This article may contain references to products or services from one or more of our advertisers or partners. We may receive compensation when you click on links to those products or services. Nonetheless, our opinions are our own.

The information presented in this article is accurate to the best of our knowledge at the time of publication. However, information is subject to change, and no guarantees are made about the continued accuracy or completeness of this content after its publication date.

- Highlights

- Comparison Between Remitly and Western Union

- User Profiles: Who Chooses Which Service?

- Comparing Rates and Fees

- Security and Technology

- User Experience and Accessibility

- Market Performance and Customer Base

- Which Service Fits Your Needs?

- Final Thoughts: Your Smart Move in the Remittance Market

- Frequently Asked Questions

- Recommended Reads

Highlights

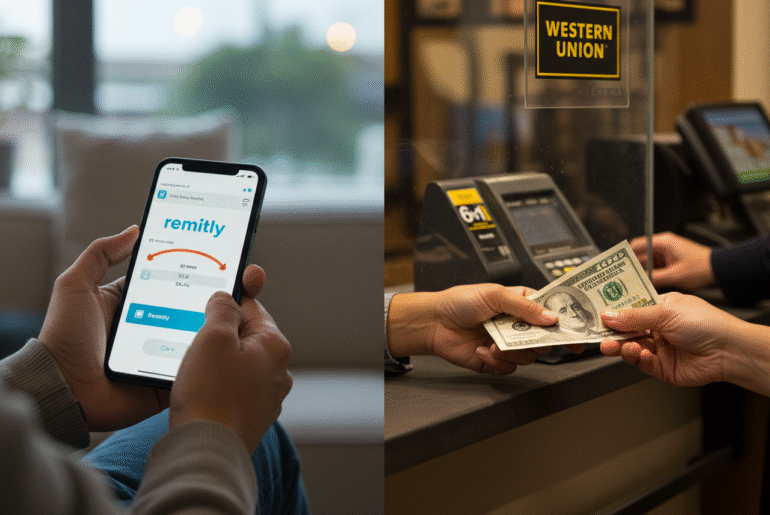

Choosing the right money transfer service can significantly impact how much money your recipient receives and how quickly it gets there. Two major players in this space, Remitly and Western Union offer distinct advantages depending on your needs. Remitly caters to digitally savvy users with competitive rates and a streamlined app experience, while Western Union boasts a long-standing global presence and an extensive network of agent locations for cash pickups.

This comparison explores differences in cost, speed, accessibility, technology, and user preferences to help you decide which provider is the best fit for your next international money transfer.

Cost Efficiency

Remitly usually offers lower fees and better exchange rates, especially for bank account transfers.

Transfer Speed

Western Union’s global agent network often delivers faster cash pickups, though both provide instant options.

Technology Preferences

Remitly’s mobile-first platform suits digitally savvy users. Western Union accommodates both app users and those preferring traditional agent services.

Reliability and Trust

Western Union benefits from decades of global presence. Remitly gains confidence through transparent pricing and user-friendly digital features.

Comparison Between Remitly and Western Union

| Feature | Remitly | Western Union |

|---|---|---|

| Primary Focus | Primarily online international money transfers | Broad financial services, including money transfers |

| Transfer Method | Primarily digital (website, mobile app) | Online, mobile app, and physical agent locations |

| Speed | Often offers fast or express transfers | Varies by method; can be fast or take longer |

| Fees | Generally competitive, varies by destination, amount, and speed | Varies significantly based on method, destination, and amount |

| Accessibility | Requires internet access | Accessible online and through a large network of agents |

| Recipient Options | Bank deposit, mobile money, cash pickup in some locations | Bank deposit, cash pickup, mobile money in some locations, home delivery in some areas |

User Profiles: Who Chooses Which Service?

- Remitly attracts younger users who prioritize speed and digital control.

- Western Union serves a wider demographic, including individuals needing in-person service or lacking regular internet access.

Comparing Rates and Fees

- Remitly: Favorable for low transfer fees and real-time exchange rates with minimal hidden costs.

- Western Union: Stronger cash pickup network but often involves higher fees at agent locations.

Voted "Best Overall Budgeting App" by Forbes and WSJ

Monarch Money helps you budget, track spending, set goals, and plan your financial future—all in one app.

Get 50% OFF your first year with code MONARCHVIP

Security and Technology

- Both companies use encryption and identity verification to protect transactions.

- Remitly emphasizes modern security and easy tracking within its app.

- Western Union maintains comprehensive compliance systems backed by a longer operational history.

User Experience and Accessibility

- Remitly: User-friendly interface ideal for first-time users, including features like a “delivery promise.”

- Western Union: Wide access through physical agents and options to pay either digitally or with cash.

Market Performance and Customer Base

| Metric | Remitly | Western Union |

|---|---|---|

| Estimated Users | 5+ million active users | 150+ million customers |

| Digital Adoption Rate | High | Moderate, growing steadily |

| 2023 Transaction Volume | ~$20+ billion | ~$80+ billion |

| Market Reputation | Emerging fintech leader | Established global provider |

Which Service Fits Your Needs?

Choose Remitly for:

- A mobile-first, streamlined experience

- Lower fees on bank transfers

- Transparent pricing and quick setup

Choose Western Union for:

- Access to physical cash pickup in remote locations

- In-person assistance when needed

- Extensive global network coverage

Final Thoughts: Your Smart Move in the Remittance Market

Selecting a money transfer platform depends on personal priorities. Remitly suits those looking for cost-effective, fast digital transfers. Western Union remains strong for users requiring broad global reach and cash delivery options. Checking rates and delivery methods before each transfer helps maximize value. Staying aware of service updates will enhance savings and convenience.

Frequently Asked Questions

Is Remitly or Western Union cheaper?

Remitly generally has lower fees and more favorable exchange rates, particularly for digital bank transfers.

Which service offers faster transfers?

Both provide quick delivery, but Western Union can be faster for cash pickups in remote areas.

Can I use both services?

Yes, many users alternate depending on rates, destination, and delivery preferences.

Are these services safe to use?

Both follow strict regulations, with strong encryption and identity verification protocols.

Which service is better for digital users?

Remitly is optimized for mobile users, while Western Union continues improving its digital offerings

Reviewed and edited by Albert Fang.

See a typo or want to suggest an edit/revision to the content? Use the contact us form to provide feedback.

At FangWallet, we value editorial integrity and open collaboration in curating quality content for readers to enjoy. Much appreciated for the assist.

Did you like our article and find it insightful? We encourage sharing the article link with family and friends to benefit as well - better yet, sharing on social media. Thank you for the support! 🍉

Article Title: Remitly vs. Western Union: Which Sends Money Better?

https://fangwallet.com/2025/06/01/remitly-vs-western-union/The FangWallet Promise

FangWallet is an editorially independent resource - founded on breaking down challenging financial concepts for anyone to understand since 2014. While we adhere to editorial integrity, note that this post may contain references to products from our partners.

The FangWallet promise is always to have your best interest in mind and be transparent and honest about the financial picture.

Become an Insider

Subscribe to get a free daily budget planner printable to help get your money on track!

Make passive money the right way. No spam.

Editorial Disclaimer: The editorial content on this page is not provided by any of the companies mentioned. The opinions expressed here are the author's alone.

The content of this website is for informational purposes only and does not represent investment advice, or an offer or solicitation to buy or sell any security, investment, or product. Investors are encouraged to do their own due diligence, and, if necessary, consult professional advising before making any investment decisions. Investing involves a high degree of risk, and financial losses may occur including the potential loss of principal.

Source Citation References:

+ Inspo

There are no additional citations or references to note for this article at this time.