This article may contain references to products or services from one or more of our advertisers or partners. We may receive compensation when you click on links to those products or services. Nonetheless, our opinions are our own.

Updated by Albert Fang

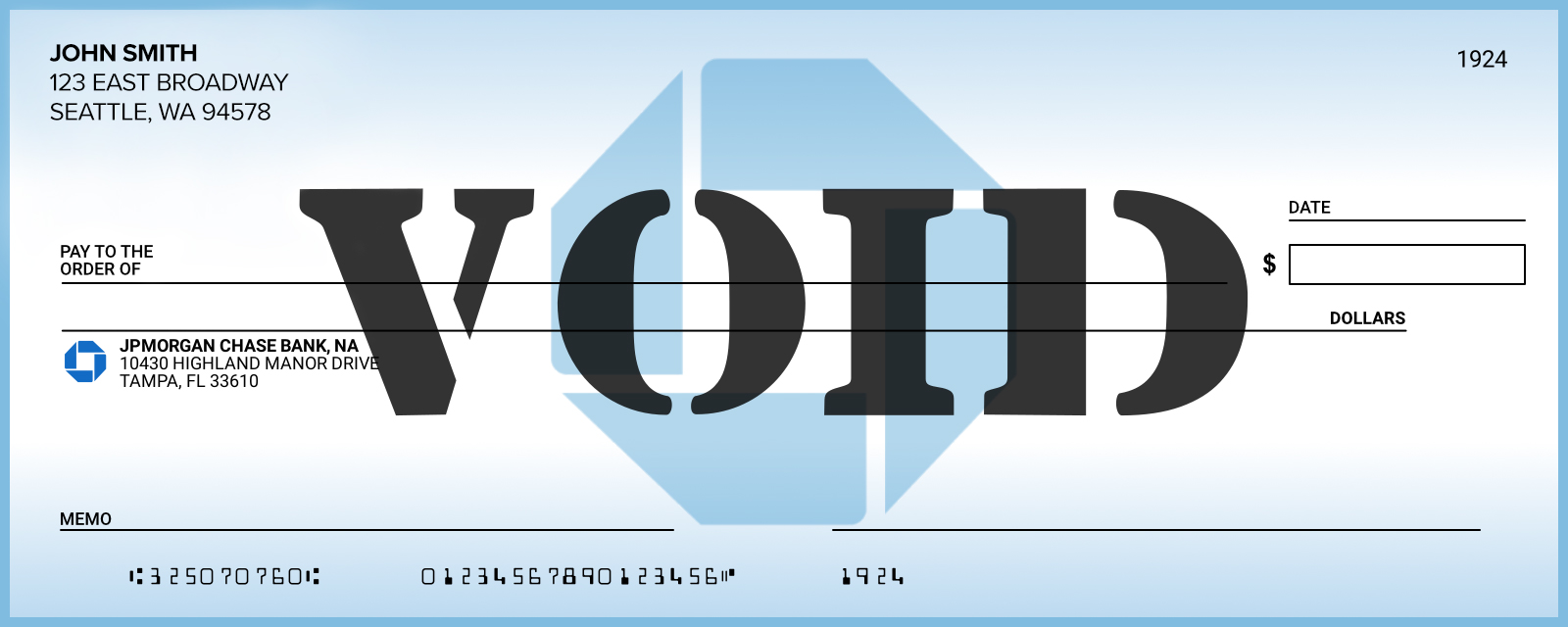

Today, the convenience and efficiency of financial transactions are not just a luxury but a necessity. What do you do if you need a voided check for setting up direct deposit or for automatic bill payments? The traditional route would involve finding your checkbook, manually voiding a check, and then dealing with the hassle of mailing or delivering it. This method, though tried and true, feels outdated in our fast-paced, digital world. This method, though tried and true, feels outdated in our fast-paced, digital world. Instead of going through this tedious process, now you can print checks at home, offering a faster, more efficient solution.

Transforming Traditional Banking Methods

Voided check is revolutionizing the way we handle banking procedures that have remained unchanged for decades. It provides and on-demand solution to create a voided check online, redefining the traditional process to make it faster, more secure, and incredibly user-friendly.

Wide-Ranging Compatibility

A standout feature of this platform is its compatibility with over 5,000 US banks and credit unions. This extensive network means that almost every banking customer in the United States can access and benefit from this service. Whether you are a client of a large national bank or a member of a local credit union, this service ensures seamless integration with your financial institution.

Uncompromised Security and Convenience

When it comes to financial transactions, security is a top priority. Recognizing this, voided check has implemented stringent security measures to safeguard user data.

The process is simple:

- Enter your banking information into their secure system

- A voided check is generated without the need for a physical checkbook.

- This not only adds convenience but also significantly reduces the risks associated with handling and transporting paper checks.

Instant and Secure Delivery

In today’s age, efficiency is key. Voided check addresses this by securely emailing the voided check directly to you. This immediate delivery enables you to quickly forward it to employers or creditors, streamlining processes like direct deposit setups or automatic payments, and minimizing errors.

A Bridge Between Old and New

This service represents a bridge between the enduring needs of traditional banking and the efficiencies of modern technology. It respects the necessity of certain banking protocols while providing a contemporary solution that aligns with our digital lifestyle.

An Environmentally Conscious Choice

In our growing awareness of environmental impact, this digital approach also offers an eco-friendly alternative to paper checks. By choosing this digital method, users contribute to reducing paper waste, making a small but meaningful impact on environmental conservation.

The Future of Banking has Arrived

In essence, this online tool is more than a mere utility; it’s a reflection of how innovation can simplify everyday tasks. Its extensive compatibility with financial institutions, reinforced by strong security measures and ease of use, positions it as an essential tool for individuals and businesses alike.

As we continue to embrace digital financial software solutions, opting for services like this not only makes practical sense but also aligns with the global shift towards more efficient, secure, and sustainable money practices. Discover the future of banking convenience with this innovative solution, where traditional banking meets the digital age.

Reviewed and edited by Albert Fang.

See a typo or want to suggest an edit/revision to the content? Use the contact us form to provide feedback.

At FangWallet, we value editorial integrity and open collaboration in curating quality content for readers to enjoy. Much appreciated for the assist.

Did you like our article and find it insightful? We encourage sharing the article link with family and friends to benefit as well - better yet, sharing on social media. Thank you for the support! 🍉

Article Title: Embrace the Future of Banking: The Ultimate Online Solution for Voided Checks

https://fangwallet.com/2024/01/26/embrace-the-future-of-banking-the-ultimate-online-solution-for-voided-checks/The FangWallet Promise

FangWallet is an editorially independent resource - founded on breaking down challenging financial concepts for anyone to understand since 2014. While we adhere to editorial integrity, note that this post may contain references to products from our partners.

The FangWallet promise is always to have your best interest in mind and be transparent and honest about the financial picture.

Become an Insider

Subscribe to get a free daily budget planner printable to help get your money on track!

Make passive money the right way. No spam.

Editorial Disclaimer: The editorial content on this page is not provided by any of the companies mentioned. The opinions expressed here are the author's alone.

The content of this website is for informational purposes only and does not represent investment advice, or an offer or solicitation to buy or sell any security, investment, or product. Investors are encouraged to do their own due diligence, and, if necessary, consult professional advising before making any investment decisions. Investing involves a high degree of risk, and financial losses may occur including the potential loss of principal.

Source Citation References:

+ Inspo