Amazon's Black Friday sale is great for shoppers. You can find big discounts on tech, home appliances, clothing, beauty, and more. Get ready to grab the best deals. Start by setting up your Amazon account, making wishlists, and checking out tools like CamelCamelCamel for hunting deals. Amazon Prime members get special benefits. They

As the 2024 tax season approaches, families are eager to know about the Child Tax Credit direct deposit updates. This direct payment helps ease financial burdens, making it crucial for parents to ensure their banking information is current for timely deposits.

Black Friday is a great time for deals. You will find discounts on tech, home appliances, fashion, and more. This big shopping event starts on November 29th, 2024, and goes until Cyber Monday. Smart shoppers can save more by planning their shopping lists, comparing prices, and using cashback apps. This year, look out

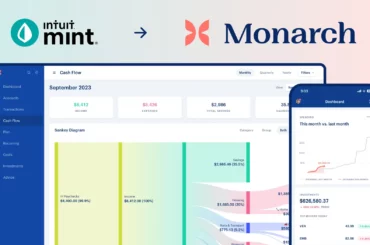

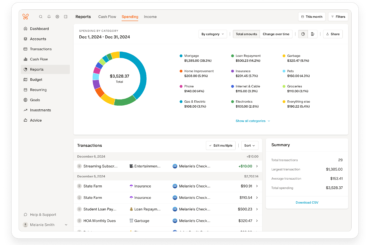

Monarch Money and Personal Capital are two popular tools that can help you track your cash. They have different purposes. This blog post compares Monarch Money and Personal Capital. It will help you decide which app meets your financial goals for 2025. You can learn about what each platform offers, like tracking spending

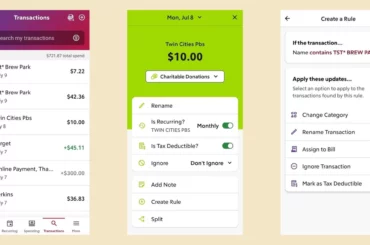

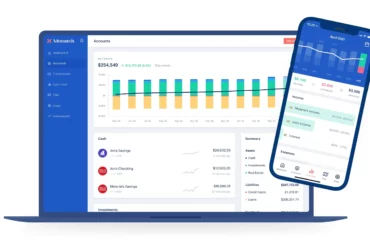

Look at the best budgeting apps for 2025: Rocket Money and Monarch Money. Learn how to manage your money with these budgeting apps. Read our simple guide to set up and use your budgeting app well. We will compare Rocket Money and Monarch Money based on their features and ease of use. Find

Easy Move: Getting your financial data from Mint to Monarch Money is straightforward and simple. Better Budgeting: With Monarch's flexible tools, you can have more control over your budget. You can set up custom categories, group your budgets, and use rollovers. Overall Financial View: Monarch offers a full view of your finances. It

Monarch Money is a great app for personal finance that makes money management easy in 2025. It has a user-friendly design, so you can navigate it with ease. You can see your finances clearly and set financial goals without a problem. The app has strong security features. Users can only access linked bank

Monarch Money is a great app for taking care of your personal finance. It is easy to use, especially if you are a beginner. This budgeting app helps you track your net worth, check your investments, and set your personal goals. It connects well with many financial institutions so you can see your

Saving for retirement is one of the most important financial goals you can set, but figuring out exactly how much you should save at each stage of life can be tricky. There isn’t a one-size-fits-all answer, as your retirement savings depend on your lifestyle, desired retirement age, and other factors. However, following some basic guidelines

Retirement planning can be a complex and daunting task, with numerous factors to consider and potential pitfalls to avoid. Retirement comes with numerous challenges and hurdles; these include underestimating your future expenses to failing to diversify investments. This blog post will explore the various ways in which a financial advisor can help you prepare for

Find out what outside food and drinks you can bring into Walt Disney World in 2025. Learn about the rules and items not allowed with any food inside the theme park. Get tips on what you need to pack food for your Disney experience. Understand how to choose the right food and best

We’ve all faced those stressful days when it feels like our cash just isn’t stretching far enough. Whether it’s a surprise bill or juggling expenses until the next paycheck, these moments can really put a dent in our peace of mind. We're here to share five savvy strategies that can help steady your financial course

Choosing the right budgeting app can be daunting; this blog post compares Simplifi and Monarch to help you decide. We'll examine core features, pricing, user experience, and more for informed decisions. A step-by-step guide for each app will ease you into using them effectively. Whether you're new to budgeting or a seasoned pro,

Today, budgeting apps are great tools for personal finance. This blog post talks about two popular apps, Copilot and Monarch Money, highlighting their pros and cons. We will look at key features like budgeting, expense tracking, investment monitoring, and user experience. You will learn how AI plays a role and how these apps

Uber and Lyft are popular ridesharing services in the United States. The prices for Uber and Lyft rides can change depending on your location and the number of people needing a ride. Generally, Uber is cheaper than Lyft in many cities across the U.S. Both services use surge pricing when demand is high.

Choosing between YNAB and Monarch Money depends on your budgeting style and money goals. YNAB focuses on zero-based budgeting. This helps you track your spending and manage your expenses closely. Monarch Money has a great financial dashboard. It helps you keep track of your bank accounts, investments, and predict future costs. Both apps

Mint and Quicken are popular apps for personal finance. Mint is free, but Quicken needs a subscription. Mint is easy to use. Its mobile app allows you to track your finances anywhere. Quicken has advanced features. It offers detailed investment tracking, retirement planning, and property management tools. Both apps provide good options for

Kirkland Bath Tissue gives you a great mix of quality and value. This article looks at how soft and strong Kirkland toilet paper is, and its effect on the environment. We will compare Kirkland with other brands like Charmin, Scott, and Cottonelle. You will learn how to assess your needs by thinking about

When you fly smart with low-cost airlines like Frontier Airlines and Spirit Airlines, you need to think about costs beyond just the ticket price. You should also consider the onboard experience and make wise choices. Knowing what makes Frontier Airlines different from Spirit Airlines helps you choose based on things like legroom and

Buying a gift card is often seen as just a convenience or a last-minute gift. But in reality, it can be a thoughtful tool for saving, budgeting, and even adding flexibility to your finances. Whether you’re looking for practical ways to reward yourself, manage expenses, or make gifting easier, here’s why it might be time

The average cost to tear off and replace a roof ranges from $5,700 to $16,000. Expect to pay between $3 and $6 per square foot for a new roof. Factors like roof size, complexity, pitch, and materials significantly impact the cost. Labor typically makes up 50% to 60% of the total roof replacement

Having a Rakuten account and using their referral link is a great way to save money while you shop online. When you refer friends and family, you can earn extra cash easily. This guide will help you understand the Rakuten Referral Program and give you tips to increase your earnings.

Free Gift Cards: You can turn your shopping receipts into free gift cards with Fetch Rewards. Scan Any Receipt: Fetch accepts receipts from grocery stores, restaurants, gas stations, and more. Special Offers: You can earn bonus points by buying certain featured brands and products. Referral Bonuses: You can make more money by inviting

Fetch Rewards is a mobile app that helps users earn rewards points by scanning receipts from different retailers. You can use these points to get gift cards, donate to charity, or join sweepstakes for bigger prizes. Signing up for the app is simple and easy to use. Fetch also gives you ways to

Discover how to maximize Fetch Rewards points using single receipts. Learn about high-value items, special offers, and partner store strategies. Explore advanced tips like combining receipts and leveraging online purchases. Understand the importance of referral codes and utilizing Fetch Shop. Find answers to common questions about Fetch Rewards. Use the referral code 55AGK

Effortless Earning: Turn your everyday shopping receipts into valuable rewards with the Fetch app. Brand Power: Earn bonus points by purchasing products from Fetch's 300+ participating brands. Points Mean Prizes: Redeem your points for a wide variety of gift cards, including popular options like Amazon, Target, and more. Beyond the Grocery Aisle: Fetch

Financial planning in Long Beach offers a pathway to secure your future investments and achieve long-term financial stability. The vibrant coastal city presents unique economic opportunities and challenges, making it crucial for residents to develop comprehensive strategies tailored to their specific needs. A well-crafted financial plan can help you navigate market fluctuations, maximize savings, and

Fetch Rewards is a mobile app that gives you points for buying featured products and scanning your receipts from any store. You can redeem your points for gift cards from hundreds of brands, including popular options like Amazon and Target. The Fetch app is free to use and doesn't require any personal banking

Effortless Earning: Accumulate points effortlessly by scanning receipts from various retailers, grocery stores, and restaurants. Bonus Point Bonanza: Boost your earnings with bonus points on featured brands, special offers, and participating products. Seamless Gift Card Redemption: Redeem your points for a variety of gift cards from popular brands, including Amazon, Walmart, and Target.

Seamlessly earn Fetch Rewards points from your Amazon purchases. Connect your Amazon account for automatic eReceipt scanning. Understand the eligible purchase types and maximize your rewards. Troubleshoot common issues with eReceipt syncing. Effortlessly accumulate points and redeem them for exciting rewards. Use the referral code 55AGK to get a bonus of 2,000 Fetch