This article may contain references to products or services from one or more of our advertisers or partners. We may receive compensation when you click on links to those products or services. Nonetheless, our opinions are our own.

The information presented in this article is accurate to the best of our knowledge at the time of publication. However, information is subject to change, and no guarantees are made about the continued accuracy or completeness of this content after its publication date.

- Key Highlights

- Introduction

- Understanding the Endowment Effect

- Real-Life Applications of the Endowment Effect

- Beginner’s Guide to Recognizing the Endowment Effect

- Step-by-Step Guide to Mitigate the Endowment Effect

- Case Studies Highlighting the Endowment Effect

- Leveraging the Endowment Effect in Business

- Conclusion

- Frequently Asked Questions

- Recommended Reads

Key Highlights

- The endowment effect means people value what they own more highly than what they don’t own.

- This bias influences everyday decisions, like selling a car or negotiating prices.

- Businesses leverage the endowment effect to enhance product value perception and drive sales.

- Understanding the endowment effect can help individuals make better financial decisions.

- Recognizing this bias helps in effective buying, selling, and negotiating.

Introduction

Why is it often so hard to let go of things we own? The endowment effect explains. It suggests that ownership creates a psychological connection, causing us to overvalue our possessions. This phenomenon highlights the strong interplay between emotion and economics, impacting decisions from personal finance to business strategies.

Understanding the Endowment Effect

The endowment effect reflects a cognitive bias where people assign more value to things simply because they own them. This bias often leads to irrational decisions, such as overpricing a used item or rejecting fair offers.

Defining the Concept

The endowment effect, a key concept in behavioral economics, suggests that people overvalue their belongings compared to identical items they do not own. This heightened valuation occurs even if ownership is brief or the item is not particularly meaningful.

Closely linked to loss aversion, the endowment effect arises from a fear of losing what we have. Research by Daniel Kahneman, Jack Knetsch, and Richard Thaler reveals that people’s dislike of loss often outweighs their desire for equivalent gains.

Psychological Underpinnings

The endowment effect is rooted in two psychological tendencies:

- Loss Aversion: The pain of losing something outweighs the pleasure of gaining an equivalent item.

- Status Quo Bias: A preference for keeping things as they are rather than risking change.

Ownership also fosters a sense of control and emotional attachment, making it harder to part with possessions. For instance, a homeowner might price their property above market value due to sentimental value, even if buyers won’t pay the premium.

Real-Life Applications of the Endowment Effect

The endowment effect isn’t limited to theoretical studies; it appears in everyday decisions, consumer behavior, and business strategies.

Impact on Daily Decision-Making

The endowment effect can skew our judgment during transactions. For instance:

- Selling Personal Items: People often overprice their belongings because they feel emotionally attached.

- Job Negotiations: Candidates may overestimate their value due to a sense of entitlement from prior roles.

Recognizing this bias can help individuals approach decisions more rationally, focusing on market realities rather than emotional attachments.

Influence on Consumer Behavior

Marketers use the endowment effect to influence purchasing decisions:

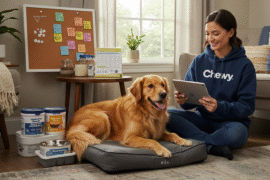

- Free Trials: Allowing consumers to test products creates a sense of ownership, making them more likely to buy.

- Scarcity Messaging: Highlighting limited availability triggers loss aversion, increasing perceived value.

For example, car dealerships offering test drives or subscription services with free trials exploit the endowment effect to boost sales.

Beginner’s Guide to Recognizing the Endowment Effect

Identifying the endowment effect in personal and professional situations can help reduce its impact.

Identifying Personal Experiences

Common examples include:

- Holding onto sentimental items, like old clothes or books, even when they no longer serve a purpose.

- Refusing to sell a project or idea because of emotional investment, despite better alternatives.

By acknowledging these tendencies, individuals can start making more objective decisions.

Tools and Resources

- Books: Thinking, Fast and Slow by Daniel Kahneman or Nudge by Richard Thaler provide insights into cognitive biases.

- Research: Journals like the Journal of Political Economy offer deeper studies on the endowment effect.

- Online Resources: Behavioral economics platforms simplify the concept for everyday application.

Step-by-Step Guide to Mitigate the Endowment Effect

You can reduce the impact of the endowment effect with these strategies:

Step 1: Awareness and Acknowledgment

Recognize that ownership may cloud your judgment. Ask yourself:

- Am I overvaluing this item because it’s mine?

- Would I pay the same price if I didn’t own it?

Step 2: Rational Evaluation

Evaluate items objectively:

- Assess how frequently you use them.

- Compare their utility against their market value.

Step 3: Compare Against Market Values

Research similar items online or consult experts to determine realistic prices. Aligning expectations with market trends can prevent emotional overvaluation.

Step 4: Implement a Delay Before Decisions

Take time to reflect before buying or selling. A cooling-off period reduces emotional bias, helping you make decisions based on logic.

Case Studies Highlighting the Endowment Effect

Case Study 1: The Coffee Mug Experiment

Participants were randomly given a coffee mug or a pen of equal value in this experiment. Owners of the mug valued it significantly higher than non-owners, illustrating how mere possession inflates perceived worth.

Case Study 2: Real Estate Pricing

Homeowners often price their properties above market value due to emotional attachments. This emotional bias can delay sales, as buyers hesitate to match inflated valuations.

Leveraging the Endowment Effect in Business

Businesses use the endowment effect to influence consumer behavior.

Enhancing Perceived Value

- Product Trials: Letting customers experience products fosters attachment and perceived value.

- Haptic Imagery: Online retailers use visuals and descriptions to simulate ownership.

Creating Ownership Before Purchase

- Test Drives and Trials: These strategies increase purchase likelihood by establishing a sense of ownership.

- Flexible Return Policies: Allowing returns reduces perceived risk, encouraging purchases.

Conclusion

The endowment effect reveals how ownership skews perceptions of value, shaping decisions in subtle but powerful ways. While businesses leverage this growth bias, individuals can mitigate its impact by adopting rational strategies. Understanding and addressing the endowment effect enables us to navigate personal and professional decisions more effectively.

Frequently Asked Questions

Can the endowment effect be entirely eliminated?

While it’s challenging to eliminate, awareness and rational evaluation can reduce its influence.

How do businesses use the endowment effect?

Companies use free trials, scarcity messaging, and experiential marketing to create a sense of ownership and increase sales.

What is the endowment effect’s impact on decision-making?

It causes people to overvalue their possessions, leading to reluctance in selling or overpricing items.

Can you provide real-life examples?

Examples include homeowners overpricing properties or consumers hesitating to cancel free trial subscriptions.

How can individuals overcome the bias?

Evaluate items objectively, compare market values, and implement a decision-making delay.

Are there positive applications of the endowment effect?

Yes, businesses can build brand loyalty and increase customer retention by fostering a sense of ownership.

Reviewed and edited by Albert Fang.

See a typo or want to suggest an edit/revision to the content? Use the contact us form to provide feedback.

At FangWallet, we value editorial integrity and open collaboration in curating quality content for readers to enjoy. Much appreciated for the assist.

Did you like our article and find it insightful? We encourage sharing the article link with family and friends to benefit as well - better yet, sharing on social media. Thank you for the support! 🍉

Article Title: Endowment Effect Examples: Real-Life Application

https://fangwallet.com/2025/02/04/endowment-effect/The FangWallet Promise

FangWallet is an editorially independent resource - founded on breaking down challenging financial concepts for anyone to understand since 2014. While we adhere to editorial integrity, note that this post may contain references to products from our partners.

The FangWallet promise is always to have your best interest in mind and be transparent and honest about the financial picture.

Become an Insider

Subscribe to get a free daily budget planner printable to help get your money on track!

Make passive money the right way. No spam.

Editorial Disclaimer: The editorial content on this page is not provided by any of the companies mentioned. The opinions expressed here are the author's alone.

The content of this website is for informational purposes only and does not represent investment advice, or an offer or solicitation to buy or sell any security, investment, or product. Investors are encouraged to do their own due diligence, and, if necessary, consult professional advising before making any investment decisions. Investing involves a high degree of risk, and financial losses may occur including the potential loss of principal.

Source Citation References:

+ Inspo