This article may contain references to products or services from one or more of our advertisers or partners. We may receive compensation when you click on links to those products or services. Nonetheless, our opinions are our own.

The information presented in this article is accurate to the best of our knowledge at the time of publication. However, information is subject to change, and no guarantees are made about the continued accuracy or completeness of this content after its publication date.

- The Real Effect of Holiday Spending on Your Money

- How to Handle Holiday Debt and Get Your Budget Back

- Importance of Setting a Realistic Budget for Any Holiday

- Tips for Embracing a Debt-Free Holiday Experience

- Major U.S. Holiday Spending Statistics

- Final Thoughts

- Frequently Asked Questions

- Recommended Reads

The Real Effect of Holiday Spending on Your Money

Holiday seasons often bring joy and celebration, but they can also create lingering financial challenges. Many individuals enter a new month, or even a new year, facing the consequences of seasonal spending, often accumulated through credit card use or loans. Understanding the true cost of holiday spending requires reflection on several key considerations:

- Budget Overruns: Exceeding a planned budget can lead to unexpected expenses and financial stress.

- Interest Rates: Using credit with high-interest rates may turn modest purchases into long-term debt.

- Emotional Spending: Holiday stress and social expectations can lead to impulsive purchases that disrupt financial goals.

To illustrate potential costs, the following table highlights estimated holiday expenses and the interest accrued over six months at a 15% annual percentage rate (APR):

| Item | Estimated Cost | Interest After 6 Months (15% APR) |

|---|---|---|

| Gifts | $500 | $22.50 |

| Decorations | $200 | $9.00 |

| Food & Drink | $300 | $13.50 |

As these costs accumulate, celebratory spending can quickly turn into financial strain. Establishing a clear holiday plan can protect your budget and reduce anxiety.

Lookout for Common Holiday Debt Traps

Any festive season can introduce financial obstacles that aren’t always immediately apparent. Awareness of these common traps is key to making informed decisions:

- Impulse Purchases: “Limited-time” deals, especially online, encourage unplanned spending. A structured shopping list helps avoid temptation.

- Credit Card Overuse: Charging purchases without a repayment plan increases financial risk. Evaluate whether the purchase is necessary before relying on credit.

- Excessive Gift-Giving: While generosity is admirable, setting spending limits or organizing gift exchanges can help control costs.

- Last-Minute Expenses: Procrastination often leads to overspending. Early preparation helps keep spending within your means.

Recognizing these patterns allows for more intentional and financially sound choices during any celebration.

Ways to Prevent Holiday Debt Before It Begins

Celebrating a holiday doesn’t have to mean financial overextension. Strategic planning can preserve both joy and financial health:

- Create a comprehensive holiday budget that includes gifts, meals, travel, and entertainment.

- Allocate monthly savings to a designated celebration fund to reduce reliance on credit.

- Make a thoughtful gift list in advance and explore meaningful or affordable alternatives. Secret exchanges, homemade gifts, or experience-based presents often create deeper memories.

| Gift Idea | Estimated Cost |

|---|---|

| Homemade Treats | $10–$20 |

| Personalized Photo Album | $15–$30 |

| Experience Days | $0–$20 |

| Handwritten Letters | Free |

How to Handle Holiday Debt and Get Your Budget Back

Managing debt after a holiday season requires a structured approach. Start by reviewing your financial obligations:

| Debt Type | Amount Owed | Interest Rate | Due Date |

|---|---|---|---|

| Credit Card 1 | $500 | 15% | 01/15/2025 |

| Credit Card 2 | $300 | 20% | 01/30/2025 |

| Personal Loan | $700 | 10% | 02/15/2025 |

Choose a repayment strategy:

- Snowball Method: Pay off the smallest debts first to build motivation.

- Avalanche Method: Pay off the highest-interest debts first to save money in the long term.

Reevaluate your monthly budget and redirect discretionary spending toward debt repayment. Cutting unnecessary expenses can speed up financial recovery and improve readiness for future holidays.

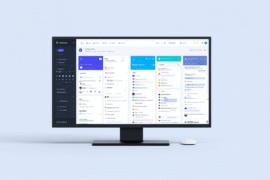

Voted "Best Overall Budgeting App" by Forbes and WSJ

Monarch Money helps you budget, track spending, set goals, and plan your financial future—all in one app.

Get 50% OFF your first year with code MONARCHVIP

Importance of Setting a Realistic Budget for Any Holiday

Holiday excitement can lead to unplanned and excessive spending. A realistic, sustainable budget helps avoid financial regret. When budgeting, consider:

- Gift Giving: Set limits per recipient.

- Food & Drink: Plan meals and stick to a shopping list.

- Travel Costs: Include transportation, lodging, and parking.

- Decorations: Use DIY options and establish clear spending caps.

| Category | Budgeted Amount | Actual Spend |

|---|---|---|

| Gifts | $200 | $150 |

| Food | $100 | $120 |

| Travel | $150 | $130 |

| Decorations | $50 | $40 |

Tracking your expenses ensures holiday joy isn’t eclipsed by post-season financial stress.

Tips for Embracing a Debt-Free Holiday Experience

Prioritizing financial health can lead to a more relaxed and meaningful celebration. Consider these steps:

- Create a Budget: Set spending limits for each category.

- Gift Thoughtfully: Consider handmade items or shared experiences.

- Embrace Minimalism: Focus on meaningful, not numerous, gifts.

- Plan Ahead: Save throughout the year to avoid using credit.

- Start New Traditions: Host affordable gatherings like potlucks or game nights.

Use a spending goal tracker to stay on course.

| Category | Budget Amount |

|---|---|

| Gifts | $200 |

| Food & Drinks | $100 |

| Decorations | $50 |

| Travel | $150 |

With discipline and creativity, you can enjoy any holiday without the burden of debt.

Major U.S. Holiday Spending Statistics

Use the following categories to understand holiday spending behavior in the U.S.:

- Average Holiday Spending Data: Per-person and household expenditures across major holidays.

- Gift Spending Over Time: Trends in how much consumers spend on gifts year over year.

- Non-Gift Spending Trends: Food, travel, and decor patterns over time.

- Holiday Spending Around the World: Compare U.S. spending with global data.

- Spending by Demographics: Income, Education, Age, Gender, and Regional Differences.

- Shopping Preferences: Online vs. in-store habits, top retailers, and seasonal sales trends.

- Gift preferences vary by age group, gender, and geographic location.

Final Thoughts

Holiday seasons, whether rooted in love, family, culture, or tradition, can offer meaningful moments. But overspending can cast a shadow over those experiences. With thoughtful planning, realistic budgeting, and intentional choices, you can enjoy each celebration without sacrificing your financial well-being. A debt-free holiday ensures the memories last longer than the bills.

Frequently Asked Questions

What is holiday debt, and how does it happen?

Holiday debt is money owed due to celebration-related spending, commonly from gifts, travel, or events. It often accumulates when purchases are made on credit without a repayment plan.

What are common ways people get into holiday debt?

Last-minute purchases, loan use, and shopping without a budget are leading causes.

How does holiday debt impact individuals?

It can lead to interest accumulation, reduced savings, and prolonged financial stress.

How can people avoid holiday debt?

Plan ahead, set a budget, pay with cash when possible, and prioritize thoughtful, low-cost gifting.

Reviewed and edited by Albert Fang.

See a typo or want to suggest an edit/revision to the content? Use the contact us form to provide feedback.

At FangWallet, we value editorial integrity and open collaboration in curating quality content for readers to enjoy. Much appreciated for the assist.

Did you like our article and find it insightful? We encourage sharing the article link with family and friends to benefit as well - better yet, sharing on social media. Thank you for the support! 🍉

Article Title: Smart Ways to Avoid Overspending During Holiday Season

https://fangwallet.com/2025/06/17/smart-ways-to-avoid-overspending/The FangWallet Promise

FangWallet is an editorially independent resource - founded on breaking down challenging financial concepts for anyone to understand since 2014. While we adhere to editorial integrity, note that this post may contain references to products from our partners.

The FangWallet promise is always to have your best interest in mind and be transparent and honest about the financial picture.

Become an Insider

Subscribe to get a free daily budget planner printable to help get your money on track!

Make passive money the right way. No spam.

Editorial Disclaimer: The editorial content on this page is not provided by any of the companies mentioned. The opinions expressed here are the author's alone.

The content of this website is for informational purposes only and does not represent investment advice, or an offer or solicitation to buy or sell any security, investment, or product. Investors are encouraged to do their own due diligence, and, if necessary, consult professional advising before making any investment decisions. Investing involves a high degree of risk, and financial losses may occur including the potential loss of principal.

Source Citation References:

+ Inspo

There are no additional citations or references to note for this article at this time.