This article may contain references to products or services from one or more of our advertisers or partners. We may receive compensation when you click on links to those products or services. Nonetheless, our opinions are our own.

The information presented in this article is accurate to the best of our knowledge at the time of publication. However, information is subject to change, and no guarantees are made about the continued accuracy or completeness of this content after its publication date.

Updated by Albert Fang

Your 20s and 30s are prime time for making smart financial moves that can help secure you for the rest of your life. It’s also a time when people tend to make a lot of financial mistakes, often thanks to inexperience, but the good news about that is you have decades ahead to make up for those errors. All the same, it’s a good idea to start off on a solid footing, and the tips below can help you do that.

Get an Advanced Degree

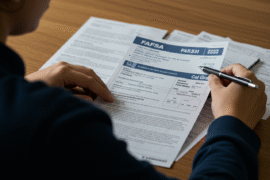

Did you finish college a few years ago, or maybe more than a few years ago? Whether it’s been three years or more than a decade, it might be time to go back to school and get that advanced degree that will further you in your career. What does that have to do with personal finances? The answer is everything, really. The core of personal finances is that you need to either figure out how to make more or spend less, and in many career fields, the key to a promotion is a graduate degree. The other personal finance issue is how you’re going to pay for it. There are a number of different options, including student loans. If you are getting an MBA, you can apply for Earnest MBA Loans to help cover the costs. Other options include paying out of personal savings, applying for scholarships, and getting tuition assistance from your employer.

Voted "Best Overall Budgeting App" by Forbes and WSJ

Monarch Money helps you budget, track spending, set goals, and plan your financial future—all in one app.

Get 50% OFF your first year with code MONARCHVIP

Contribute to Retirement

It can be tough to contribute to retirement during these years because you’re nowhere near your full earning power, and you have a lot of demands on your money with student loan repayments, buying a home, and having kids. The good news is there are alternative retirement planning options available that you can select from at various stages of life. Putting off your retirement contributions until middle age is a mistake because the money that you put away now can do so much thanks to compound interest, which means that your money will grow exponentially. You might be able to put more away as you get older, but it will never have the same amount of time to mature, so it’s worth making a few sacrifices. If you aren’t sure about where to invest or even what your goals should be, meeting with a financial professional may help you clarify that.

Have Emergency Savings

You might hear advice like stay out of credit card debt, but it can be tough to stick to that when you’re dealing with all of the unexpected events that life throws at your, from car and home repairs, to unexpected illnesses to periods of job loss and more. Emergency savings can help shield you from the financial repercussions much better than a line of credit can because you’ll have the money up front. One charge on the credit card may not seem like much, but these have a way of mounting, and high interest rates can make it difficult to pay off. The standard advice is to save up for three to six months of expenses, but depending on your financial obligations, you may want to have as much as a year’s worth or more.

Reviewed and edited by Albert Fang.

See a typo or want to suggest an edit/revision to the content? Use the contact us form to provide feedback.

At FangWallet, we value editorial integrity and open collaboration in curating quality content for readers to enjoy. Much appreciated for the assist.

Did you like our article and find it insightful? We encourage sharing the article link with family and friends to benefit as well - better yet, sharing on social media. Thank you for the support! 🍉

Article Title: Smart Personal Finance Tips for Your 20s and 30s

https://fangwallet.com/2022/09/11/smart-personal-finance-tips-for-your-20s-and-30s/The FangWallet Promise

FangWallet is an editorially independent resource - founded on breaking down challenging financial concepts for anyone to understand since 2014. While we adhere to editorial integrity, note that this post may contain references to products from our partners.

The FangWallet promise is always to have your best interest in mind and be transparent and honest about the financial picture.

Become an Insider

Subscribe to get a free daily budget planner printable to help get your money on track!

Make passive money the right way. No spam.

Editorial Disclaimer: The editorial content on this page is not provided by any of the companies mentioned. The opinions expressed here are the author's alone.

The content of this website is for informational purposes only and does not represent investment advice, or an offer or solicitation to buy or sell any security, investment, or product. Investors are encouraged to do their own due diligence, and, if necessary, consult professional advising before making any investment decisions. Investing involves a high degree of risk, and financial losses may occur including the potential loss of principal.

Source Citation References:

+ Inspo