This article may contain references to products or services from one or more of our advertisers or partners. We may receive compensation when you click on links to those products or services. Nonetheless, our opinions are our own.

The information presented in this article is accurate to the best of our knowledge at the time of publication. However, information is subject to change, and no guarantees are made about the continued accuracy or completeness of this content after its publication date.

- Summary Highlights

- Introduction

- The 5 C’s Of Credit

- The Role Of The 5 C’s In Loan Approval

- In-Depth Analysis Of Every Credit Factor

- Character: Assessing A Borrower’s Trustworthiness

- Capacity: Evaluating Ability To Repay

- Capital: The Borrower’s Financial Commitment

- Collateral: Assets As Loan Security

- Conditions: External Factors Affecting Loans

- Putting It All Together: Strengthening Your Loan Application

- Applying The 5 C’s To Small Business Loans

- Why Business Credit Matters

- Tips For Small Business Borrowers

- Conclusion

- FAQs

- Recommended Reads

Summary Highlights

- Get to know the 5 C’s of credit: character, capacity, capital, the value put up for a loan, and conditions that help decide if the bank or lender will say yes to giving out a loan.

- Learn how your credit score and history with money matter to a bank or lender and count toward how you rate as a borrower.

- See why things like how much you owe versus what you make, what you can put up to back your loan, and how much cash you have to give matter when a lender checks loan risk.

- Find out how outside money trends and loan rules at each lender can play a part in if your loan will get approved.

- Pick up useful ways to make your own or your business loan application stronger.

- See how the way the system looks at loan requests works for all kinds of people and for small business owners.

Introduction

Getting a loan can seem hard, but banks and other lenders have a simple way to look at each person who applies. They use something called the 5 C’s of credit. This stands for character, capacity, capital, security, and conditions. Lenders use these to decide if you get a loan or not. They look at your credit score, how you handle money, and why you want the loan. When you understand these 5 C’s, you can see what lenders look for from you. Knowing this makes you a better borrower. It also gives you a better chance for your loan to get approved.

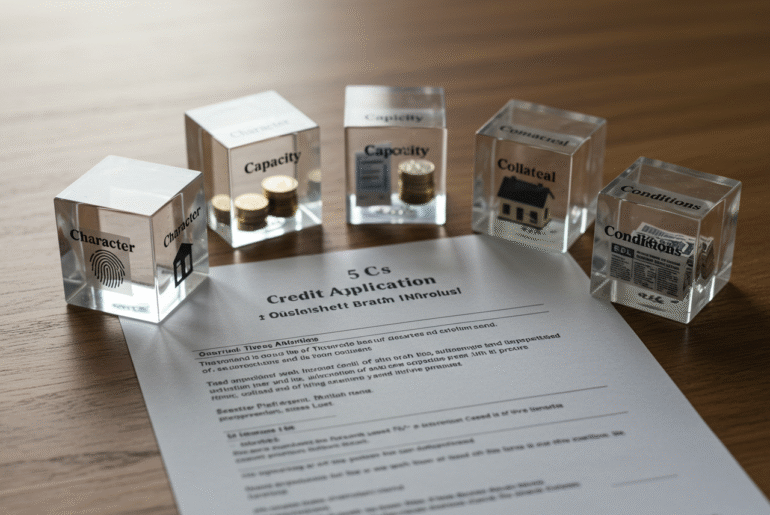

The 5 C’s Of Credit

The 5 C’s of credit help banks and other lenders decide if they should give out loans. They look at things like your credit score and the loan’s terms and conditions when they do this. This way of checking is a part of credit risk management. It helps the bank figure out if people can pay back the money, if they can be trusted, and if they have put in enough of their own money. Whether you want a personal loan or business credit, it is important to know about these five parts. Your character shows if you are good with money. Your capacity tells if you can pay back the money with your income. Lenders also look at collateral, capital, and the loan conditions.

The Role Of The 5 C’s In Loan Approval

A big part of getting a loan is how banks look at risk. The 5 C’s of credit help banks and lenders check people who apply for loans. Character is about your credit history. It shows if you pay back money on time. This helps a lender trust you. Capacity is the money you earn compared to what you already owe. It shows if you can handle new loan payments. Capital and collateral are about the money you have and what you can give as a guarantee if you do not pay back the loan. These things help lenders feel safer. They help lenders to cut down on what they might lose. Conditions include outside factors like the current state of the economy or changes in the business world. Lenders look at these things to help them decide about new loan requests. The 5 C’s give banks and other lenders a way to look at loan risk. When you learn about each part, you can get your money details ready to show you are a strong choice for a loan. This will help you get a better chance of being approved.

In-Depth Analysis Of Every Credit Factor

Each of the 5 C’s gives you good information about your money situation.

- Character: This is your credit history and the way you pay back what you owe.

- Capacity: This looks at how much you owe compared to what you make. It shows if you can pay back any new money you borrow.

- Capital: This is about your savings and any money you have put away. It also looks at things you own that could help you pay what you owe.

- Collateral: This is what you promise the lender in case you can’t pay back the loan. It could be things you own that are worth money.

- Conditions: This includes things outside of you, like why you want the loan and what the current interest rates are. Lenders think about these when you ask for a loan.

Lenders do not look at just one thing on its own. They look at all parts of your application as a whole. For example, if you have strong collateral, it can make up for a credit history that is not as good. If you know what lenders check, you can find and work on any weak parts, which can help you get your loan approved.

Character: Assessing A Borrower’s Trustworthiness

Lenders look at your character to see if you can be trusted with money. They check your credit history, like how you made payments in the past, any debts you still owe, and if you have had big problems like bankruptcies. If you have a high credit score, lenders feel better about giving you money. This lowers the risk they feel about you. Major credit bureaus like Experian, Equifax, and TransUnion give detailed reports about your payment history. When you show good money habits, it helps your reputation. It also makes it easier for you to get credit.

What Lenders Look For In Credit History

Lenders look at your credit report and your credit score. These scores are mostly given by big credit bureaus. If your report shows late payments, collection accounts, or bankruptcies, they see you as a higher risk. This can change whether you get a loan or not. FICO scores go from 300 to 850 and show how good someone’s money habits are. A higher score can help someone get better rates for loans and credit. When you make your payments on time and avoid mistakes, you have a better chance to get approved. Besides credit scores, lenders also look at credit use. This is the amount of credit you use compared to the total you have. Try to keep your credit use low. Always pay your bills on time. Doing this can help you have a good credit history. It also helps lenders trust you more.

Ways To Improve Your Credit Character

To make your credit better, you need to work on it all the time.

- Pay all your bills when they are due. This helps you stay away from bad marks and will make lenders feel better about giving you money.

- Talk to people you owe money to and try to settle your unpaid debts.

- Use a secured credit card the right way. This can help you make your credit score better or get it back up.

- Check your credit report often. Fix any mistakes you find so you can get a better FICO score.

Showing that you handle money well can help your credit score. It also makes it more likely for you to get approved for a loan or credit.

Voted "Best Overall Budgeting App" by Forbes and WSJ

Monarch Money helps you budget, track spending, set goals, and plan your financial future—all in one app.

Get 50% OFF your first year with code MONARCHVIP

Capacity: Evaluating Ability To Repay

Lenders look at your ability to pay back loans before they say yes. They check the debt-to-income (DTI) ratio. This shows how all your monthly debt adds up compared to your monthly income. If your DTI is lower, it means you are less risky for lenders. Cash flow trends, like how steady your income is and if you have any ups or downs with debt, are checked. If you have a steady income that matches what you need to pay, you are more likely to get approved.

Debt-To-Income Ratio Explained

Your debt-to-income ratio shows how much of your money goes to debt each month. To get this number, you divide your total monthly debt payments by what you make before taxes each month. For example, say you pay $1,400 for debts in a month, and you earn $5,000 before taxes. Your DTI in this case would be 28%. Lenders usually want the DTI to be under 36% for people who own homes. For renters, they look for it to be under 20%. A high DTI can get in the way of you getting approved because there might not be enough money for more debt. If you pay down what you owe or earn more, you can make your DTI better. This can help you get a loan.

Income Stability And Its Impact

Having a steady income is important when you want to get a loan. If you change jobs often or your pay goes up and down, it can be hard for the bank to feel sure you will pay the money back. When you have worked in the same line of work for a long time, it shows you are likely to keep earning money. This helps lenders feel confident that you can pay off the loan. If your income changes, you may need to give more documents to show you are able to pay back the money. The way you handle your other debts can also affect if you get approved.

Capital: The Borrower’s Financial Commitment

Capital is the money that you put in yourself, like your savings or a down payment. A bigger amount of money from you at the start shows that you are serious. It also makes the lender feel less at risk. Making a higher down payment can help you get better loan rates and terms. Having savings is also good. These savings give you a buffer if any unexpected costs come up. This makes it easier for you to keep up with regular payments.

Importance Of Down Payments And Savings

A big down payment helps lower the risk for the lender and makes your credit look better. For example, if you put down 20% for a home, you will often get a better rate on your mortgage. Having some money put aside for emergencies shows that you plan ahead and are ready for the unexpected. Even if you get a loan with a lower down payment, like FHA mortgages, it is good to show that you have some savings.

How Capital Demonstrates Financial Responsibility

| Factor | Relevance to Lenders |

|---|---|

| Down Payment Size | Higher payments reduce risks and secure better loan interest rates. |

| Savings Availability | Demonstrates preparedness for unexpected challenges and reinforces payment consistency. |

| Asset Contributions | Reflect borrower commitment and reliability. |

Having strong capital shows lenders that you are responsible with money. This can help you get better loan terms.

Collateral: Assets As Loan Security

Collateral helps secure loans because it gives the lender rights to the borrower’s things if they have not paid back. The things used as collateral are usually property, cars, or investment accounts. Secured loans are less risky for lenders than other loans. When you know what types of collateral the lender will accept, it helps make your application stronger.

Types Of Acceptable Collateral

- Real estate, like homes or land.

- Vehicles that you use for auto loans.

- Promises from you to pay back the money, which are legal.

- Credit lines that use your savings or investments to back them up.

Collateral needs are different for each loan. To lower risk and maybe cut costs, match your assets with what the lender wants.

How Collateral Lowers Lender Risk

When you use collateral, the lender knows they have something they can take if the loan is not paid. This lowers their chance of losing money. Lenders often let people borrow more money or get loans with better terms when they put up strong collateral.

Conditions: External Factors Affecting Loans

Conditions are all the outside things that can affect the loan. Lenders think about things like how strong the economy is, what interest rates are, and the type of loan you want. If the economy is not doing well, lenders might say no more often or raise interest rates. The terms of the loan also matter, like how long the loan lasts or how it will be paid back.

Economic Environment And Loan Terms

In a strong economy, lenders are often more willing to take risks. But in a weak economy, they get stricter to avoid losing money. Loan terms include how long you will pay and if the interest rate is fixed or variable. These parts matter to lenders because they affect how much they might get back and when.

Lender Policies And Market Trends

Each lender may have rules that change how they check loans. Some may focus more on credit scores, while others look closely at collateral or income. Market trends like changes in laws or new financial products also play a part. Being aware of these helps you understand why loan requirements can change over time.

Putting It All Together: Strengthening Your Loan Application

To get a loan, you want to be strong in all five parts. Here are ways to do that:

- Show good credit habits and keep your credit report clean.

- Make sure your income is steady and your debts are low.

- Save money for a good down payment or have capital ready.

- Use collateral that lenders will accept.

- Be aware of current loan conditions and pick loans that fit your situation.

By getting ready in all these ways, you improve your chance of getting the loan you want.

Applying The 5 C’s To Small Business Loans

Small businesses need to show the same 5 C’s to get loans. Lenders want to see if the business owner can be trusted, can repay, and has money invested. Business credit is like personal credit but focuses on how the business runs. Having a good business plan, steady sales, and good money management helps.

Why Business Credit Matters

Business credit shows if the company is good at paying bills and managing money. A strong business credit score helps get loans with better terms. Lenders also look at business assets and collateral. These show the health of the business and how likely it is to pay back loans.

Tips For Small Business Borrowers

- Keep good personal and business credit.

- Prepare documents like tax returns, profit and loss statements, and business plans.

- Show that you have skin in the game by investing your own money.

- Understand loan terms and conditions before applying.

This approach helps small business owners get the money they need.

Conclusion

The 5 C’s of credit help lenders decide if you get a loan. By knowing about character, capacity, capital, collateral, and conditions, you can prepare your application better. This gives you a stronger chance to be approved and get the best terms. Whether it’s a personal loan or a small business loan, understanding these factors can guide you to manage your money well and meet lenders’ needs.

FAQs

What happens if one of the 5 C’s is weak?

Lenders look at all five, so a weak area might be balanced by strengths in other areas, like strong collateral or a high income.

Can improving my credit score help me get a loan faster?

Yes, a better credit score improves trustworthiness and can lead to faster approvals and better loan terms.

How much should my down payment be?

It depends on the loan type, but generally, a larger down payment lowers lender risk and may get you better rates.

What is a good debt-to-income ratio?

Lenders usually prefer a DTI below 36% for homeowners and under 20% for renters.

Are economic conditions outside my control important?

Yes, lenders consider economic trends and interest rates, which can affect loan approvals and terms.

Reviewed and edited by Albert Fang.

See a typo or want to suggest an edit/revision to the content? Use the contact us form to provide feedback.

At FangWallet, we value editorial integrity and open collaboration in curating quality content for readers to enjoy. Much appreciated for the assist.

Did you like our article and find it insightful? We encourage sharing the article link with family and friends to benefit as well - better yet, sharing on social media. Thank you for the support! 🍉

Article Title: The 5 C’s of Credit: Factors for Loan Approval

https://fangwallet.com/2025/06/07/the-5-cs-of-credit/The FangWallet Promise

FangWallet is an editorially independent resource - founded on breaking down challenging financial concepts for anyone to understand since 2014. While we adhere to editorial integrity, note that this post may contain references to products from our partners.

The FangWallet promise is always to have your best interest in mind and be transparent and honest about the financial picture.

Become an Insider

Subscribe to get a free daily budget planner printable to help get your money on track!

Make passive money the right way. No spam.

Editorial Disclaimer: The editorial content on this page is not provided by any of the companies mentioned. The opinions expressed here are the author's alone.

The content of this website is for informational purposes only and does not represent investment advice, or an offer or solicitation to buy or sell any security, investment, or product. Investors are encouraged to do their own due diligence, and, if necessary, consult professional advising before making any investment decisions. Investing involves a high degree of risk, and financial losses may occur including the potential loss of principal.

Source Citation References:

+ Inspo

There are no additional citations or references to note for this article at this time.