In 2025, Credit.com continues to be a reliable resource for managing personal finances. Its user-friendly interface and comprehensive credit monitoring tools empower users to take control of their credit health, making complex financial concepts more accessible.

Introduction Starting a business in California can be exciting and hard for people who want to start something new. The state has a strong economy with many chances for the ones who want to open their own company. But it is important to handle the registration steps the right way so you do not run

Main Points of the Procure-to-Pay Workflow The procure-to-pay (P2P) process is a major buying method that covers every step from asking for something to paying the final bill. It helps companies manage buying in a better way. P2P has main steps. These include making a buy order, handling bills, getting the goods, dealing with suppliers,

For large-scale businesses and institutional investors, liquidity and capital efficiency are crucial. Traditional lending options, such as bank loans and lines of credit, can be slow and restrictive. Accounts receivable (AR) financing presents an alternative that not only enhances cash flow for businesses but also provides investors with a unique opportunity to generate steady returns.

Nasdaq Inc Philippines Market Trends and Insights Nasdaq Inc. builds a strong position in the Philippines by giving top technology solutions to companies in financial services. The Philippine Stock Exchange (PSE) now uses the Nasdaq Eqlipse Trading platform. This helps make the market’s setup better and adds more money movement. Teamwork and new steps stand

When it comes to car resale value, color matters more than you might think. Shades like bright yellow or trendy purple can deter buyers, while classic colors like white, silver, and navy often command higher prices. Choose wisely to maximize your investment!

Introduction TurboTenant has made it easier than ever for landlords and tenants to manage rentals in one place. The platform combines secure rent collection, customizable lease agreements, and thorough tenant screening all into a simple, online solution. Because of these powerful tools, TurboTenant has become a top pick for landlords who want to save time

The L.A. immigration protests were deeply influenced by labor unions, which rallied for workers' rights and immigrant justice. Their collective power highlighted the struggles of marginalized communities, transforming protests into a pivotal movement for social change.

Trump's metals tariffs, designed to protect domestic industries, may inadvertently raise costs for everyday essentials like food and beer cans. As manufacturers face higher aluminum prices, consumers could soon see these increased costs passed on at the checkout.

Picture this: You're driving along a scenic highway, the sun is shining, and everything feels perfect—until something unexpected shows up in your lane. Maybe it's a piece of metal, a sudden patch of fog, or a truck swerving into your path. In a blink, a smooth ride can become a dangerous situation. Road hazards don't

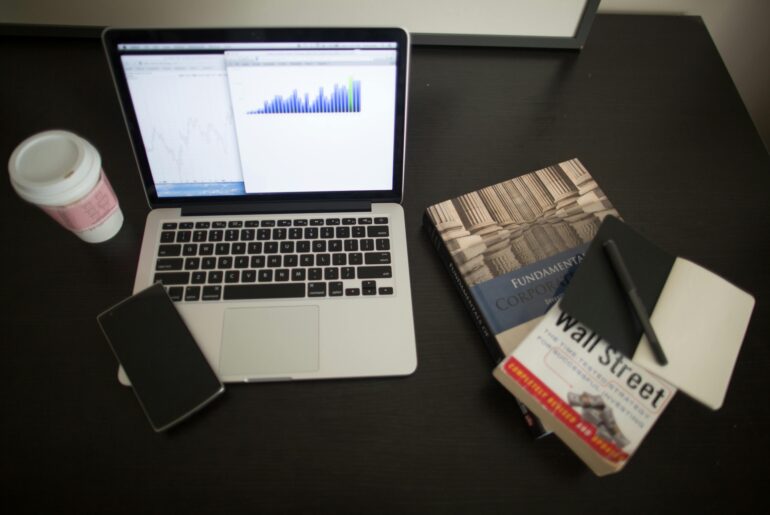

There's a gentle revolution happening in bedrooms across the nation — and it has nothing to do with TikTok trends or viral dances. It's the buzz of a generation listening in on financial freedom. More and more teens have started asking big questions about money in recent years: “What's the stock market?” “How do I

Budgeting Principles for Special Needs Families Good budgeting starts when you set clear goals for your money that match what your family needs. You need to keep track of health and childcare costs and see how they fit in with what you make at work. This helps your family stay on top of bills and

Looking to showcase your art online? In our listicle, you'll discover the best website builders tailored for artists like you. From sleek templates to integrated e-commerce options, find the perfect platform to elevate your creative portfolio!

Why Budgeting Matters During a Career Change Moving to a new job or changing what you do at work can bring money problems, so making a budget is very important to keep things steady. The money you have saved from your job, what you spend, and your emergency fund are important when you are switching

How Men Can Start Building Financial Independence Starting the journey to have your own money and be free means you need to know about money and build some useful habits. You should set up an emergency fund. This will help if things go wrong. Make your own money plan, too. This makes things clear and

Benefits of Riding or Walking Daily Riding a bike to work or around town lets you be free from bus times. You save money compared to using a car, and your own energy makes the bike go. Walking is a healthy and smart way to get around the city. You do not have to pay

Legal Considerations for Side Hustles Learn how to make your side hustle follow US laws and avoid extra risks. Understand how job contracts and company rules help manage side work and lower conflicts. See why keeping the right paperwork is important to protect your small business in a legal way. Get to know the tax

Practical Tips for Investing as a Parent Get practical tips on how to invest smartly while handling the ups and downs of happy families. Find ways to put your family members’ needs first without losing your financial strength. Learn money strategies that link good school results with long-term money goals. See the secrets of happy

American Express 5 Rebate Rewards Program The American Express 5 Rebate Rewards program gives people cash back on certain things they buy, like gas and groceries. Get a first-time bonus and more cash back in the first three months. Get rebate rewards as a statement credit once a year, which can help you manage your

Benefits of 0% Intro APR Cards Find the good things about American Express cards with 0% intro APR offers. These cards are great if you need to make big payments and do not want to pay interest right away. Get statement credits when you buy from places that are part of Amex Offers. You just

In California, $1.3 million can open the door to a variety of homes, from modern condos in vibrant urban areas to charming houses in serene suburbs. Each offering unique features reflects the diverse lifestyle options available in the Golden State.

Elon Musk's vision for Mars isn't just science fiction; it's a potential investment goldmine. As private space exploration accelerates, savvy investors should consider aerospace stocks, tech innovations, and sustainable technologies shaping our Martian future.

Telegram’s Main Privacy and Security Features Telegram has strong security tools. These include secret chats and messages that can delete themselves. This helps you talk in private. Its privacy settings let people choose who gets to see their phone number and other details. The app is a top pick for big group chats or for

Major Trends Shaping Capital Equipment See how advanced CNC making methods are changing the way people make and design big machines. Learn why it is important to know the value limits and buy costs if you want to do a good job with sorting and buying assets. Look at how built-in controllers and serial numbers

How to Get Coverage Without Being on the Title Learn about how to get a car insurance policy for a vehicle if your name is not on the title. Look into non-owner car insurance to see how it works, what it is for, and when it is the best choice. Find out how insurable interest

Introduction Have you thought about why Bank of America does not give traveler’s checks anymore? These checks used to be very common for trips outside the country with people from the United States. They gave a safe way to handle your money in another country. They helped people feel better about not carrying too much

Fisher Investments Benefits for New Investors Fisher Investments Canada gives you wealth management that matches your goals and what you need from investing. They have years of global experience working with private people, families, and big groups that invest money. They use a smart way to invest that relies on data and makes sure choices