This article may contain references to products or services from one or more of our advertisers or partners. We may receive compensation when you click on links to those products or services. Nonetheless, our opinions are our own.

The information presented in this article is accurate to the best of our knowledge at the time of publication. However, information is subject to change, and no guarantees are made about the continued accuracy or completeness of this content after its publication date.

The evolution of how people exchange money continues to accelerate in complexity and scale. By 2025, payment ecosystems may look significantly different from what most consumers are accustomed to today. While digital wallets and contactless cards have become familiar, new patterns are forming quietly.

- What Comes After Digital Wallets?

- Decentralized Currencies Quietly Enter Everyday Use

- Subscription Creep and the Fragmentation of Consumer Budgets

- Biometric Authentication Becomes a Default Layer

- Reframing Buy Now, Pay Later Models in a Tightening Economy

- Automated Micro-Saving Tools Gain Ground

- Looking Ahead: Payment as Experience, Not Just Function

- FAQs

- Recommended Reads

What Comes After Digital Wallets?

While digital wallets like Apple Pay and Google Wallet are no longer novel, their next-generation capabilities may catch many by surprise. These platforms are expected to evolve from mere payment facilitators into multi-layered financial command centers.

Integrated Ecosystems with Adaptive Capabilities

By 2025, major wallet providers are likely to integrate features such as:

- Smart spending analysis using real-time behavioral data

- Automated switching between payment methods for best rewards or interest savings

- Built-in investment and insurance management modules

A Shift From Convenience to Financial Strategy

This movement reflects a change not in how people pay, but why and with what awareness. Seamless interfaces may begin to guide users toward optimized financial outcomes during the act of purchase.

Decentralized Currencies Quietly Enter Everyday Use

While headlines have focused on speculative cryptocurrency trading, the foundational infrastructure for using decentralized currencies in ordinary purchases is quietly solidifying. Select retailers, particularly in online marketplaces, are already experimenting with seamless crypto checkouts.

Enabling Real-Time Conversion and Scalability

One of the more transformative capabilities is the expansion of real-time crypto-to-fiat conversions at the point of sale. This development allows consumers to pay in digital assets without volatility concerns, while merchants receive stable local currency.

Implications for Security and Privacy

Cryptocurrency transactions can also introduce enhanced privacy layers by minimizing exposure of sensitive card or banking details. Combined with smart contracts and blockchain transparency, digital assets are likely to reshape not just transactions, but trust mechanics.

Subscription Creep and the Fragmentation of Consumer Budgets

Monthly payment models have expanded far beyond media and software. Today, subscriptions include everything from personal care products to transportation access. This fragmentation is prompting consumers to reevaluate the cumulative impact of recurring charges on their financial health.

From Passive Charges to Active Optimization

Consumers are increasingly seeking tools to audit and optimize their recurring commitments. Fintech platforms are introducing automated cancelation features, bundled billing options, and tiered budgeting recommendations.

Sample Budget Allocation

| Subscription Category | Avg. Monthly Spend | Potential for Value Recovery |

|---|---|---|

| Streaming Media | $12 | High if bundled |

| Wellness/Fitness | $30 | Moderate |

| Learning Platforms | $25 | High with active use |

The evolution of subscription payments reflects a broader need for users to align spending with intention and utility.

Voted "Best Overall Budgeting App" by Forbes and WSJ

Monarch Money helps you budget, track spending, set goals, and plan your financial future—all in one app.

Get 50% OFF your first year with code MONARCHVIP

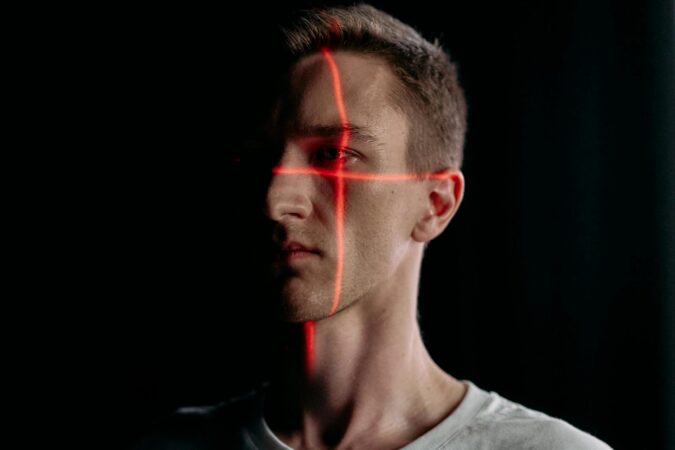

Biometric Authentication Becomes a Default Layer

Payments requiring no physical device are gaining serious traction. Facial recognition, fingerprint scans, and even palm vein authentication are being incorporated into everyday checkout experiences. While privacy remains a point of public scrutiny, the frictionless nature of these transactions is accelerating adoption.

Beyond Phones and Cards

Retailers and transit systems in select global cities have already piloted biometric terminals that authenticate a customer’s identity in under two seconds. This may soon expand into restaurant payments, office vending machines, and high-speed retail environments.

Primary Benefits

- Greater resistance to credential theft

- Reduced checkout time in high-volume environments

- Elimination of dependency on physical devices

Security experts warn that biometric data must be securely encrypted and stored in compliance with international privacy standards to avoid biometric identity misuse.

Reframing Buy Now, Pay Later Models in a Tightening Economy

As global markets fluctuate and personal debt loads increase, the once celebratory tone around Buy Now, Pay Later (BNPL) options is being reassessed. While still growing in popularity, consumers and regulators are demanding more transparency and responsible design.

Risk-Based Structuring and AI Monitoring

BNPL providers are deploying adaptive AI models to assess default risk in real time. These systems allow for more individualized payment terms and proactive alerts when a user is at risk of overextending.

H4: BNPL Payment Example

| Product | Purchase Value | Monthly Payment | Term |

|---|---|---|---|

| Home Office Desk | $500 | $125 | 4 months |

| Laptop Upgrade | $1,200 | $300 | 4 months |

Consumer advocacy groups are lobbying for clearer disclosures, built-in credit reporting standards, and better protection against late-fee stacking.

Automated Micro-Saving Tools Gain Ground

One of the most overlooked payment-adjacent trends is the quiet expansion of passive savings tools. These platforms round up transactions, allocate spare change into savings, and enforce scheduled contributions without manual interaction.

Behavioral Finance in Action

What sets these tools apart is not technical innovation, but psychological design. By automating good habits, users avoid the cognitive burden of daily money decisions and build financial stability over time.

Long-Term Impact

| Weekly Set-Aside | Annual Result |

|---|---|

| $10 | $520 |

| $25 | $1,300 |

| $50 | $2,600 |

Micro-saving platforms are particularly effective for users who struggle with traditional savings strategies, and they may become embedded into mainstream bank accounts by default.

Looking Ahead: Payment as Experience, Not Just Function

The convergence of biometric systems, crypto integrations, and intelligent payment flows signals a shift in how consumers perceive financial interactions. By 2025, payments may cease to feel like discrete tasks. Instead, they may be woven into environments and orchestrated by intelligent systems that quietly optimize behind the scenes.

As financial platforms mature, so too will consumer expectations: prioritizing seamlessness, autonomy, and systems that don’t just process money, but help manage it with foresight.

Absolutely. Here’s the revised set of 4 concise FAQs, directly referring to the content of the article:

FAQs

How are biometric payments used in 2025?

They enable fast, secure checkouts through facial recognition or fingerprint scans, often replacing cards entirely.

Is cryptocurrency practical for everyday spending?

Yes. The article highlights real-time crypto-to-fiat conversion and growing retailer adoption as key enablers.

What should users know about Buy Now, Pay Later services?

BNPL remains popular but, as noted, users should track terms, budget impact, and credit risk closely.

How do automated savings tools help users?

They passively build savings by rounding up purchases or setting scheduled contributions, as shown in the article’s comparison table.

Reviewed and edited by Albert Fang.

See a typo or want to suggest an edit/revision to the content? Use the contact us form to provide feedback.

At FangWallet, we value editorial integrity and open collaboration in curating quality content for readers to enjoy. Much appreciated for the assist.

Did you like our article and find it insightful? We encourage sharing the article link with family and friends to benefit as well - better yet, sharing on social media. Thank you for the support! 🍉

Article Title: 5 Unexpected Payment Trends That Could Take 2025 by Storm

https://fangwallet.com/2025/06/13/payment-trends/The FangWallet Promise

FangWallet is an editorially independent resource - founded on breaking down challenging financial concepts for anyone to understand since 2014. While we adhere to editorial integrity, note that this post may contain references to products from our partners.

The FangWallet promise is always to have your best interest in mind and be transparent and honest about the financial picture.

Become an Insider

Subscribe to get a free daily budget planner printable to help get your money on track!

Make passive money the right way. No spam.

Editorial Disclaimer: The editorial content on this page is not provided by any of the companies mentioned. The opinions expressed here are the author's alone.

The content of this website is for informational purposes only and does not represent investment advice, or an offer or solicitation to buy or sell any security, investment, or product. Investors are encouraged to do their own due diligence, and, if necessary, consult professional advising before making any investment decisions. Investing involves a high degree of risk, and financial losses may occur including the potential loss of principal.

Source Citation References:

+ Inspo

There are no additional citations or references to note for this article at this time.