This article may contain references to products or services from one or more of our advertisers or partners. We may receive compensation when you click on links to those products or services. Nonetheless, our opinions are our own.

The information presented in this article is accurate to the best of our knowledge at the time of publication. However, information is subject to change, and no guarantees are made about the continued accuracy or completeness of this content after its publication date.

Updated by Albert Fang

Having an emergency fund is a rule of thumb for any modern educated person. And nowadays, when the whole world struggles because of a pandemic, it’s an incredibly hot topic.

Should you start saving in times of crisis? How to accumulate savings when your income becomes lower?

Let’s analyze how the COVID outbreak affected usual rules of emergency fund creation and what you should do to stay confident even in this economically unstable period.

What Is An Emergency Fund

Let’s start with the emergency fund definition. In simple words, it is your savings for unexpected situations. Don’t confuse it with regular savings; it’s a separate account with money for the case of an emergency.

You can use them to pay sudden medical bills, repair your car in case of an accident, or survive some time after a job loss.

Of course, if you don’t have any savings in case of sudden financial needs, it’s not the end. You can use a different application to receive emergency cash immediately bad credit is not an obstacle. But it’s not a fund, just another financial tool, some kind of last resort.

There are several simple rules on emergency fund creation.

- Use budgeting. It’s great advice for every aspect of financial life, including funds and savings. Determine your fixed and variable expenses and the number of your earnings remaining. Find the expenses you can trim down or think Of an additional income.

- Keep your savings in a separate account and use calculators to stay motivated. You should have easy access to your emergency savings and use all the benefits of savings accounts interest rates. Use the online calculator to determine the income from holdings; it will help to maintain motivation.

- Set up an auto credit. Most banks allow setting up monthly automatic contributions. It eliminates the necessity of constant checking and helps to make payments regular.

- Determine milestones. Short-term goals are good for your motivation and make the final destination easier to achieve.

Sometimes it’s hard to sacrifice your desires at the moment for the sake of future stability, but remember that it’s a question of safety. Sometimes only such savings can prevent a complete bankruptcy.

How Much Emergency Fund Should I Have

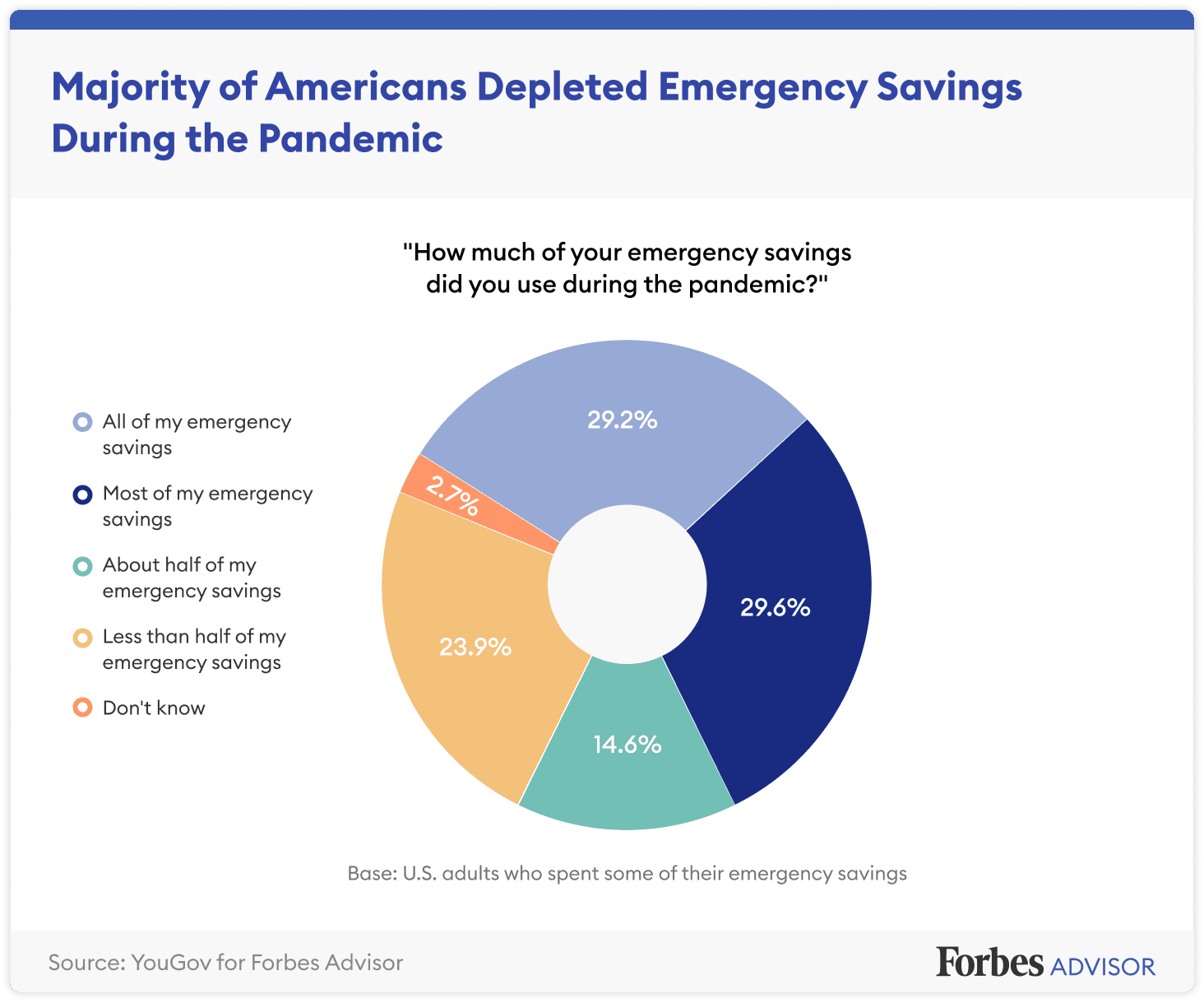

According to statistics, 25% of Americans don’t have savings for a rainy day. Another study showed that 60% of respondents having an emergency savings fund before the pandemic used it in time of the lockdown.

Before the pandemic, we had a strict rule on how much you should have in an emergency fund. The emergency fund amount should cover three to five months of your usual expenses. The advice is clear and seems easy to follow, but why do so many people fail to create such savings?

The first reason is purely psychological. You have to save money for a bad situation you don’t want to happen. Our brain doesn’t want to concentrate on negative things, and the necessity of such savings is ignored.

The second reason is the high sum you need to accumulate. Multiply your income by five, and it seems impossible to save so much money. Add all the pleasant things you can spend on today, and the day of reaching the required amount of emergency fund is pushed even further away.

The third reason is quite new: no one would expect an unstable situation to last for so long. Even the households with savings for six months of expenses have depleted their funds and offered social benefits aren’t able to cover the financial gaps. But the side effect is obvious: many people think that the emergency funds are useless and are not worth sparing the money.

Now you know the answer to the question: “how much should my emergency fund be?” and we can discuss the special aspects of pandemic emergency funds.

Covid Emergency Fund

COVID pandemic became a shock both from the health and financial point of view. Many people lost their jobs; others suffered from income reduction. In 2021, we realize that the effects of lockdown are long-lasting, and we must consider them in every part of life, especially in its financial aspect.

The emergency fund is more important than ever, but the circumstances are to be considered!

First, in this difficult period, it’s harder to save extra money. The experts recommend reevaluating the final goal of your savings. Now you should count only the necessary expenses. Such a fund can help you keep up for several months without any extra spending, like traveling or luxury things.

If you don’t have a habit of putting away some part of your earnings, it’s the right time to develop it. Everyday news can be good motivation.

Actually, in good times we tend to be too optimistic and often forget to make a reservation. Today, it’s hard to relax, and it can positively influence your financial state.

Don’t blame yourself if you can’t reach this financial goal fast, and don’t deprive yourself of small mercies. Sometimes moving at a slower pace is better than spending all the energy during the first few months. Your goal is not only to form a financial cushion but also to live a normal life.

You can act as an investor when your emergency fund COVID 19 is higher than your three-four month budget. Divide the sum into two parts. The emergency amount for three months should stay in your savings account; the rest can be used for smart investments. This way, you are not only safe for the first time but have additional income.

Summing Up

In this article, we discussed the features of the pandemic emergency fund and came to the conclusion that it’s a necessary financial tool in this difficult period.

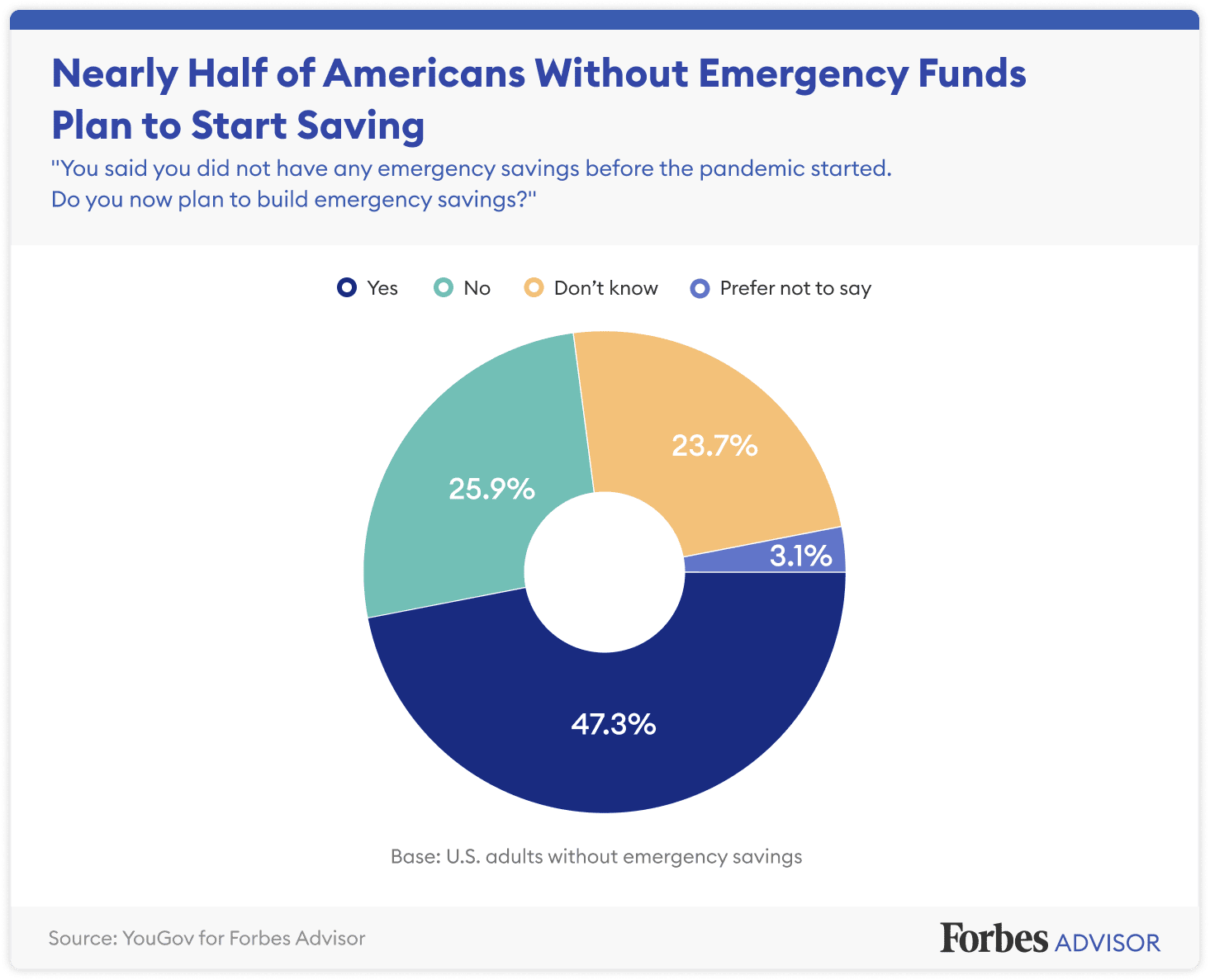

Don’t despair if you didn’t make the fund earlier, start saving money right now. It’s never too late to take care of your future well-being.

And we hope that tips from our article will help you in creating a rainy day fund. The last important piece of advice: stay positive and take care of your health.

Reviewed and edited by Albert Fang.

See a typo or want to suggest an edit/revision to the content? Use the contact us form to provide feedback.

At FangWallet, we value editorial integrity and open collaboration in curating quality content for readers to enjoy. Much appreciated for the assist.

Did you like our article and find it insightful? We encourage sharing the article link with family and friends to benefit as well - better yet, sharing on social media. Thank you for the support! 🍉

Article Title: Emergency Fund: High Value During the Covid-19 Pandemic

https://fangwallet.com/2021/12/10/emergency-fund-high-value-during-the-covid-19-pandemic/The FangWallet Promise

FangWallet is an editorially independent resource - founded on breaking down challenging financial concepts for anyone to understand since 2014. While we adhere to editorial integrity, note that this post may contain references to products from our partners.

The FangWallet promise is always to have your best interest in mind and be transparent and honest about the financial picture.

Become an Insider

Subscribe to get a free daily budget planner printable to help get your money on track!

Make passive money the right way. No spam.

Editorial Disclaimer: The editorial content on this page is not provided by any of the companies mentioned. The opinions expressed here are the author's alone.

The content of this website is for informational purposes only and does not represent investment advice, or an offer or solicitation to buy or sell any security, investment, or product. Investors are encouraged to do their own due diligence, and, if necessary, consult professional advising before making any investment decisions. Investing involves a high degree of risk, and financial losses may occur including the potential loss of principal.

Source Citation References:

+ Inspo