This article may contain references to products or services from one or more of our advertisers or partners. We may receive compensation when you click on links to those products or services. Nonetheless, our opinions are our own.

Updated by Albert Fang

For parents, teaching their kids the value of saving and spending wisely may be a tall order to fill. Fortunately, the Greenlight app was developed with parents in mind to distill good spending habits within their kids at a young age.

With Greenlight app, parents now have the power to nudge their kids into the right direction when it comes to valuing money.

What is Greenlight?

Greenlight is a fintech company that provides children debit card designed to help parents monitor their children’s spending habits. Greenlight was founded in 2014 and created to empower parents with convenient controls to safely manage family finances and create teachable moments around earning, spending, saving and giving. Greenlight is easier and more flexible than cash, with parental controls that allow families to manage exactly where, and how much their kids can spend.

Is Greenlight safe?

Greenlight has built in safety measures to ensure your financials are safe.

- Every Greenlight account is FDIC-insured through our partner, Community Federal Savings Bank, to protect your kids’ earnings.

- As with all debit cards, Greenlight requires you to set a 4-digit PIN after activation.

- Greenlight use state-of-the-art encryption, firewalls and VPNs.

- Greenlight block unsafe spend categories and don’t let kids get cash back at the register.

Greenlight benefits

Parents now have a powerful tool in their arsenal to teach their kids at a young age the value of saving, spending, and using a debit card in society today.

- Child allowance feature

- Blocking feature

- Spend monitoring

- Investing feature

- Assign chores for allowance incentive straight through the Greenlight app

- Ability to donate to a charity

How to use Greenlight for beginners tutorial

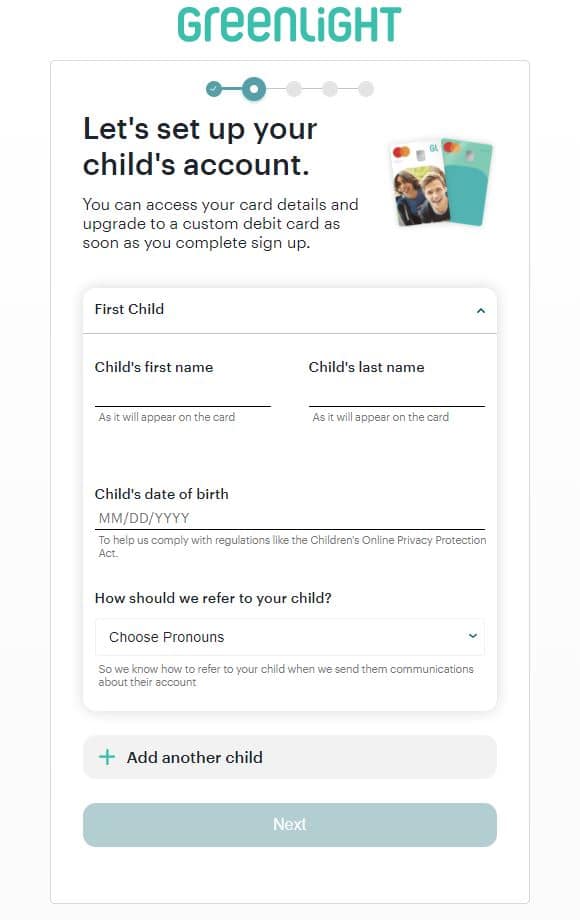

The first step to getting started with Greenlight is to sign-up for a Greenlight account as the parent/guardian main account.

Once the parent account has been set-up, you will be able to set-up the child’s account. Note that for every child added, each child will have their own individual custom debit card from Greenlight.

Shortly after, you will be asked to fund at minimum $10 to your parent account to start allocating funds to your child’s debit cards.

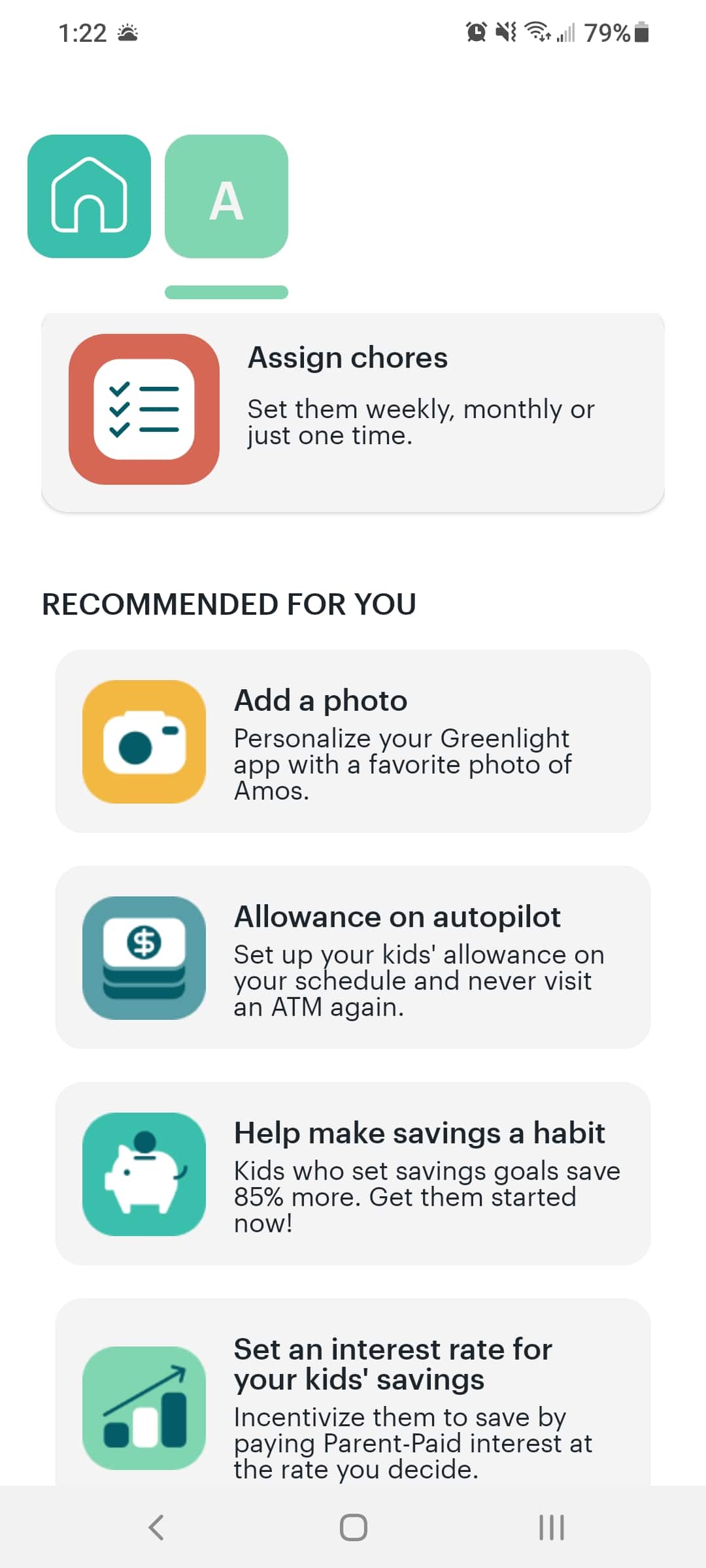

Greenlight app screenshot example

Frequently Asked Questions

What age is best for kids to get a Greenlight card?

Earlier the age the better to teach kids the value of saving and spending. Legally, there is no minimum age requirement restriction to get started with Greenlight.

When will I receive my child’s debit card after signing up for Greenlight?

It may take anywhere between 5 – 10 business days for the Greenlight debit card to come in the mail.

How do I receive the $30 Greenlight referral code sign-up bonus?

According to Greenlight’s referral program, for every family or friend referral, you and your family or friend are eligible for a $30 bonus cash.

What type of card is the Greenlight card?

The Greenlight card is classified as a prepaid debit card.

Reviewed and edited by Albert Fang.

See a typo or want to suggest an edit/revision to the content? Use the contact us form to provide feedback.

At FangWallet, we value editorial integrity and open collaboration in curating quality content for readers to enjoy. Much appreciated for the assist.

Did you like our article and find it insightful? We encourage sharing the article link with family and friends to benefit as well - better yet, sharing on social media. Thank you for the support! 🍉

Article Title: Greenlight App Review – Greenlight Referral Code 2025-2026 Signup Bonus

https://fangwallet.com/2021/09/06/greenlight-referral-code-2021-signup-bonus/The FangWallet Promise

FangWallet is an editorially independent resource - founded on breaking down challenging financial concepts for anyone to understand since 2014. While we adhere to editorial integrity, note that this post may contain references to products from our partners.

The FangWallet promise is always to have your best interest in mind and be transparent and honest about the financial picture.

Become an Insider

Subscribe to get a free daily budget planner printable to help get your money on track!

Make passive money the right way. No spam.

Editorial Disclaimer: The editorial content on this page is not provided by any of the companies mentioned. The opinions expressed here are the author's alone.

The content of this website is for informational purposes only and does not represent investment advice, or an offer or solicitation to buy or sell any security, investment, or product. Investors are encouraged to do their own due diligence, and, if necessary, consult professional advising before making any investment decisions. Investing involves a high degree of risk, and financial losses may occur including the potential loss of principal.

Source Citation References:

+ Inspo

There are no additional citations or references to note for this article at this time.