This article may contain references to products or services from one or more of our advertisers or partners. We may receive compensation when you click on links to those products or services. Nonetheless, our opinions are our own.

The information presented in this article is accurate to the best of our knowledge at the time of publication. However, information is subject to change, and no guarantees are made about the continued accuracy or completeness of this content after its publication date.

Updated by Albert Fang

Can you name several kinds of life insurance right off the top of your head? Don’t feel discouraged if you only though of two or three kinds. Unless you’re a financial industry professional, chances are you only have heard of the two most basic types of policies: term and whole. It’s true that all the rest fall into one of those two major categories, but there are actually dozens of different combinations and variations of coverage you can get, depending on your needs, lifestyle, health status, age, and desires. Here’s a brief look at the multiple variations on a theme.

Whole vs Term

Every life policy is either whole or term. The former is permanent, while the latter comes with a specific expiration date. Term policies are typically sold in increments of five or ten years, include a fixed benefit amount, and come with level premiums (monthly, quarterly, or annual in most cases). Permanent, or whole, policies never expire unless you stop paying the premiums or sell them, and many come with cash value that builds up on a fixed schedule. However, the central difference between the two types is longevity. One has a fixed term of operation. The other can last as long as you live.

Cash Value or No Cash Value

Another way to categorize coverage types is to label them as can be sold for cash, or can’t be sold, have no cash value. If your policy includes a feature for build-up of monetary value and the provisions allow you to sell it, it’s important to know what you can get for it. If you want to sell your life insurance policy, it’s relatively easy to get an estimate of its approximate value quickly and painlessly via online resources. This is an important step for making a budget and planning what you’ll do with the money you receive. Just knowing whether you can sell is not enough.

Simplified, Guaranteed, and Group

Simplified coverage usually comes with no cash component and does not require a medical exam. Guaranteed contracts are categorized as term coverage and, as the name implies, are granted to any paying applicant regardless of their state of health. A group policy covers multiple people, and is most commonly used by companies who want to offer coverage to their employees, who have the option of accepting or declining the policy.

Universal and Variable

Universal life insurance comes with low premiums, is permanent, and features a cash buildup over the years. Variable insurance contracts are also a type of permanent coverage, but policyholders can invest the cash portion, what there is of it, in the stock market.

Read the Fine Print

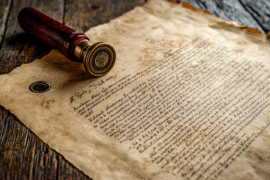

One challenge people often face is the different terminology and legalese used by the various carriers. That’s why it’s imperative to read all the fine print on a contract before buying or selling. Yes, the process can take an hour or so and promises to be a tad on the boring side. The good news is that after you’re finished, you’ll be well-informed about how the policy works, how a sales provision operates, what the requirements are for sellers, and all the other pertinent data about the contract.

Reviewed and edited by Albert Fang.

See a typo or want to suggest an edit/revision to the content? Use the contact us form to provide feedback.

At FangWallet, we value editorial integrity and open collaboration in curating quality content for readers to enjoy. Much appreciated for the assist.

Did you like our article and find it insightful? We encourage sharing the article link with family and friends to benefit as well - better yet, sharing on social media. Thank you for the support! 🍉

Article Title: Do You Know the Different Types of Life Insurance?

https://fangwallet.com/2021/06/07/do-you-know-the-different-types-of-life-insurance/The FangWallet Promise

FangWallet is an editorially independent resource - founded on breaking down challenging financial concepts for anyone to understand since 2014. While we adhere to editorial integrity, note that this post may contain references to products from our partners.

The FangWallet promise is always to have your best interest in mind and be transparent and honest about the financial picture.

Become an Insider

Subscribe to get a free daily budget planner printable to help get your money on track!

Make passive money the right way. No spam.

Editorial Disclaimer: The editorial content on this page is not provided by any of the companies mentioned. The opinions expressed here are the author's alone.

The content of this website is for informational purposes only and does not represent investment advice, or an offer or solicitation to buy or sell any security, investment, or product. Investors are encouraged to do their own due diligence, and, if necessary, consult professional advising before making any investment decisions. Investing involves a high degree of risk, and financial losses may occur including the potential loss of principal.

Source Citation References:

+ Inspo