This blog post may contain references to products or services from one or more of our advertisers or partners. We may receive compensation when you click on links to those products or services.

Are you trying to grow your business without having the financial resources? Developing your company without the money to do so can be challenging. This article will examine what you can do to keep your company on an upward trajectory when the funds are low.

Keep Essential Machinery Running

If you can’t afford to replace your old machinery, the least you can do is ensure it is running properly. If your equipment goes down, it can result in expensive downtime, which is detrimental to the growth of your business. Source a legacy parts provider that can help you update and replace your old Mitsubishi parts and equipment so it can continue to deliver the products your clients expect.

Improve Your Customer Service

Upgrading your customer service skills doesn’t have to cost you a penny. Respond promptly and accurately to customer enquiries and politely to any complaints. If there’s an issue, make sure that you are transparent with the customer and focused on resolving any problems that might arise when they place an order.

Create Value-Added Content

Creating value-added content can help you stand out as an expert in your chosen topic. Take the time to research your target customer and select topics that they might find interesting. Provide solutions to common questions they may ask, and share your content on your social media channels. Showcasing your content on social media platforms is a cost-effective way to raise awareness of your products and services.

Build Good Working Relationships

It can be tough to grow your business when you have limited financial resources to offer incentives like pay raises or promotions. But creating quality workplace relationships is essential for the future of your company. Create an atmosphere where you recognize and celebrate employee achievements and are receptive to feedback and employee concerns.

Another innovative strategy to leverage when financial resources are constrained is investing in custom awards for appreciation to foster a robust organizational culture and acknowledge employee contributions effectively. Recognizing your team’s hard work through customized tokens not only boosts morale but can significantly impact productivity and loyalty without incurring substantial costs.

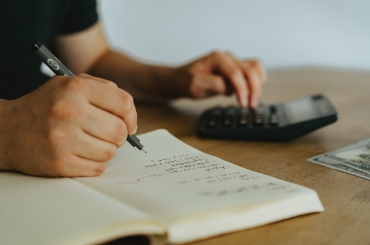

Business Funding

Business funding provides the much-needed fuel to propel growth. Obtaining external funding allows small businesses to access the necessary capital to expand operations, invest in new technologies, and explore new markets. There are a variety of different options such as business loans, accounts receivable factoring, venture capitalists, or crowdfunding platforms. With careful planning, you can leverage available resources to capture the opportunities to grow your firm. With proper financial management, businesses can overcome financial limitations and embark on a path of sustained success.

Look At Crowdfunding

Do you need to raise capital but don’t have the means to release equity in the business? Consider a crowdfunding campaign with a business like Indiegogo to generate the money you need for your next project. The best part about crowdfunding is that you are also bringing in new customers at the same time you are raising money.

Work Remotely

Working remotely is a great way to save money on expensive overheads like renting office space. If you have a business that can work without a set office space, do so to cut back on costs that you can spend on other areas of the business. If you have a team, keep in touch with them via online games or regular catch-ups.

Conclusion

You can grow a business with limited resources by building good working relationships with your clients and employees. Create content that your customers will find valuable, and look at crowdfunding as a way to bring on new customers without releasing equity in the business. Save on overheads like office space, and engage with your employees regularly online to ensure they remain engaged and happy.

Become an Insider

Editorial Disclaimer: The editorial content on this page is not provided by any of the companies mentioned and has not been endorsed by any of these entities. Opinions expressed here are author's alone

The content of this website is for informational purposes only and does not represent investment advice, or an offer or solicitation to buy or sell any security, investment, or product. Investors are encouraged to do their own due diligence, and, if necessary, consult professional advising before making any investment decisions. Investing involves a high degree of risk, and financial losses may occur.