the annual plan. It’s important to read customer reviews and compare its features with other platforms. This will help you make better financial decisions. A qualified financial advisor can also provide helpful insights.

Monarch Money is happy to be clear and trustworthy. They do not have any hidden fees. If you have questions or need help, their customer support is easy to reach for any problems. You may also want to consult a financial advisor for advice made just for you.

Are there any tips or strategies for beginners to manage their costs effectively while using Monarch Money?

- Use the app’s tools to budget and manage your costs.

- Try the free trial before you buy a subscription.

- If you want help with financial planning, talk to a financial advisor.

- Think about getting an annual subscription to save some money.

Reviewed and edited by Albert Fang.

See a typo or want to suggest an edit/revision to the content? Use the contact us form to provide feedback.

At FangWallet, we value editorial integrity and open collaboration in curating quality content for readers to enjoy. Much appreciated for the assist.

Did you like our article and find it insightful? We encourage sharing the article link with family and friends to benefit as well - better yet, sharing on social media. Thank you for the support! 🍉

Article Title: Monarch Money Cost Breakdown: What to Expect as a Beginner in 2025

https://fangwallet.com/2024/11/23/monarch-money-cost/The FangWallet Promise

FangWallet is an editorially independent resource - founded on breaking down challenging financial concepts for anyone to understand since 2014. While we adhere to editorial integrity, note that this post may contain references to products from our partners.

The FangWallet promise is always to have your best interest in mind and be transparent and honest about the financial picture.

Become an Insider

Subscribe to get a free daily budget planner printable to help get your money on track!

Make passive money the right way. No spam.

Editorial Disclaimer: The editorial content on this page is not provided by any of the companies mentioned. The opinions expressed here are the author's alone.

The content of this website is for informational purposes only and does not represent investment advice, or an offer or solicitation to buy or sell any security, investment, or product. Investors are encouraged to do their own due diligence, and, if necessary, consult professional advising before making any investment decisions. Investing involves a high degree of risk, and financial losses may occur including the potential loss of principal.

Source Citation References:

+ Inspo