Remember those eye-watering monthly bills from disposable vapes before the ban hit? Most of us got a nasty shock when we actually added up what we were spending. Since single-use disposables disappeared from the market, refillable vape kits have stepped up as the obvious replacement, and honestly, they're miles better than disposables ever were. I'm

Let’s be honest, when you think of managing money, the word “fun” probably doesn’t come to mind. Instead, you might picture balancing spreadsheets, calculating expenses, and denying yourself that morning latte (again). It feels like a chore, right? But what if I told you that managing your money doesn’t have to be boring? In fact,

In this listicle, you'll discover the best car insurance options in Utah tailored to your needs. From affordable rates to excellent customer service, we'll guide you through top picks that ensure you're protected on the road!

Are you feeling stressed out by your student loan payments? These eight practical ways to lower your monthly bills, from refinancing to income-driven repayment plans, will help you breathe a little easier each month.

Graduates often complain about the job market, but it's time to move on. Taking on responsibility can help you grow. Graduates can set themselves up for success by working on their personal growth, making connections, and being open to new opportunities.

Buying a new smartphone can be a big investment, but paying for it all at once can be hard. Smartphone financing options like Affirm are a good thing because they let you break up the cost into monthly payments that are easier to handle. This flexibility makes it easier to get the newest technology without

Get ready for a successful spring with this complete spring garden prep and budget guide. Learn how to prepare soil, plant vegetables, manage pests, and track garden finances for a productive season.

In a surprising twist, Netflix has unveiled new strategies aimed at attracting new subscribers. From introducing ad-supported tiers to expanding free trials, the streaming giant is recalibrating its approach, seeking to boost its viewer base in a competitive landscape.

Want to save money while you're on the road? Forget about the plane and take a train. Train travel is a cheap and stress-free way to get around, with lower ticket prices and beautiful routes. Find out how to see more while spending less.

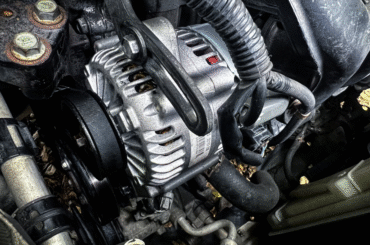

Introduction Finding the right tires is not just about looking at the prices. You need to choose tires that match your driving needs and fit your car. Important things to consider are tire size, the type of terrain you will drive on, and how well they handle different weather conditions. For instance, if you live

The middle class is facing unprecedented pressures as everyday costs rise, threatening their financial stability. From skyrocketing housing prices to soaring healthcare expenses, these seven costs are eroding the foundation of middle-class life. It's time to confront this reality.

That old car sitting in your driveway might look like a rust bucket, but it could actually still have some potential. When your vehicle reaches the end of its road life, parting it out can put significantly more money in your pocket than selling it whole to a scrapyard. Most car owners don't realize the

Looking to make your birthday even more special? Dive into our list of the Best Birthday Rewards! From sweet deals and freebies at your favorite restaurants to exclusive offers from retailers, you’ll discover unique ways to celebrate. Get ready for some amazing perks on your big day!

As American consumers face potential price hikes from new tariffs, many are finding creative ways to adapt. From meal prepping to bulk buying and cutting non-essentials, everyday Americans are crafting budgets and making choices to stretch their dollars further.

If you're looking to save money while shopping online, TopCashback is a great option! Sign up today and earn a $10 bonus just for joining. Plus, you'll receive $45 for every friend you refer, making it a win-win for everyone involved!

If you've been eyeing the Oura Ring, now's the perfect time to snag a charger! With prices slashed nearly in half, you can power up your health tracking device without breaking the bank. Don't miss this opportunity to enhance your wellness journey!

Reviving leftovers can transform the mundane into a culinary delight! From zesty stir-fries to hearty casseroles, I love experimenting with different spices and herbs. Join me as I share 13 of my favorite ways to breathe new life into last night's dinner!

Japan Airlines offers an enticing roundtrip deal from Portland to Fukuoka, Japan, for just $587, taxes included. This affordable fare opens the door to experiencing Japan’s rich culture and stunning landscapes, making it an opportunity not to be missed!

AI is transforming personal finance by making budgeting smarter and more personalized. AI budgeting apps analyze spending patterns, offer customized tips, and forecast future expenses. Examples include Rocket Money for bill negotiation and Credit Karma for tracking financial health. These tools automate tasks like expense tracking, helping you focus on financial planning. The future

Preparing for a recession begins with assessing your finances. Create a budget, cut unnecessary expenses, and build an emergency fund. Diversifying your income sources can also provide stability. Taking proactive steps now can help safeguard your future.

Flexible Loan Options: Upgrade Loans offer customizable loan amounts and terms through a user-friendly online application process. Accessible for Fair Credit: Borrowers with fair credit may secure better rates than traditional lenders. Potential Downsides: Origination fees and high interest rates can apply, especially for borrowers with lower credit scores. Debt Consolidation Benefits: Upgrade Loans

Cash Outlay Explained A cash outlay is the money you pay out, usually for things you buy, put money into, or spend to keep your business going. It is a big part of knowing what it costs to spend money and how to handle money in your own life or at work. Some examples of

In 2025, PocketGuard continues to impress with its user-friendly interface and robust budgeting tools. The app's unique "In My Pocket" feature simplifies tracking expenses, helping users make informed financial decisions effortlessly. A must-try for budgeters!

The average gas price directly affects monthly fuel costs and household budgets across the United States. To estimate fuel costs, consider your car’s fuel efficiency, driving distance, and local gas prices. Gas prices fluctuate due to factors like crude oil prices, global events, and seasonal demand. Efficient driving habits—like steady acceleration and reduced idling—can

Minimalist Living Tips for a Simpler Life Imagine living a simple life. The rooms are open and feel bright. Your mind is calm. What you do every day gets easier. Being a minimalist does not mean you have to keep only a little. It means you pick what matters most. This way of thinking is

Introduction Dealing with your own money when you do not have a lot to spend can be hard. People or families who get by one paycheck at a time often feel like their money is gone before the month ends. Bills can pile up fast. A surprise cost, or just buying what you need, may

Introduction Costco’s return policy is one of the best in stores. The company works hard to make sure customers are happy. If you have a product that does not work, if you do not like what you bought, or if you change your mind, you can return it easily. The company wants the return process

Fun and Memorable Birthday Ideas Get 10 fun and simple ways to make your birthday one you will always remember. Find great ideas for birthday parties that work inside or outside and for all age groups. See how to use special decorations and snacks to add your own touch to your celebration. Learn how you

Introduction Have you ever bought something and right away wished you had not? This feeling is called buyer’s remorse. It is normal to feel guilt and frustration when it happens. You might get clothing that does not fit well, or maybe you buy a gadget but then you never use it. These kinds of shopping

Practical Ways to Manage Debt and Travel Wisely If you like to travel and have debt, you may feel some stress. It is important to know there are ways to take care of both. A smart plan can help you enjoy your trips and still keep up with your payments. You do not have to