This article may contain references to products or services from one or more of our advertisers or partners. We may receive compensation when you click on links to those products or services. Nonetheless, our opinions are our own.

The information presented in this article is accurate to the best of our knowledge at the time of publication. However, information is subject to change, and no guarantees are made about the continued accuracy or completeness of this content after its publication date.

These are the best SECR softwares to boost your ESG strategy:

- Dcycle

- EcoOnline

- Watershed

- Accuvio

- GHGi Analytics

- Mavarick.ai

- Novisto

- Envizi

- Figbytes

- Enablon

If you report in the UK, a SECR software is a must. The right platform does more than generate an annual document. It becomes the place where energy data lives.

Calculations run automatically. Evidence stays audit ready. The same dataset can power CSRD, EU Taxonomy, SBTi and ISO work.

Below is a fully rephrased guide to the leading SECR tools, with clear buying criteria, common pitfalls and a simple rollout plan. We start with Dcycle, which acts as a central ESG hub rather than a one-off compliance tool.

Why use a SECR software now

SECR demands consistent data collection, correct UK conversion factors, year-on-year comparison and at least one intensity metric. Spreadsheets can work once.

They rarely scale. A dedicated platform unifies data from invoices, meters and internal systems. It applies the right factors. It preserves history. It keeps records verifiable. It also lets you reuse the same information across other disclosures so you stop rebuilding reports from scratch.

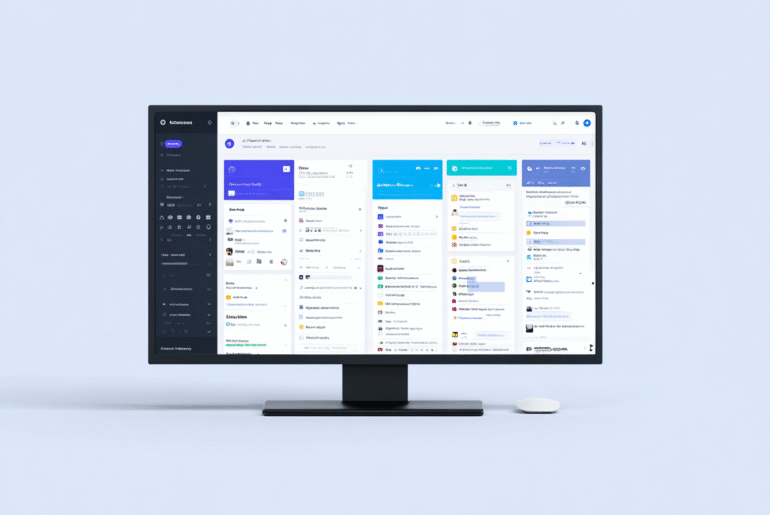

10 Best SECR Softwares in 2025

1. Dcycle

Dcycle is a next-generation ESG management platform that consolidates all your sustainability data, energy, emissions, water, waste, and social metrics, into one intelligent system. It’s designed for companies that want SECR compliance today and readiness for future regulations tomorrow.

Unlike traditional SECR tools, Dcycle isn’t limited to reporting. It centralizes and structures data so that one dataset can be used for EINF, CSRD, SBTi targets, EU Taxonomy, and ISO certifications.

Key Features

- Unified ESG database for SECR, CSRD, and beyond.

- AI-powered automation for data collection and validation.

- Flexible framework alignment with upcoming regulations.

- Real-time dashboards for impact measurement and decision-making.

- Scalable pricing and multi-user collaboration features.

Dcycle turns ESG from a reporting obligation into a growth driver. Instead of working with spreadsheets and fragmented systems, companies gain one structured environment that produces consistent, audit-ready data across all reporting frameworks.

Best For: Companies that want to future-proof their sustainability reporting and integrate SECR directly into business strategy.

2. EcoOnline

EcoOnline is a clean, intuitive SECR solution designed for transparency and simplicity. It enables teams to collect energy data, monitor usage, and prepare compliant reports without needing advanced technical skills.

Key Features

- Prebuilt SECR templates and intensity ratio calculators.

- Easy user permissions and audit trails.

- Real-time energy tracking and exportable analytics.

EcoOnline’s biggest strength is usability. Even organizations without a dedicated sustainability department can manage SECR data effectively.

Best For: Small and medium-sized businesses seeking a fast, reliable SECR reporting workflow.

3. Watershed

Watershed combines SECR reporting with powerful carbon intelligence. It’s engineered to process vast datasets from utility bills, invoices, and IoT sources, converting them into actionable carbon metrics.

Key Features

- End-to-end automation: upload → calculation → report.

- Integrated support for frameworks like CDP and CSRD.

- Scenario modeling and target tracking for emissions reductions.

Watershed’s automation and scale make it ideal for companies managing multiple sites or subsidiaries. It’s also trusted by large enterprises for ESG alignment across borders.

Best For: Enterprises and multinational corporations with complex reporting needs.

4. Accuvio

Accuvio offers a straightforward, preconfigured SECR module that’s ready to use out of the box. Its focus is agility, organizations can go live quickly with minimal setup.

Key Features

- Plug-and-play SECR templates.

- Automatic factor updates.

- Intuitive dashboards for quick insights.

Accuvio is perfect for businesses that need to comply fast without long implementation cycles.

Best For: Medium-sized companies looking for a quick, efficient SECR compliance solution.

5. GHGi Analytics

GHGi Analytics is a precision-focused SECR platform for accurate carbon accounting. It consolidates data from multiple operational areas, meters, invoices, vehicles, and ensures results remain comparable year after year.

Key Features

- Integration with hardware meters and ERP systems.

- Annual updates to official UK emission factors.

- Robust version control for audits.

Its emphasis on verification and historical comparability makes GHGi Analytics ideal for organizations with strict internal governance.

Best For: Businesses that prioritize precision, auditability, and compliance rigor.

6. Mavarick.ai

Mavarick.ai automates energy data collection to make SECR compliance effortless. It uses AI and smart integrations to eliminate manual entry and minimize human error.

Key Features

- Automated data pipelines from invoices and sensors.

- Instant generation of audit-ready SECR reports.

- Smart alerts for anomalies or missing data.

By removing manual processes, Mavarick.ai dramatically reduces reporting time and boosts reliability.

Best For: Organizations seeking a fully automated, low-maintenance SECR process.

7. Novisto

Novisto provides an end-to-end ESG management suite that includes SECR. It merges sustainability, finance, and compliance reporting in one connected workspace.

Key Features

- Unified ESG and financial data tracking.

- Customizable SECR templates.

- Analytics that connect carbon performance to business KPIs.

Novisto helps sustainability and finance teams collaborate seamlessly, using the same data to tell a unified story.

Best For: Corporates integrating SECR with investor-grade ESG reporting.

8. Envizi

Envizi, now part of IBM, specializes in energy and carbon data management for large organizations. Its SECR functions integrate directly with other ESG modules for comprehensive analysis.

Key Features

- Real-time energy consumption monitoring.

- Advanced analytics and visual dashboards.

- Seamless integration with ERP and financial systems.

Envizi goes beyond compliance, its analytics identify inefficiencies and support long-term decarbonization strategies.

Best For: Enterprises focused on operational efficiency and long-term emissions reduction.

9. FigBytes

FigBytes merges ESG reporting with storytelling, making it easier to communicate sustainability progress to both internal and external audiences.

Key Features

- Visual dashboards tailored to SECR metrics.

- Multi-framework compatibility (CDP, TCFD, GRI).

- Automated data mapping from existing systems.

Its emphasis on visualization and communication makes sustainability data accessible to non-technical teams.

Best For: Organizations that need to engage employees and stakeholders through clear, visual reporting.

10. Enablon

Enablon is a powerful enterprise platform that integrates SECR with risk management and compliance functions.

Key Features

- Scalable system for complex corporate structures.

- Integration with audit and governance modules.

- Pre-validated data models for SECR compliance.

Enablon is a one-stop solution for corporations managing global ESG, EHS, and compliance data in one environment.

Best For: Large, multinational companies requiring a unified governance platform.

What SECR software actually does

- Collects energy and fuel data from invoices, meters and systems.

- Applies official UK conversion factors to produce CO₂e.

- Separates Scope 1 and Scope 2. Supports Scope 3 where material.

- Stores history for year-on-year comparison and audit.

- Calculates at least one intensity ratio that fits your business.

- Generates outputs aligned with SECR filing needs.

- Reuses the same dataset across additional ESG frameworks.

Selection criteria that matter

- Alignment with UK rules. Thresholds, factors and formats must reflect current SECR guidance.

- Complete energy coverage. Electricity, gas, fuels, fleet and relevant business travel.

- Automated calculations. Reduce human error and free up analyst time.

- Comparability. Year-on-year views with consistent methodology and audit trails.

- Flexible intensity metrics. Per employee. Per revenue. Per floor area. Choose what fits.

- Audit readiness. Traceability, role-based access and exports reviewers can follow.

- Scalability beyond SECR. Use the same data for CSRD, SBTi, EU Taxonomy and ISO work.

Voted "Best Overall Budgeting App" by Forbes and WSJ

Monarch Money helps you budget, track spending, set goals, and plan your financial future—all in one app.

Get 50% OFF your first year with code MONARCHVIP

Expected benefits

- One source of truth for ESG data.

- Less manual entry and fewer mistakes.

- Reusable information across multiple disclosures.

- Faster reviews with clear evidence chains.

- Trend analysis that drives action, not just reports.

- Higher credibility with customers, investors and regulators.

Mistakes to avoid

- Treating SECR as a once-a-year chore. You will rebuild the process every cycle.

- Ignoring integrations. Without connections to invoices and meters, your team will chase spreadsheets.

- Choosing only on price. Cheap tools often limit features and block future frameworks.

- Overlooking usability. If only one person can operate the system, you create risk.

- Forgetting the bigger ESG picture. SECR should sit inside an integrated data model

A simple rollout plan

- Baseline your data. List sources, formats and gaps. Decide which frameworks you must cover this year.

- Get the right people involved. Sustainability, finance, operations and IT. Shared ownership prevents stalls.

- Define required outputs. SECR first. Add CSRD, SBTi and Taxonomy as needed. Outputs dictate the data model.

- Select a flexible platform. Prioritize UK alignment and multi-framework reuse.

- Adopt a monthly or quarterly cadence. Keep data fresh and audit ready. Avoid year-end scrambles.

Why Dcycle works as the ESG hub

Many tools can print a SECR report. Dcycle is designed to be your living ESG database. You collect information once. You standardize it once. You then generate SECR and reuse the same dataset for EINF, CSRD, SBTi, EU Taxonomy and ISO documentation.

This approach eliminates duplication, shortens reviews and improves consistency across disclosures. It also gives leaders reliable numbers for planning and performance tracking.

Conclusion

SECR compliance is the baseline. What matters now is how effectively you can use that same data to guide your sustainability and ESG decisions.

A strong SECR platform saves time, reduces human error, and builds trust with auditors and stakeholders. But the best ones, like Dcycle, go further: they connect compliance with corporate strategy, turning sustainability reporting into a tangible business advantage.

In 2025, choosing SECR software isn’t about ticking boxes. It’s about building a smarter, data-driven ESG foundation that keeps your organization compliant, competitive, and ready for what’s next.

Reviewed and edited by Albert Fang.

See a typo or want to suggest an edit/revision to the content? Use the contact us form to provide feedback.

At FangWallet, we value editorial integrity and open collaboration in curating quality content for readers to enjoy. Much appreciated for the assist.

Did you like our article and find it insightful? We encourage sharing the article link with family and friends to benefit as well - better yet, sharing on social media. Thank you for the support! 🍉

Article Title: 10 SECR Software Platforms To Supercharge Your ESG Reporting In 2025

https://fangwallet.com/2025/11/15/10-secr-software-platforms-to-supercharge-your-esg-reporting-in-2025/The FangWallet Promise

FangWallet is an editorially independent resource - founded on breaking down challenging financial concepts for anyone to understand since 2014. While we adhere to editorial integrity, note that this post may contain references to products from our partners.

The FangWallet promise is always to have your best interest in mind and be transparent and honest about the financial picture.

Become an Insider

Subscribe to get a free daily budget planner printable to help get your money on track!

Make passive money the right way. No spam.

Editorial Disclaimer: The editorial content on this page is not provided by any of the companies mentioned. The opinions expressed here are the author's alone.

The content of this website is for informational purposes only and does not represent investment advice, or an offer or solicitation to buy or sell any security, investment, or product. Investors are encouraged to do their own due diligence, and, if necessary, consult professional advising before making any investment decisions. Investing involves a high degree of risk, and financial losses may occur including the potential loss of principal.

Source Citation References:

+ Inspo

There are no additional citations or references to note for this article at this time.