This article may contain references to products or services from one or more of our advertisers or partners. We may receive compensation when you click on links to those products or services. Nonetheless, our opinions are our own.

The information presented in this article is accurate to the best of our knowledge at the time of publication. However, information is subject to change, and no guarantees are made about the continued accuracy or completeness of this content after its publication date.

Comparison

Quick matrix to help you scan rewards style, foreign-fee policy, and standout perks at a glance.

| Card | Core rewards | Foreign fees | Signature perks | Best for |

|---|---|---|---|---|

| Chase Sapphire Preferred | 2x travel & dining | none | Ultimate Rewards transfers | Flexible point maximizers |

| Capital One Venture Rewards | 2x on everything | none | Easy mile redemptions | Simplified earning |

| American Express Platinum | premium travel earns | none | Lounge access & concierge | Luxury travelers |

| Discover it Miles | 1.5x flat | none | First-year miles match | Budget travelers |

| Citi Premier | 3x travel & dining | none | Travel protections | Category bonus users |

| Wells Fargo Propel Amex | 3x dining & transit | none | No annual fee | Everyday spenders |

| Bank of America Travel Rewards | 1.5x flat | none | Simple redemptions | No-fee seekers |

| HSBC Cash Rewards Mastercard | flat cashback | none | Global support | Cashback fans |

Top 8 cards for Overseas Travel

Numbered picks with one-sentence highlights and compact feature blocks for fast decisions.

1. Chase Sapphire Preferred Card

The Chase Sapphire Preferred offers flexible Ultimate Rewards redemptions, strong travel and dining earn, and no foreign transaction fees for travelers who want transfer value.

- Rewards

2x on travel & dining - Redemptions

Ultimate Rewards portal & partners - Foreign fee

None

2. Capital One Venture Rewards Credit Card

- Rewards

2x on everything - Redemption

Mile eraser or transfers - Foreign fee

None

3. American Express Platinum Card

Amex Platinum is built for premium travel with Centurion and partner lounge access, elite travel credits, strong insurance and a global concierge service.

- Perks

Airport lounges & credits - Coverage

Extensive travel protections - Foreign fee

None

4. Discover It Miles

Discover it Miles is a low-cost option that earns 1.5x on all purchases, doubles your first-year miles, and charges no foreign transaction fees where accepted.

- Rewards

1.5x flat - Bonus

First-year miles match - Foreign fee

None

5. Citi Premier Card

The Citi Premier delivers 3x on air travel, hotels, restaurants and more, plus travel protections and flexible point uses for global travelers focused on category bonuses.

- Rewards

3x on travel & dining - Protections

Trip cancellation & interruption - Foreign fee

None

6. Wells Fargo Propel American Express Card

This no-annual-fee card earns 3x on dining, transit, rideshares and travel with no foreign transaction fees, a solid everyday traveler pick.

- Rewards

3x dining, transit, travel - Annual fee

None - Foreign fee

None

7. Bank of America Travel Rewards Credit Card

Bank of America Travel Rewards gives a simple 1.5x on all purchases, easy redemptions and no annual or foreign transaction fees for steady, low-hassle rewards.

- Rewards

1.5x flat - Costs

No annual fee - Foreign fee

None

8. HSBC Cash Rewards Mastercard

The HSBC Cash Rewards card focuses on straightforward unlimited cashback, global customer support and no foreign transaction fees for travelers who prefer cash returns.

- Cashback

Unlimited cashback - Support

24/7 global assistance - Foreign fee

None

Voted "Best Overall Budgeting App" by Forbes and WSJ

Monarch Money helps you budget, track spending, set goals, and plan your financial future—all in one app.

Get 50% OFF your first year with code MONARCHVIP

FAQs

What credit card is best for international travel?

There is no single best card. It depends on your priorities. Luxury-focused travelers may get the most value from the American Express Platinum for lounges and credits, while those who want simple, strong returns will like Capital One Venture or Discover it Miles. Point optimizers who transfer to airlines often prefer Chase Sapphire Preferred or Citi Premier. Evaluate acceptance, foreign fees, and which redemption path gives you the highest value.

Do all travel credit cards have no foreign transaction fees?

No, some travel-branded cards still impose foreign transaction fees, so you must confirm the card’s fee schedule before traveling. A single foreign-transaction fee can add up quickly on extended trips. If a card charges fees, consider carrying a no-fee backup card to avoid unnecessary costs. Always check the issuer’s current terms since policies can change.

How can I maximize rewards when traveling internationally?

Use cards that bonus travel and dining abroad and redeem through high-value transfer partners or travel portals. Pair a flat-rate card with a category bonus card to cover all spend types for higher overall returns. Time large purchases to meet sign-up bonuses and use issuer portals only when they offer the best value. Track point valuations and transfer ratios to convert points where they deliver the most travel value.

Are travel insurance benefits on credit cards worth it?

Often yes, card benefits such as trip cancellation, interruption, and emergency medical coverage can reduce out-of-pocket risks. However, coverage varies by issuer and often requires booking travel with the card to qualify. Read the issuer’s benefit guide carefully for limits, exclusions, and claim procedures. For high-cost or complex trips, consider supplemental standalone travel insurance in addition to card benefits.

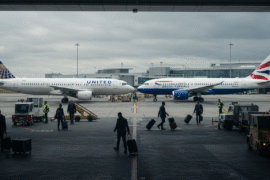

Can I use these cards worldwide?

Most cards listed are widely accepted globally, but network reach varies by country and merchant. Cards on Visa, Mastercard, and major Amex networks typically have broad acceptance, while Discover or smaller networks may be limited in some regions. Carry a backup card on a different network and confirm acceptance at your destination. Notify your issuer of travel plans to reduce fraud holds and ensure smooth use abroad.

Closing Insights

Choosing the right card for overseas travel means balancing no foreign fees, rewarding earn rates and protections that actually deliver when you need them. Flat-rate cards simplify earning and redemption, while transfer-focused cards often unlock highest per-point value for flights and hotels. Premium cards add lounge access and concierge help but require weighing credits and fees to judge net value. No-annual-fee options provide steady rewards for budget-conscious travelers without extra cost. Always confirm current terms, network acceptance and benefit details before you travel so there are no surprises. With the right mix, primary and backup, you’ll minimize fees, boost rewards and travel with greater peace of mind.

Reviewed and edited by Albert Fang.

See a typo or want to suggest an edit/revision to the content? Use the contact us form to provide feedback.

At FangWallet, we value editorial integrity and open collaboration in curating quality content for readers to enjoy. Much appreciated for the assist.

Did you like our article and find it insightful? We encourage sharing the article link with family and friends to benefit as well - better yet, sharing on social media. Thank you for the support! 🍉

Article Title: 8 Best Travel Credit Cards With No Foreign Fees 2025

https://fangwallet.com/2025/08/22/8-best-travel-credit-cards-with-no-foreign-fees-2025/The FangWallet Promise

FangWallet is an editorially independent resource - founded on breaking down challenging financial concepts for anyone to understand since 2014. While we adhere to editorial integrity, note that this post may contain references to products from our partners.

The FangWallet promise is always to have your best interest in mind and be transparent and honest about the financial picture.

Become an Insider

Subscribe to get a free daily budget planner printable to help get your money on track!

Make passive money the right way. No spam.

Editorial Disclaimer: The editorial content on this page is not provided by any of the companies mentioned. The opinions expressed here are the author's alone.

The content of this website is for informational purposes only and does not represent investment advice, or an offer or solicitation to buy or sell any security, investment, or product. Investors are encouraged to do their own due diligence, and, if necessary, consult professional advising before making any investment decisions. Investing involves a high degree of risk, and financial losses may occur including the potential loss of principal.

Source Citation References:

+ Inspo

There are no additional citations or references to note for this article at this time.