This article may contain references to products or services from one or more of our advertisers or partners. We may receive compensation when you click on links to those products or services. Nonetheless, our opinions are our own.

Updated by Albert Fang

- Key Highlights

- Introduction

- Understanding Monarch Money App in 2025

- Getting Started with Monarch Money: A Beginner’s Guide

- Step-by-Step Guide to Maximizing Monarch Money Features

- Conclusion

-

Frequently Asked Questions

- How Does Monarch Money Ensure User Data Security?

- Can Monarch Money Help Achieve Financial Goals Faster?

- What are the key features of the Monarch Money App?

- How does the Monarch Money App compare to other financial management apps on the market?

- Are there any fees associated with using the Monarch Money App?

- Is the Monarch Money App compatible with different devices and operating systems?

- Recommended Reads

Key Highlights

- Monarch Money is an app for managing your finances.

- It helps with budgeting, setting goals, and tracking investments.

- You can link all your accounts to see a complete view of your finances.

- The app gives you insights that are personalized to improve your money management.

- Monarch Money is available through a subscription, and it also offers a free trial.

- The referral code MONARCHVIP currently offers the highest Monarch Money referral discount opportunity. For a limited time get 50% off your first year.

Introduction

In today’s tech world, managing your money is simpler. The Monarch Money app is a helpful tool for your finances. This app makes things easy, from budgeting to tracking your investments. It helps you make good choices in your financial life. But will it still be useful in 2025?

Understanding Monarch Money App in 2025

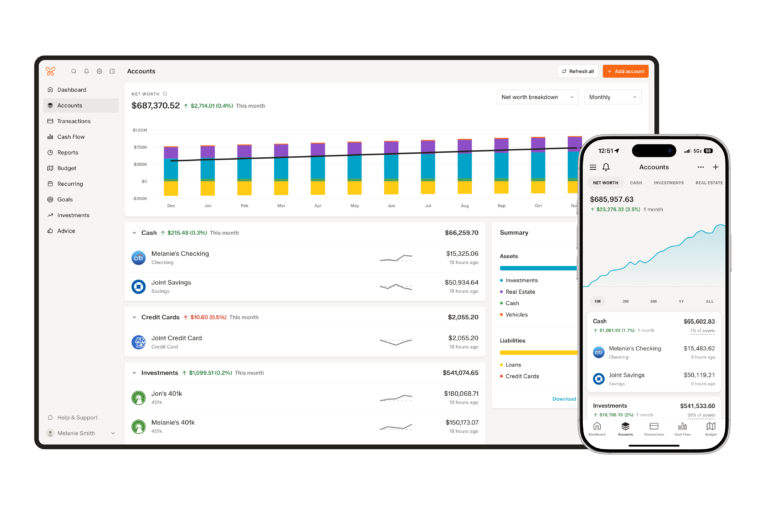

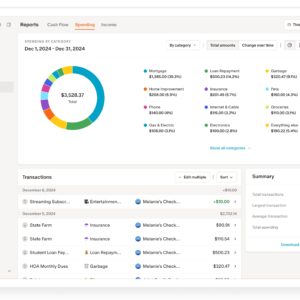

The Monarch Money App changed in 2025. Now, it is a great budgeting app that does more than just track your spending. You can see your income, expenses, and investments all in one place. Monarch provides tools to help you set and reach your financial goals. It connects with many financial institutions to give you a complete view of your money. This makes it easier to see where your money goes and how to improve your spending and saving. Whether you want to plan a dream vacation or build an emergency fund, Monarch Money helps you focus on your financial goals.

What Makes Monarch Money Stand Out?

Monarch Money is unique because it has many helpful features and is easy to use. Unlike some apps that only show a quick view, Monarch allows you to clearly see your total net worth. You can track your financial journey with charts and diagrams that show your income, expenses, and net worth over time. The simple dashboard gives you a good look at your financial situation, which makes it easy to find areas for improvement. Monarch knows that everyone’s financial journey is different. That’s why it offers a free plan along with its subscription. This way, you can try the main features and see if it suits your needs before deciding on your finances.

The Evolution of Monarch Money Over the Years

Monarch Money has always worked hard to get better. Since it started, it has added many new features. At first, it helped people with budgeting. Now, the app has advanced tools too. These tools help you track investments and check historical performance. They can also help you plan for the future. Monarch Money can analyze your monthly income. It finds ways for you to save more money. Another big change is that the app listens to what users say. Monarch keeps improving its interface. It adds features based on user suggestions. This focus on getting better makes the app useful. It meets the changing needs of its users.

Getting Started with Monarch Money: A Beginner’s Guide

Getting your finances in order can feel hard, but Monarch Money makes it easy. You can begin with a free trial before you sign up for a subscription. The Monarch app connects well with most financial institutions to keep your bank account information safe. After you connect, it sorts your transactions for you. This helps you see how you spend your money, which can help you make better financial choices.

What You Need to Get Started with Monarch Money

Getting started with Monarch Money is easy. You just need a few important things to enjoy it completely:

- Log into your online banking or financial accounts: This helps you link your accounts and get updates on your transactions automatically.

- Have a list of your credit cards: Adding your credit card details helps you keep track of spending, handle payments, and see your credit use.

- Know your financial goals clearly: If you want to build an emergency fund, save for retirement, or pay off debt, understanding your goals will help you use the app better and focus on your financial dreams.

Setting Up Your Monarch Money Account: A Step-by-Step Process

Getting started with Monarch Money is easy. Here’s how you can start:

- Download the mobile app: You can get Monarch Money on the App Store for iOS or on Google Play for Android.

- Create an account: Sign up with your email. You can link your Google account to make it quicker.

- Link your bank account: Search for your bank or credit union. Then, follow the safe steps to connect your accounts.

- Set up budget categories (optional): Create spending categories that fit your needs and financial goals, or use the ones that Monarch provides.

- Explore savings accounts (optional): You can link your existing savings accounts or check out new options on the Monarch Money platform.

- The referral code MONARCHVIP currently offers the highest Monarch Money referral discount opportunity. For a limited time get 50% off your first year.

Step-by-Step Guide to Maximizing Monarch Money Features

Monarch Money is a helpful budgeting app that can do much more than just track how you spend. You can use this app to take control of your money. Start by setting up your dashboard. Next, link your accounts. Then, create a budget that fits your needs and set financial goals to monitor your progress. Following these steps will help you feel more confident about your money.

Step 1: Customizing Your Financial Dashboard

One of the great things about Monarch Money is its ability to display your financial information using easy-to-read charts. You can adjust this dashboard to highlight the details that matter most to you.

|

Feature |

Description |

|

Net Worth Tracker |

Displays your assets and debts and provides a real-time snapshot of your net worth. |

|

Income vs. Expense Chart |

Provides a visual breakdown of your income streams and expenses to quickly see where your money is going. |

|

Savings Goal Progress Bars |

Tracks your progress toward your savings goals and keeps you motivated. |

If you are managing debt, place the “Debt Payoff Tracker” at the top of your dashboard. This will help you focus on your goal. It will also motivate you to stay on track.

Step 2: Linking Bank Accounts and Setting Budgets

Linking your bank accounts and credit cards is important for using the Monarch Money app well. This helps you see all your income and spending in one spot. When you connect your checking, savings, investment, and credit card accounts, the app can assist you more. After linking your accounts, budgeting becomes easier. The Monarch Money app allows you to create budgets for different areas, like groceries, entertainment, and transportation. You can adjust these categories based on your spending habits. The app keeps track of your spending and gives you alerts. This helps you stay on top of your finances.

Conclusion

The Monarch Money app is fantastic in 2025. It has smart features and is easy to use. The app keeps your data safe and helps you reach your financial goals quickly. Monarch Money is a tool you can rely on for managing your money. You can set up your own dashboard, link your bank accounts, and create budgets to use the app effectively. Whether you are new or experienced, Monarch Money makes it simple for everyone. Look at what you can do with the Monarch Money app today to stay ahead of your finances!

- The referral code MONARCHVIP currently offers the highest Monarch Money referral discount opportunity. For a limited time get 50% off your first year.

Frequently Asked Questions

How Does Monarch Money Ensure User Data Security?

Monarch Money takes your data security seriously. They use strong bank-level encryption to safeguard your bank login. Their mobile app has multi-factor authentication, too. This extra step helps to keep your financial information safe.

Can Monarch Money Help Achieve Financial Goals Faster?

Monarch Money helps you learn more about your money. This app lets you make smart choices about budgeting, savings accounts, and investments. It is simple to create an emergency fund and plan to achieve your goals effectively.

What are the key features of the Monarch Money App?

The Monarch Money budgeting app comes with many features. You can customize your dashboard to meet your needs. It helps you automatically track and sort your transactions. You can set financial goals and use planning tools too. There is no free plan offered, but you can try the app risk-free during a free trial.

How does the Monarch Money App compare to other financial management apps on the market?

The Monarch Money App is better than other apps like Mint, which is not available anymore. It has tools that let you track your investments and manage your money. This app connects easily with financial institutions. However, you will need a subscription to use it, while some other apps are free.

Are there any fees associated with using the Monarch Money App?

The Monarch Money App comes with a subscription. It doesn’t have a free plan that lasts forever, but you can try the app for free during a trial period. You can pay monthly or yearly to better manage your monthly income.

Is the Monarch Money App compatible with different devices and operating systems?

The Monarch Money mobile app is simple to use for your financial life. You can download it on both Android and iOS devices. This means it works on many platforms.

Reviewed and edited by Albert Fang.

See a typo or want to suggest an edit/revision to the content? Use the contact us form to provide feedback.

At FangWallet, we value editorial integrity and open collaboration in curating quality content for readers to enjoy. Much appreciated for the assist.

Did you like our article and find it insightful? We encourage sharing the article link with family and friends to benefit as well - better yet, sharing on social media. Thank you for the support! 🍉

Article Title: Monarch Money App: Is It Worth It in 2025?

https://fangwallet.com/2024/11/23/monarch-money-app/The FangWallet Promise

FangWallet is an editorially independent resource - founded on breaking down challenging financial concepts for anyone to understand since 2014. While we adhere to editorial integrity, note that this post may contain references to products from our partners.

The FangWallet promise is always to have your best interest in mind and be transparent and honest about the financial picture.

Become an Insider

Subscribe to get a free daily budget planner printable to help get your money on track!

Make passive money the right way. No spam.

Editorial Disclaimer: The editorial content on this page is not provided by any of the companies mentioned. The opinions expressed here are the author's alone.

The content of this website is for informational purposes only and does not represent investment advice, or an offer or solicitation to buy or sell any security, investment, or product. Investors are encouraged to do their own due diligence, and, if necessary, consult professional advising before making any investment decisions. Investing involves a high degree of risk, and financial losses may occur including the potential loss of principal.

Source Citation References:

+ Inspo