This article may contain references to products or services from one or more of our advertisers or partners. We may receive compensation when you click on links to those products or services. Nonetheless, our opinions are our own.

The information presented in this article is accurate to the best of our knowledge at the time of publication. However, information is subject to change, and no guarantees are made about the continued accuracy or completeness of this content after its publication date.

- Which Offers Best High-Yield Savings Account for 2025

- Introduction

- How SoFi and Amex Fit the U.S. Savings Market

- Account Security and Insurance

- How to Choose Between SoFi and Amex

- Steps to Open Your Account

- Final Thoughts

-

Frequently Asked Questions

- Can I open both a SoFi and an American Express high-yield savings account?

- Does SoFi require direct deposit to earn the highest APY?

- How safe are SoFi and Amex for storing savings online?

- Which account is better for everyday transfers or budgeting tools?

- Are there fees or penalties for withdrawing money from these accounts?

- Recommended Reads

Which Offers Best High-Yield Savings Account for 2025

Choosing the Right High-Yield Savings Account

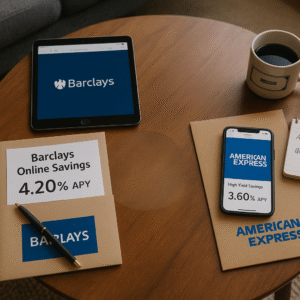

SoFi and American Express both offer top-tier high-yield savings accounts that outperform traditional banks. SoFi is known for its modern financial tools and higher promotional rates with direct deposit. American Express delivers stability, ease of use, and consistent returns without complex conditions.

Interest Rate Advantage

Both accounts offer competitive APYs. SoFi provides up to 3.80% with qualifying direct deposits, while American Express offers a flat 3.70%. These rates fluctuate based on the Federal Reserve and are updated regularly to stay aligned with market movements.

Savings Goals and Banking Style

Your ideal account depends on your goals. If you want additional perks like budgeting tools and integrated checking, SoFi is a strong fit. For those who prefer a straightforward, savings-only account from a trusted legacy brand, Amex is the more stable option.

Introduction

Online savings accounts are now the go-to option for maximizing returns while keeping your money safe. SoFi and American Express National Bank both offer high-yield savings accounts with rates far above the national average. This comparison highlights which account offers better value depending on your financial needs, lifestyle, and tech preferences.

How SoFi and Amex Fit the U.S. Savings Market

More Americans are switching to digital banks in search of better returns, mobile access, and minimal fees. SoFi and Amex have emerged as strong contenders by offering high interest rates, FDIC protection, and no hidden fees. While SoFi attracts digitally engaged savers with its full financial suite, Amex appeals to traditional savers looking for dependable performance with fewer requirements.

| Feature | SoFi | American Express |

|---|---|---|

| APY | Up to 3.80% (with direct deposit) | 3.70% (flat) |

| Minimum Deposit | $0 | $1 |

| Monthly Fees | None | None |

| FDIC Insurance | Yes, up to $250,000 | Yes, up to $250,000 |

| Mobile App | Yes, with budgeting and Vaults | Yes, clean and easy to use. |

| Account Type | Combined Checking and Savings | High-Yield Savings Only |

| Extra Features | Auto Save, Direct Deposit Bonus | Brand reliability, Simple UI |

| Interest Compounding | Daily | Daily |

| Customer Support | 24/7 Chat and Phone | Phone and Secure Messaging |

| ATM Access | Limited (via SoFi checking) | None |

| Rate Update Frequency | Frequently based on Fed changes | Less frequent, more stable |

Account Security and Insurance

FDIC Insurance Coverage

Both SoFi and Amex are FDIC-insured, meaning your funds are protected up to $250,000 per depositor, per institution. This level of insurance applies to your principal and accrued interest, offering peace of mind in case of bank failure.

Data Security and Fraud Protection

The banks use advanced encryption, fraud monitoring, and two-factor authentication. SoFi emphasizes modern mobile security features, while Amex enforces strict compliance and account protection protocols, reflecting its legacy in consumer trust.

How to Choose Between SoFi and Amex

Getting Started: What You Need

Opening either account requires:

- A valid government-issued ID

- Your Social Security number

- U.S. residency and age over 18

Initial funding can be done via ACH transfer or debit card. SoFi doesn’t require a minimum deposit, while Amex requires just $1.

Factors That Matter When Choosing

Consider these:

- Do you want a simple savings-only experience (Amex) or access to advanced tools like vaults and budgeting features (SoFi)?

- Are you comfortable meeting conditions (like direct deposit) to unlock higher APYs?

- How important are mobile experience and integrations with other financial tools?

Steps to Open Your Account

Step 1: Prepare Identification and Banking Info

Have your Social Security number, driver’s license, and funding account details ready. This helps speed up the verification process.

Step 2: Apply Online

Visit the provider’s website and follow the guided online application process. This typically takes under 10 minutes and includes basic personal and financial questions.

Step 3: Fund and Activate Your Account

Transfer funds to begin earning interest. You can enable direct deposit or set up recurring transfers. Download the app to track your savings and monitor interest growth.

Final Thoughts

SoFi and American Express each offer reliable, secure high-yield savings accounts with no monthly fees. SoFi’s appeal lies in its app-based tools and rewards for active users, making it ideal for digital natives. Amex excels with a stable APY and a no-fuss experience perfect for traditional savers. Your choice should align with how hands-on you want to be and what features you value most in a savings account.

Frequently Asked Questions

Can I open both a SoFi and an American Express high-yield savings account?

Yes, you can open both accounts as long as you meet each bank’s eligibility requirements. This strategy can help diversify your savings approach. You may also benefit from unique features in each platform: SoFi’s automation and bonuses and Amex’s consistent APY.

Does SoFi require direct deposit to earn the highest APY?

Yes, to receive the maximum advertised APY from SoFi (currently 3.80%), you must set up qualifying direct deposits. Without it, the APY is typically lower. If you’re not planning to use direct deposit, Amex may offer a more predictable rate.

How safe are SoFi and Amex for storing savings online?

Both banks are FDIC-insured and offer up to $250,000 in protection per depositor. They also use robust security practices such as encryption, two-factor authentication, and fraud monitoring. This ensures your money and personal information are well protected.

Which account is better for everyday transfers or budgeting tools?

SoFi is better suited for those who want built-in tools for budgeting, automatic saving, and goal tracking. It also integrates checking and savings in one account. American Express, on the other hand, is best if you prefer a focused, savings-only experience without extra features.

Are there fees or penalties for withdrawing money from these accounts?

Neither account charges monthly maintenance fees. However, excessive withdrawals or transfers may be limited under federal guidelines. SoFi and Amex typically allow up to six savings withdrawals per month. Always check the latest terms to avoid possible transfer delays or restrictions.

Reviewed and edited by Albert Fang.

See a typo or want to suggest an edit/revision to the content? Use the contact us form to provide feedback.

At FangWallet, we value editorial integrity and open collaboration in curating quality content for readers to enjoy. Much appreciated for the assist.

Did you like our article and find it insightful? We encourage sharing the article link with family and friends to benefit as well - better yet, sharing on social media. Thank you for the support! 🍉

Article Title: SoFi vs. Amex: Best High-Yield Savings Account for 2025-2026

https://fangwallet.com/2025/07/09/sofi-vs-amex-best-high-yield-savings-account-for-2025-2026/The FangWallet Promise

FangWallet is an editorially independent resource - founded on breaking down challenging financial concepts for anyone to understand since 2014. While we adhere to editorial integrity, note that this post may contain references to products from our partners.

The FangWallet promise is always to have your best interest in mind and be transparent and honest about the financial picture.

Become an Insider

Subscribe to get a free daily budget planner printable to help get your money on track!

Make passive money the right way. No spam.

Editorial Disclaimer: The editorial content on this page is not provided by any of the companies mentioned. The opinions expressed here are the author's alone.

The content of this website is for informational purposes only and does not represent investment advice, or an offer or solicitation to buy or sell any security, investment, or product. Investors are encouraged to do their own due diligence, and, if necessary, consult professional advising before making any investment decisions. Investing involves a high degree of risk, and financial losses may occur including the potential loss of principal.

Source Citation References:

+ Inspo

There are no additional citations or references to note for this article at this time.