This article may contain references to products or services from one or more of our advertisers or partners. We may receive compensation when you click on links to those products or services. Nonetheless, our opinions are our own.

The information presented in this article is accurate to the best of our knowledge at the time of publication. However, information is subject to change, and no guarantees are made about the continued accuracy or completeness of this content after its publication date.

Updated by Albert Fang

Peer-to-peer payment apps like Cash App, Venmo, and Zelle have changed the way consumers send, receive, and transfer funds within a matter of seconds. Paying rent or splitting a check has never been easier thanks to these mobile payment apps revolutionizing how consumers use their money on the go in the 21st century.

The current popular payment apps are as follows:

- Cash App

- Venmo

- Zelle

All these services are free to use, however, realize there are some slight differences in each of the three services provided and how they operate.

Cash App

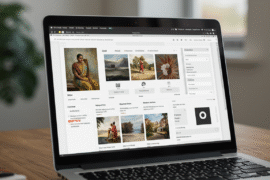

The Cash App is unique in that the app enables users to invest in stock and cryptocurrency in addition to the app being a peer-to-peer payment app. In other words, the Cash App incentivizes users to hold a balance and invest with the app itself. Whereas other mobile payment apps like Venmo and Zelle cater more to the transfer of funds from one person to another.

If Robinhood and Venmo had a baby, it would be the Cash App because the platform offerings draw many characteristics of both platforms: the ability to invest and at the same time offer a peer-to-peer transfer of monetary funds in one centralized location.

Cash App referral bonus for new users

The Cash App offers new users a $5 referral bonus for new users if they use the referral code: 8LPVG29

The only terms is that new Cash App users must transfer funds to another Cash App user within 14-days to be eligible for the free $5 sign-up bonus.

Apply referral bonus code: 8LPVG29 for a $5 sign-up bonus with Cash App.

Voted "Best Overall Budgeting App" by Forbes and WSJ

Monarch Money helps you budget, track spending, set goals, and plan your financial future—all in one app.

Get 50% OFF your first year with code MONARCHVIP

Venmo

Venmo is strictly a peer-to-peer payment app solution that is designed to have a hint of social media aspect to its app design. Only recently have Venmo started expanding its product offerings to include Venmo Business and even a Venmo Credit Card.

Venmo enables friends of your Venmo network to see your payment history and transactions. Moreover, the app boasts a newsfeed of the recent transactions to essentially glance at what your friends are up to. The app is similar to the Cash App in that Venmo enables user to hold a balance, although there is no investing incentive like the Cash App platform has.

Zelle

Out of the three apps, Zelle is the most secure and endorsed by banks the most. The reason is that the app does not hold a balance for you at all. All funds that are routed to your email or phone number that is tied to your Zelle account get deposited straight into your bank account.

With the Zelle app, banks are actually losing money for each transaction made. Banks are subsidizing the cost of the transaction from consumers hoping the user will eventually become a customer of the financial institution.

In other words, there is no middleman app in between. The transfer of funds goes directly into the account holder’s bank – which makes Zelle one of the most secure peer-to-peer payment app out there available in the mobile payment market.

Reviewed and edited by Albert Fang.

See a typo or want to suggest an edit/revision to the content? Use the contact us form to provide feedback.

At FangWallet, we value editorial integrity and open collaboration in curating quality content for readers to enjoy. Much appreciated for the assist.

Did you like our article and find it insightful? We encourage sharing the article link with family and friends to benefit as well - better yet, sharing on social media. Thank you for the support! 🍉

Article Title: Cash App vs Venmo vs Zelle: Best Mobile Payment App

https://fangwallet.com/2021/04/05/cash-app-vs-venmo-vs-zelle-best-mobile-payment-app/The FangWallet Promise

FangWallet is an editorially independent resource - founded on breaking down challenging financial concepts for anyone to understand since 2014. While we adhere to editorial integrity, note that this post may contain references to products from our partners.

The FangWallet promise is always to have your best interest in mind and be transparent and honest about the financial picture.

Become an Insider

Subscribe to get a free daily budget planner printable to help get your money on track!

Make passive money the right way. No spam.

Editorial Disclaimer: The editorial content on this page is not provided by any of the companies mentioned. The opinions expressed here are the author's alone.

The content of this website is for informational purposes only and does not represent investment advice, or an offer or solicitation to buy or sell any security, investment, or product. Investors are encouraged to do their own due diligence, and, if necessary, consult professional advising before making any investment decisions. Investing involves a high degree of risk, and financial losses may occur including the potential loss of principal.

Source Citation References:

+ Inspo