This article may contain references to products or services from one or more of our advertisers or partners. We may receive compensation when you click on links to those products or services. Nonetheless, our opinions are our own.

Updated by Albert Fang

Have you ever found yourself wondering where your money goes or even how you spend it? You have enough money in your bank account at the beginning of the month, but somewhere in between, you cannot pay your bills.

Well, you are not alone and do not have to worry about this anymore. We will discuss mindful spending in this article and show you how you can gain control over your money and spending.

But before we do that, do you know what mindful spending is? We cannot start discussing this concept if you do not know what it means.

What is Mindful Spending?

Mindful spending revolves around understanding yourself and what you want to do with your life. You are then required to apply this understanding when making expenditure decisions.

Chances are you have bought something that you really did not need or want. We have all done that. However, when practicing mindful spending, you find yourself assessing your money decisions based on your goals and long-term value.

How Can You Achieve Mindful Spending?

Now that you know what mindful spending is, chances are that this is something you would like to practice. But do you know how you can achieve it? Well, here are some things you can start with to work towards achieving mindful spending.

1. Track How You Spend Money

You can start by reviewing how you spend money regularly. You can do this weekly or monthly, depending on how much you transact. You might think this will be a lot of work, but it will help you evaluate how much you spend and see things that consume most of your money.

You can find many applications online to help you with this. For instance, get free Excel templates for finance to help you track every penny you spend. You can even use these templates to create forecasts and compare them with what you have actually spent.

2. Pay Using Cash

Chances are that you rarely carry cash with you. Well, we cannot blame you for this because of advancements in technology. Today, you can make payments using debit or credit cards. You can also use other platforms like Google Pay and Apple Pay.

Studies have found that very few people carry cash in the United States, and when they do, it is only half of the time. You do not have to be trendy and follow what everyone else is doing. Always ensure you have cash with you – but only what you need. This will help you to avoid spending on things that you do not need and save more money.

3. Avoid One-Click Purchases

If you look at most of the online retailers you have used before, you will realize they have implemented one-click purchases. They do this to ensure that you do not abandon their shopping carts.

It is a tactic that will lead you to impulse purchases. All you need to do is simply click a button, and the payment will be made. Go back to all the online retailers you use and ensure that this feature is disabled. If you are often tempted to shop online, uninstall any applications that tempt you to do that.

4. Plan Your Annual Budget

Every year, you will have events like travel plans, weddings, or even graduations to take care of. These events can leave a dent in your pocket if you are not careful. Look at what you will spend a lot of money on at the beginning of the year.

Start planning your budget early. You do not want to wait until the last minute to start spending hundreds or thousands of dollars for an event. Instead, start saving early. The money you save from the little things you will not be spending money on can be used for these events.

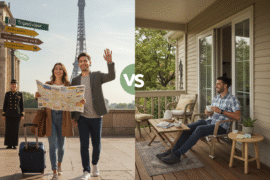

5. Designate Money for Fun Activities

Practicing mindful spending does not mean you cannot do anything for fun. Of course, this is your money, and you have worked so hard for it. There is no way you will be working all the time and never having any form of fun.

However, you should not spend unplanned money on these activities. You, therefore, should set aside some money that you can use for these activities. If you want, open another bank account and can keep the money for these activities. This will even help you track how you are spending your money.

How Mindful Spending Can Transform Your Finances

As you can see above, mindful spending requires you to change how you spend your money. If you practice everything discussed in this article, you will transform your finances.

If you change how you spend your money, you will have fewer expenses to worry about. In addition, you will have more money left than you usually have. Your life will also change since you will be buying right and better.

Mindful spending will also help you reduce clutter in your house. Chances are that you will be buying high-quality products, only when you need them. These products will last longer, meaning you will not need to replace them soon.

In addition, you will spend your money only on the things that you love, not just everything else that you feel like buying. You will even buy products or pay for services that help you achieve your lifestyle goals. At the end of the day, you will be proud of yourself, and your financial goals will be easy to achieve.

Mindful spending can also give you stability and control when it comes to your finances. You can make the right spending decisions instead of poor impulse purchases that only hurt your finances. This way, you will find yourself saving more money and on the right path toward achieving your financial goals.

Start Mindful Spending Today

If you have never practiced mindful spending, chances are you have found yourself in situations where you regret spending money on some things. As you can see above, mindful spending can help you manage your finances and achieve your financial goals.

In addition, it is not difficult to practice, since all the things you need to do are easy. You do not need to get any form of training. So, what are you waiting for? Start mindful spending today and reap the benefits.

Reviewed and edited by Albert Fang.

See a typo or want to suggest an edit/revision to the content? Use the contact us form to provide feedback.

At FangWallet, we value editorial integrity and open collaboration in curating quality content for readers to enjoy. Much appreciated for the assist.

Did you like our article and find it insightful? We encourage sharing the article link with family and friends to benefit as well - better yet, sharing on social media. Thank you for the support! 🍉

Article Title: Understanding Mindful Spending & How It Can Transform Your Finances

https://fangwallet.com/2023/05/15/understanding-mindful-spending-how-it-can-transform-your-finances/The FangWallet Promise

FangWallet is an editorially independent resource - founded on breaking down challenging financial concepts for anyone to understand since 2014. While we adhere to editorial integrity, note that this post may contain references to products from our partners.

The FangWallet promise is always to have your best interest in mind and be transparent and honest about the financial picture.

Become an Insider

Subscribe to get a free daily budget planner printable to help get your money on track!

Make passive money the right way. No spam.

Editorial Disclaimer: The editorial content on this page is not provided by any of the companies mentioned. The opinions expressed here are the author's alone.

The content of this website is for informational purposes only and does not represent investment advice, or an offer or solicitation to buy or sell any security, investment, or product. Investors are encouraged to do their own due diligence, and, if necessary, consult professional advising before making any investment decisions. Investing involves a high degree of risk, and financial losses may occur including the potential loss of principal.

Source Citation References:

+ Inspo