This article may contain references to products or services from one or more of our advertisers or partners. We may receive compensation when you click on links to those products or services. Nonetheless, our opinions are our own.

The information presented in this article is accurate to the best of our knowledge at the time of publication. However, information is subject to change, and no guarantees are made about the continued accuracy or completeness of this content after its publication date.

Updated by Albert Fang

Students are poor – this is a popular stigma or belief that commonly surrounds the category of people who are enrolled in educational establishments. Partially, it is true when students come from low-income families. They seek savings, affordability, and just want to find their place under the sun. The below-mentioned information is a good fit for another group of students, those who just want to build proper management of their finances and always keep their heads above the water.

Voted "Best Overall Budgeting App" by Forbes and WSJ

Monarch Money helps you budget, track spending, set goals, and plan your financial future—all in one app.

Get 50% OFF your first year with code MONARCHVIP

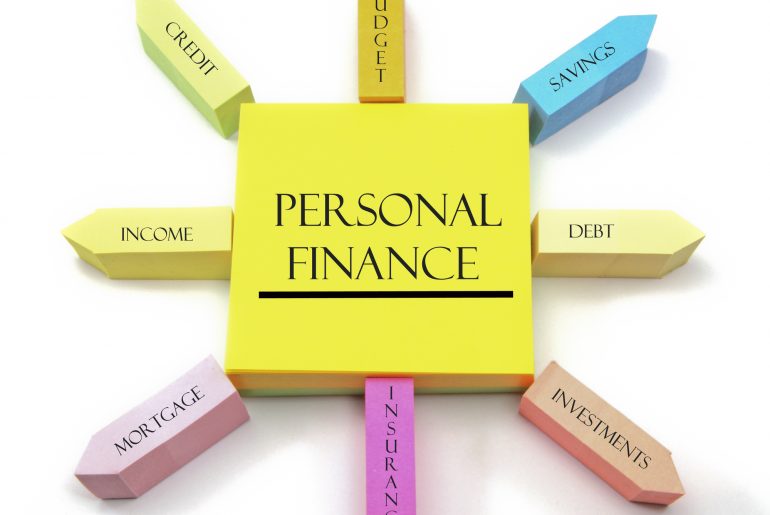

Why is ABC of Finance Crucial for Students?

First off, let’s hint you at why managing finances is important. Nowadays, you can come across lots of success stories from businessmen, entrepreneurs, and simply celebrities. On most occasions, they share stories of how they survived with no money and managed to get a huge profit. Moreover, today they speak how they are independent of money because they just changed their perception of cash. When it comes to students, money management is crucial because it helps to build necessary values to survive, and become successful. Beyond that, it helps to understand how to avoid a number of hurdles in life including addiction, and wastefulness among others.

Let’s pretend you have money, but you are afraid of managing it or cannot cope with overspending. What to do? Make a habit of following the next 7 effective personal finance tips.

#1. Make Friends with Budget-Building

If you do not want to end up having a myriad of debts, you have to approach your spendings gradually. It means that your available money should be put to limits or simply called a budget. In simple terms, you have a clean-cut scheme on expenses on your educational books, materials, tutors. Then, you have a pocket for toiletries, clothes, and necessary items. Finally, there is a separate budget for entertainment. When you go over the budget in one of them, you have to put a pause on spending. When only building a budget, ensure to add some dollars for unforeseen expenses as well.

#2. Keep Track of All Your Spendings

Today, there are dozens of mobile applications which you can use for tracking your spendings. Otherwise, you can always do it manually in a notebook, how convenient is for you. Some students do also integrate special features offered by their banks where they can receive monthly statements and check where they spend money the most on. After each month, you have to overlook what the “garbage” purchases were. Think about them, and ask yourself whether you need such spendings the next month.

#3. Set a Goal

Setting a goal means that you can try to proceed with savings when raising money for your dream or a certain thing. For instance, it can be a journey or vacation with your friends. It can be a gadget which you need for your studying or working. Just ensure that your goal will help you further on instead of planning the dreams which bear no value at all.

#4. Invest

It is a pretty common practice among modern students to not raise money but invest it. Such events are inspired again by entrepreneurs who themselves recommend them. You can work on building your own startup where your personal money is involved. Or, you can simply invest in cryptocurrency and other projects which may yield the fruits within time. Yet, be careful with investment because it is a great risk.

#5. Find a Freelance Job

If you only study without having any part-time job, you should think about working as early as possible. First off, it is a pure chance of becoming an independent person. Secondly, you start creating your working experience that will help you find a full-time job after graduation. If possible, find online freelance jobs where you have to dedicate some time only, since it won’t affect your studying progress.

#6. Eat Wisely

You might think it is a ridiculous tip, however, believe us – when you eat everything you can grab, it does not cater to any savings. Instead of buying snacks, and just cheap products, you have to learn more about recipes that involve more greens. As a result, you will buy food that may last longer and be used for many dishes at once rather than a pack of potato chips that should be refilled daily. Or, you can also stick to some diets (only healthy ones) which cater to brain-stimulating consumption of products with minimum investment.

#7. Resist Temptation

Last but not least tip is to resist your guilty pleasures. Particularly, it concerns the ones which make you throw money down the drain on a regular basis. For instance, when you cannot cope with your papers assigned in college, you would order them all online with designated essay writing services. Note, such companies as Write My Paper Hub are truly lifesavers, however, they should be turned to only when you really cannot do it all alone and you need to pay someone to have your papers written. Otherwise, you will get hooked on third-party help and will neglect your personal responsibility. The same concerns expensive clothes – yes, they are good as a reward for hard work but should be avoided if you need money for more important things.

Stick to the above-mentioned tips and within one month check how your spending behavior is changed. If needed, you can also ask for help from your close environment.

Reviewed and edited by Albert Fang.

See a typo or want to suggest an edit/revision to the content? Use the contact us form to provide feedback.

At FangWallet, we value editorial integrity and open collaboration in curating quality content for readers to enjoy. Much appreciated for the assist.

Did you like our article and find it insightful? We encourage sharing the article link with family and friends to benefit as well - better yet, sharing on social media. Thank you for the support! 🍉

Article Title: 7 Effective Personal Finance Tips for College Students

https://fangwallet.com/2021/07/27/7-effective-personal-finance-tips-for-college-students/The FangWallet Promise

FangWallet is an editorially independent resource - founded on breaking down challenging financial concepts for anyone to understand since 2014. While we adhere to editorial integrity, note that this post may contain references to products from our partners.

The FangWallet promise is always to have your best interest in mind and be transparent and honest about the financial picture.

Become an Insider

Subscribe to get a free daily budget planner printable to help get your money on track!

Make passive money the right way. No spam.

Editorial Disclaimer: The editorial content on this page is not provided by any of the companies mentioned. The opinions expressed here are the author's alone.

The content of this website is for informational purposes only and does not represent investment advice, or an offer or solicitation to buy or sell any security, investment, or product. Investors are encouraged to do their own due diligence, and, if necessary, consult professional advising before making any investment decisions. Investing involves a high degree of risk, and financial losses may occur including the potential loss of principal.

Source Citation References:

+ Inspo