This article may contain references to products or services from one or more of our advertisers or partners. We may receive compensation when you click on links to those products or services. Nonetheless, our opinions are our own.

Updated by Albert Fang

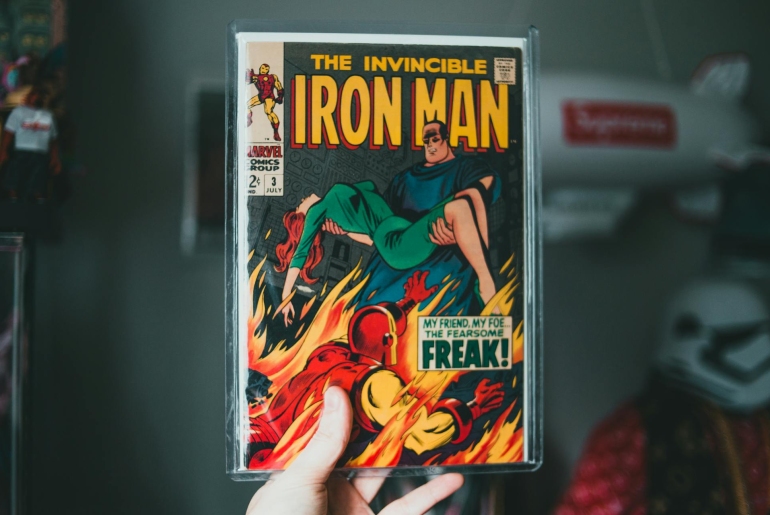

Why settle for the same old stocks and bonds when your investment portfolio could tell a story? Rare collectibles, ranging from sports memorabilia to vintage comic books, are standing out as a compelling subplot in the narrative of wealth building. These assets aren’t just about financial gain; they carry with them cultural significance and a lineage that can surpass generations.

Consider this: each item has its own origin tale, often interwoven with historical milestones or athletic achievements. The allure is palpable — but what potential do they hold for diversifying your investment strategy? Let’s unpack the tangible benefits of adding these unique pieces to your asset mix.

Within the vast sales houses and private collections, an auction for sports memorabilia can sometimes resemble a fervent battleground where emotions run high and wallets open wide. It’s here that the financial promise of rare collectibles comes into sharp relief. Different from traditional investments, these items can appreciate independently from stock market fluctuations, offering a form of diversification that can cushion your portfolio against economic downturns.

While it’s clear that these tangible pieces hold sentimental worth, their monetary value is significantly influenced by scarcity and provenance. A baseball signed at a pivotal game or a rare rookie card — especially when preserved in a professional card collection display — embody moments frozen in time, coveted by enthusiasts and investors alike. What sets them apart is not only their potential for capital gains but also their ability to provide a hedge against inflation, especially when considering the finite nature of truly singular items.

But how does one assess the right pieces to pursue? Evaluation begins with research-intensive due diligence. Understand the story behind each piece; examine its authenticity, condition, and rarity. It’s crucial to recognize that this market demands expertise—or at least guidance from those knowledgeable—to identify true treasures amidst the noise. Consider this as you weigh adding collectibles to your assets; think beyond mere aesthetics or nostalgia towards strategic acquisition.

Beyond the Display Case: Liquidity and Legacy

One might wonder, can an asset class steeped in heritage and physicality offer liquidity? There’s a duality here — rare collectibles are not shares that you can sell off with a click during market hours. Yet, their liquidity is found in the ever-present demand from other collectors and investors; there’s often someone willing to acquire a slice of history.

This market possesses its own rhythm. Unlike traditional assets, where price points tend toward transparency, the value of collectibles often hinges on private sales and auction results. It’s akin to fishing in waters where the next catch could either be common or once in a lifetime. And when you do land that exceptional piece, it tends to appreciate quietly over time.

But there’s more at play than potential profits. These items carry forward legacies — whether they are tied to sports legends or historical events — offering an intangible satisfaction beyond their financial worth. For many, passing down a storied item becomes part of their familial narrative, making this investment as much about personal legacy as portfolio performance.

Navigating this space requires strategic timing and networking. A collector must have both patience for long-term holding and readiness to act when unique opportunities present themselves. Thus lies the artistry behind investing in rare and valuable collectibles: knowing when to hold them close and when to release them into another steward’s care for continued appreciation.

The Last Word

In essence, integrating rare collectibles into your investment portfolio is about embracing assets that offer more than monetary gains. They’re a bridge to the past and an heirloom for the future, providing diversification and personal enrichment in equal measure — a true testament to wealth beyond currency.

Reviewed and edited by Albert Fang.

See a typo or want to suggest an edit/revision to the content? Use the contact us form to provide feedback.

At FangWallet, we value editorial integrity and open collaboration in curating quality content for readers to enjoy. Much appreciated for the assist.

Did you like our article and find it insightful? We encourage sharing the article link with family and friends to benefit as well - better yet, sharing on social media. Thank you for the support! 🍉

Article Title: Diversifying Your Investment Portfolio with Rare Collectibles

https://fangwallet.com/2024/03/11/diversifying-investment-portfolio-with-rare-collectibles/The FangWallet Promise

FangWallet is an editorially independent resource - founded on breaking down challenging financial concepts for anyone to understand since 2014. While we adhere to editorial integrity, note that this post may contain references to products from our partners.

The FangWallet promise is always to have your best interest in mind and be transparent and honest about the financial picture.

Become an Insider

Subscribe to get a free daily budget planner printable to help get your money on track!

Make passive money the right way. No spam.

Editorial Disclaimer: The editorial content on this page is not provided by any of the companies mentioned. The opinions expressed here are the author's alone.

The content of this website is for informational purposes only and does not represent investment advice, or an offer or solicitation to buy or sell any security, investment, or product. Investors are encouraged to do their own due diligence, and, if necessary, consult professional advising before making any investment decisions. Investing involves a high degree of risk, and financial losses may occur including the potential loss of principal.

Source Citation References:

+ Inspo

There are no additional citations or references to note for this article at this time.