This article may contain references to products or services from one or more of our advertisers or partners. We may receive compensation when you click on links to those products or services. Nonetheless, our opinions are our own.

The information presented in this article is accurate to the best of our knowledge at the time of publication. However, information is subject to change, and no guarantees are made about the continued accuracy or completeness of this content after its publication date.

Updated by Albert Fang

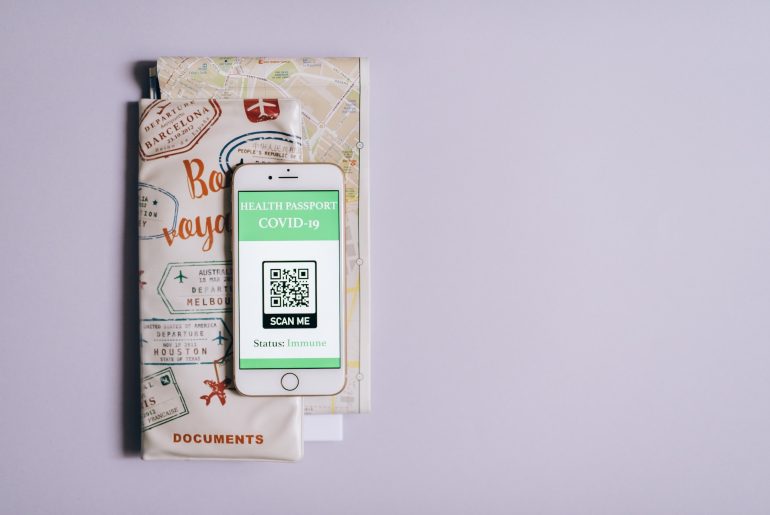

Perhaps you think you can do without travel insurance. But what happens when you contract COVID-19 while on your trip? You will need to change your flights, you might need to seek medical attention. All of this means added costs to you. While we hope that we return home safe from a trip without going through mishaps, we must be prepared for every possible scenario so that in the event that something happens, we can be well guarded and have contingency plans in place to mitigate the repercussions. In this article, we discuss the importance of travel insurance with COVID-19 coverage when travelling out of Singapore. We also provide information on the types of travel insurance available and guide you through the process of getting insured for your beach holiday or business trip.

Why is COVID-19 coverage critical?

Borders have reopened. Revenge travel – travelling to make up for lost time during the pandemic – is surging. With a number of countries globally scaling back on their restrictions, more are seeing droves of tourists, a greater number of business trips are being organised, and postponed conferences and exhibitions are back in full swing.

Although this is so, COVID-19 has not been eradicated, and as travellers, we cannot let our guard down. As COVID-19 variants continue to crop up, getting adequate coverage with travel insurance from HL Assurance lets you hedge against the risks of contracting the virus that come with travelling. By taking on a comprehensive package, you can be covered if you contract the virus right before travelling and are required to cancel or have to postpone your flights whilst on your trip.

Voted "Best Overall Budgeting App" by Forbes and WSJ

Monarch Money helps you budget, track spending, set goals, and plan your financial future—all in one app.

Get 50% OFF your first year with code MONARCHVIP

What to look out for when buying COVID-19 travel insurance in Singapore?

1. COVID-19 coverage limit

You want to ensure that your total coverage limit is more than what you will spend. The bulk of your expenses is for your airline tickets, hotel costs and any multi-day tour packages. First, calculate your total expenses, including your flights, accommodation and other expenses of your itinerary, such as tour packages. Next, check the limit of COVID-19 coverage in the insurance policies they are browsing. For example, if your flights cost S$2,000 and your accommodation costs S$1,800, and the trip cancellation limit is S$2,000, you will not be fully covered, and that means wasted costs.

2. Exclusions of benefits

Different countries have different policies with respect to COVID-19. Some countries might require that you be fully vaccinated in order to cross their borders, while others require that you do an on-arrival or pre-arrival PCR or ART test. Some insurance policies do not cover those who are not vaccinated but test positive for COVID-19 before entering the country or while travelling. Others do not offer coverage if you’re travelling to a country that the Singapore government has issued travel advisories against. It’s important that you do the due diligence of checking both the requirements of your travel destination as well as the travel policy you plan on buying.

3. Check your medical coverage limits

When looking for travel insurance plans that include coverage for COVID-19, there are several tiers that determine how comprehensive your coverage is when seeking medical care. Ensure that your medical treatment and hospitalisation coverage is at least SG$30,000, the average amount of the bill in private hospitals to support COVID-recovery. Some plans also cover follow-up treatment care back in Singapore.

It’s also important to take into consideration the country or region you’re travelling to. For example, the United States is found to have the world’s most expensive medical expenses, followed by Switzerland. If you’re travelling to such countries, taking on travel insurance with a higher coverage limit can help you guard against expensive hospital bills.

4. Trip duration

There are three main types of travel insurance:

- Single trip travel insurance policy: One-off travel policy that covers one trip and is valid for a specific short duration. These are most beneficial for those who do not travel frequently.

- Annual trip travel insurance policy: Also known as multi-trip travel insurance, this travel insurance package is a cost-effective option for those who travel to the same region frequently.

- Group travel insurance policy: This travel policy is for businesses who are looking to provide protection to their employees when they go on business trips.

Protect yourself with the right COVID-19 travel insurance policy

Travel insurance can provide valuable protection if you contract COVID-19 while travelling out of Singapore. It can cover medical expenses, trip cancellations and interruptions, and other related costs. However, it is important to carefully read the fine print and understand the specific coverage offered by the various COVID-19 travel insurance policies available in Singapore, as not all insurance plans offer the same level of protection for COVID-19-related issues. It is also advisable to purchase travel insurance as soon as you book your trip, as some policies may not cover COVID-19 if it was already a known risk at the time of purchase.

By considering travel insurance, you can have peace of mind and financial protection in the event that you contract COVID-19 while travelling.

Reviewed and edited by Albert Fang.

See a typo or want to suggest an edit/revision to the content? Use the contact us form to provide feedback.

At FangWallet, we value editorial integrity and open collaboration in curating quality content for readers to enjoy. Much appreciated for the assist.

Did you like our article and find it insightful? We encourage sharing the article link with family and friends to benefit as well - better yet, sharing on social media. Thank you for the support! 🍉

Article Title: COVID-19 Travel Insurance in Singapore: How Can it Protect You?

https://fangwallet.com/2023/01/17/covid-19-travel-insurance-in-singapore-how-can-it-protect-you/The FangWallet Promise

FangWallet is an editorially independent resource - founded on breaking down challenging financial concepts for anyone to understand since 2014. While we adhere to editorial integrity, note that this post may contain references to products from our partners.

The FangWallet promise is always to have your best interest in mind and be transparent and honest about the financial picture.

Become an Insider

Subscribe to get a free daily budget planner printable to help get your money on track!

Make passive money the right way. No spam.

Editorial Disclaimer: The editorial content on this page is not provided by any of the companies mentioned. The opinions expressed here are the author's alone.

The content of this website is for informational purposes only and does not represent investment advice, or an offer or solicitation to buy or sell any security, investment, or product. Investors are encouraged to do their own due diligence, and, if necessary, consult professional advising before making any investment decisions. Investing involves a high degree of risk, and financial losses may occur including the potential loss of principal.

Source Citation References:

+ Inspo