This article may contain references to products or services from one or more of our advertisers or partners. We may receive compensation when you click on links to those products or services. Nonetheless, our opinions are our own.

The information presented in this article is accurate to the best of our knowledge at the time of publication. However, information is subject to change, and no guarantees are made about the continued accuracy or completeness of this content after its publication date.

Buying a car is a significant investment, and for many, it’s a decision that requires careful consideration. Fortunately, there are several money-saving tips that you can use to get the most out of your investment. In this article, we’ll provide you with some practical tips for car buyers, including how to negotiate a deal, when to buy, and how to take advantage of car lease deals. We’ll also highlight a popular car, the Honda HR-V, and how it can fit into your budget.

Do Your Research

Before you start your car-buying journey, it’s important to do your research. This means not only researching the cars you’re interested in but also understanding the market conditions. You should look at car reviews, safety ratings, fuel efficiency, and other features that are important to you. Additionally, it’s important to research the price range for the cars you’re considering, so you know what to expect when you start negotiating.

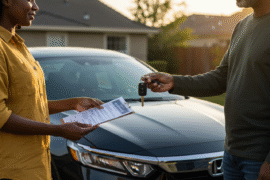

Negotiate the Price

When you’re ready to buy a car, negotiating the price can save you a lot of money. Dealerships and private sellers expect buyers to negotiate, so it’s important to go into the negotiation with a plan. You can start by offering a lower price than what’s listed, and be willing to walk away if the seller isn’t willing to meet your offer.

Time Your Purchase

Timing your purchase can also save you money. Car prices fluctuate throughout the year, and there are certain times when prices are lower. For example, you may be able to get a better deal on a car towards the end of the year, as dealerships are looking to clear their inventory for the new year’s models. Additionally, buying a car during a slow sales month, such as January or February, can also result in lower prices.

Consider Car Lease Deals

If you’re looking to save money, car lease deals can be a great option. Lease deals allow you to drive a new car for a fixed period, usually two or three years, and then return the car at the end of the lease term. This means you won’t have to worry about selling the car or dealing with depreciation. Additionally, lease payments are typically lower than car loan payments, which can save you money each month.

The Honda HR-V is a popular car that is available for lease. This compact SUV has a stylish design, impressive fuel economy, and a roomy interior. Additionally, it’s loaded with features, including a rearview camera, touchscreen infotainment system, and a suite of advanced safety features.

Improve Your Credit Score

Your credit score can have a significant impact on your car-buying experience. If you have a high credit score, you’re more likely to be approved for a car loan with a lower interest rate. This means you’ll pay less in interest over the life of the loan. To improve your credit score, you can pay your bills on time, keep your credit card balances low, and limit new credit applications.

Shop Around for Financing

When you’re ready to buy a car, it’s important to shop around for financing. This means looking at different lenders, including banks, credit unions, and online lenders, to find the best deal. You can start by getting pre-approved for a loan, which will give you an idea of the interest rate and terms you can expect.

Avoid Add-Ons

When you’re buying a car, dealerships may try to sell you additional features or services, such as extended warranties or gap insurance. While these add-ons may seem tempting, they can also add to the cost of the car. Before you agree to any add-ons, make sure you understand what they are and how much they will cost. In many cases, you can find cheaper options elsewhere or even opt-out of some add-ons altogether.

Consider a Used Car

If you’re looking to save money, a used car may be a good option. While new cars may be tempting, they also come with a higher price tag. By purchasing a used car, you can save money on the initial purchase price and also avoid some of the depreciation that occurs during the first few years of a car’s life.

Maintain Your Car

Once you’ve purchased your car, it’s important to maintain it properly. Regular maintenance can help prolong the life of your car and prevent costly repairs down the road. This includes things like oil changes, tire rotations, and brake inspections. By keeping up with regular maintenance, you can avoid the need for more expensive repairs later on.

Final Thoughts

Buying a car can be a major investment, but with the right approach, you can save money and get the most out of your investment. By doing your research, negotiating the price, considering lease deals, improving your credit score, shopping around for financing, avoiding add-ons, considering a used car, and maintaining your car, you can maximize your investment and enjoy your new ride.

The Honda HR-V is an excellent car for those looking for a balance between affordability, practicality, and style. It’s a popular choice for many car buyers, and with its impressive features and fuel efficiency, it’s easy to see why. If you’re interested in leasing a Honda HR-V, be sure to shop around for the best deal and understand the terms of the lease before signing any agreements.

In conclusion, purchasing a car can be a daunting task, but with these money-saving tips, you can make the process easier and more affordable. Remember to do your research, negotiate the price, consider lease deals, improve your credit score, shop around for financing, avoid add-ons, consider a used car, and maintain your car properly. By following these tips, you can maximize your investment and enjoy your new car for years to come.

Reviewed and edited by Albert Fang.

See a typo or want to suggest an edit/revision to the content? Use the contact us form to provide feedback.

At FangWallet, we value editorial integrity and open collaboration in curating quality content for readers to enjoy. Much appreciated for the assist.

Did you like our article and find it insightful? We encourage sharing the article link with family and friends to benefit as well - better yet, sharing on social media. Thank you for the support! 🍉

Article Title: Maximizing Your Investment: Money-Saving Tips for Car Buyers

https://fangwallet.com/2023/04/12/maximizing-your-investment-money-saving-tips-for-car-buyers/The FangWallet Promise

FangWallet is an editorially independent resource - founded on breaking down challenging financial concepts for anyone to understand since 2014. While we adhere to editorial integrity, note that this post may contain references to products from our partners.

The FangWallet promise is always to have your best interest in mind and be transparent and honest about the financial picture.

Become an Insider

Subscribe to get a free daily budget planner printable to help get your money on track!

Make passive money the right way. No spam.

Editorial Disclaimer: The editorial content on this page is not provided by any of the companies mentioned. The opinions expressed here are the author's alone.

The content of this website is for informational purposes only and does not represent investment advice, or an offer or solicitation to buy or sell any security, investment, or product. Investors are encouraged to do their own due diligence, and, if necessary, consult professional advising before making any investment decisions. Investing involves a high degree of risk, and financial losses may occur including the potential loss of principal.

Source Citation References:

+ Inspo