This article may contain references to products or services from one or more of our advertisers or partners. We may receive compensation when you click on links to those products or services. Nonetheless, our opinions are our own.

The information presented in this article is accurate to the best of our knowledge at the time of publication. However, information is subject to change, and no guarantees are made about the continued accuracy or completeness of this content after its publication date.

The year 2022 has indeed seen the rising rates of car insurance throughout the US.

According to Insurance Information Institute, vehicle insurance costs have increased by 3.8% so far this year.

The main reasons for increasing costs of car insurance are inflation and changing driving habits ever since the onset of the pandemic. Further, the disruption in supply chain operations and labor shortages during the COVID-19 lockdowns have also contributed significantly to rising insurance costs.

The rise in vehicle costs along with inflation has caused an increase in the pricing structures of most insurance providers.

Although these increasing rates seem stressful, having the right knowledge about your insurance plan can help you proactively plan to lower these costs. With the help of some planning and discount offers, you can surely cut down some costs on your insurance premiums.

In this blog, we discuss the top 12 ways to prepare yourself to reduce your insurance costs. While some of these steps can be implemented instantly, others may need some sound planning and time to show up the results.

-

12 Tips for Cutting Car Insurance Costs

- 1. Research for Better Quotes

- 2. Compare the Costs of Premiums

- 3. Opt for Higher Deductibles

- 4. Maintain an Excellent Credit Record

- 5. Go for Lower Coverage on Older Cars

- 6. Focus on Lowering Your Mileage

- 7. Enquire about Group Insurance

- 8. Ask for Discounts

- 9. Revise Your Coverage on a Timely Basis

- 10. Pay the Full Premium Amount If Possible

- 11. Install Safety Gadgets

- 12. Take up a Defensive Driving Course

- Wrapping Up

- Recommended Reads

12 Tips for Cutting Car Insurance Costs

1. Research for Better Quotes

Researching and keeping multiple insurance options from different car insurance companies is one of the best and quickest ways to reduce insurance costs. Although this can be a time-consuming process, it is mandatory as car insurance rates can vary significantly depending upon your insurance providers.

Another reason why you should shop around for insurance quotes is to understand the terms and benefits the insurance policies offer. You should read the policy documents thoroughly to know more about the terms, add-ons you might need, as well as hidden costs.

Also, check out the insurance company’s website to understand its financial strength and go through the customer’s testimonials and reviews.

The price of your car, the approximate repair costs, and its overall safety record also determines the premium amounts. Other factors, such as your age, profession, driving record, and other criteria also play a significant role in the premium costs.

Checking and comparing premiums manually all by yourself can be a time-consuming process. You can connect with insurance agents, ask them required questions, and speed up your processes.

If you are buying a new car, you could go for a cheaper one. As the higher the price of your car is, the more premium you will have to pay. Luxury cars or sports cars are considered to be risky as compared to sedans or vans and thus, call in for higher premiums.

3. Opt for Higher Deductibles

A deductible is a portion of an insurance claim that is usually borne by you. For example, if your insurance claim amount is $10000 and you have a deductible of $1000 then your insurance form is liable to pay you $9000 at the time of claims.

By increasing your deductibles, you can lower your premium costs. However, you need to ensure that you have enough money with you to pay in case of the claim as you will have to pay the money before your insurance firm pays for the damages.

To understand this better, read our post on how auto insurance claim works before opting for higher deliverables.

4. Maintain an Excellent Credit Record

A credit score plays a key role in determining your insurance costs. The higher your credit

score, the better insurance rates you receive.

According to Forbes, it was observed that drivers with poor credit scores have to pay an average of 76% more insurance costs than the ones with a good credit score.

Take a look at your credit reports and see if you can do some improvements to the same. Furthermore, focus on making on-time credit payments. Try to keep your credit usage to 20% of the available credit limit or lesser. Do not opt for any new credit accounts.

5. Go for Lower Coverage on Older Cars

Older cars do not need the same insurance plan as new cars. Purchasing coverage for older cars whose worth is 10 times less than your premium is not a cost-effective solution. Look up the worth of your car by contacting auto-dealers or banks and consider reviewing your insurance coverage.

For example, you can eliminate collision coverage for older cars as it takes up a huge portion of your insurance costs.

Secondly, consider parking your older cars in the garage rather than on the street or driveway. It reduces their risks of being stolen or damaged due to crashes, thereby decreasing the premium costs.

6. Focus on Lowering Your Mileage

Driving less than the average number of miles per year (around 7500 miles per year) categorizes you in the low-mileage driver category. Insurance firms may offer discounts to low-mileage drivers on their insurance premiums. This is also affected by your location, age,

and gender.

Here are two approaches you can follow to be eligible for low-mileage discounts.

- Taking a bus or carpooling with your colleagues or classmates to work or school

- Working remotely or studying from home

In either case, let your insurance agent know and you shall be able to take advantage of the available discounts.

7. Enquire about Group Insurance

As the name suggests, group insurance covers insurance for many people in the same insurance contract. This usually includes employees from the same organization, alumni groups, business associates, and other professional associations.

You can connect with insurance companies to ask about group insurance plans they offer. Once you have a response from any insurance company, you can get in touch with your employer to see if they are interested in these types of insurance benefits. You can also connect with alumni groups or club members for group insurance.

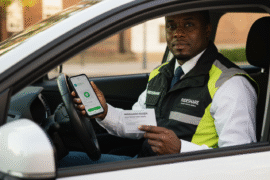

8. Ask for Discounts

If you have a history of safe driving and no record of any accidents or violations, ask for additional discounts from your insurance company.

Driving violations like cell phone use while driving or driving under influence increases the costs of insurance. Having a clean driving record is thus required for seeking better discounts.

You can also take up a defensive driving course and seek discounts. Some companies offer good discounts to long-time customers, students having good grades, and customers having excellent credit scores. We will talk more about defensive driving skills further in the post.

In addition to this, some insurance companies offer excellent discounts to the policyholders owning anti-theft or any other types of safety devices.

Speak to your insurance agent to understand the discount opportunities you can take advantage

of to lower your car insurance costs.

9. Revise Your Coverage on a Timely Basis

Evaluating your insurance coverage periodically helps you know your insurance requirements better.

For example, you might not require car rental coverage for your vehicle. That is why reviewing how much coverage you need is important. Further, you could also switch your insurance provider whose insurance plans align with your requirements better.

Do not opt for unnecessary insurance add-ons that you might not need. Avoid installing additional fittings as it attracts additional coverage costs. Ditching the coverage you do not need will reduce your insurance premiums drastically.

Paying your premium in one go can entitle you to some additional discounts. Many insurance firms offer discounts of up to 10% to policyholders who pay the premiums in full. It will relieve you from the worry of late premium payments and help you avoid policy lapses.

Keep an eye out for other payment discounts, such as electronic payments, automatic payments, or direct bank transfers as these payment modes could bring in additional discounts or cashback.

11. Install Safety Gadgets

Installing safety devices like anti-theft devices, steering wheel locks, airbags, and other devices can fetch you a good discount on insurance premiums. You can connect with your insurance agent to know more about the devices which can help in lowering the premiums. If you are associated with associations like WIAA (Washington Interscholastic Athletic Association) or AAI (Alliance of American Insurers), you can enjoy discounts on your premiums.

It not only lowers your premiums but also adds to the safety of your car.

12. Take up a Defensive Driving Course

Insurance companies provide a discount to all those drivers who have verified defensive driving or any other certificate. Improve your driving skills by taking up a defensive driving course or an accident prevention course that is approved by your insurer. You can then submit the certification of this course for added discounts.

Ensure that you speak to your insurance agent before signing up for this course and discuss the benefits.

For example, drivers in New York can save up to 10% on insurance premiums for three years by completing an approved safety driving course.

Wrapping Up

The price of auto insurance is likely to rise even more in the future. However, if you follow the above-mentioned tips you can save a considerable amount on your insurance premiums without any hassles.

Start looking out for the desired coverage plan that suits your requirements today and save a significant amount on your car insurance costs.

Reviewed and edited by Albert Fang.

See a typo or want to suggest an edit/revision to the content? Use the contact us form to provide feedback.

At FangWallet, we value editorial integrity and open collaboration in curating quality content for readers to enjoy. Much appreciated for the assist.

Did you like our article and find it insightful? We encourage sharing the article link with family and friends to benefit as well - better yet, sharing on social media. Thank you for the support! 🍉

Article Title: Top 12 Tips to Lower Your Car Insurance Costs

https://fangwallet.com/2022/04/18/top-12-tips-to-lower-your-car-insurance-costs/The FangWallet Promise

FangWallet is an editorially independent resource - founded on breaking down challenging financial concepts for anyone to understand since 2014. While we adhere to editorial integrity, note that this post may contain references to products from our partners.

The FangWallet promise is always to have your best interest in mind and be transparent and honest about the financial picture.

Become an Insider

Subscribe to get a free daily budget planner printable to help get your money on track!

Make passive money the right way. No spam.

Editorial Disclaimer: The editorial content on this page is not provided by any of the companies mentioned. The opinions expressed here are the author's alone.

The content of this website is for informational purposes only and does not represent investment advice, or an offer or solicitation to buy or sell any security, investment, or product. Investors are encouraged to do their own due diligence, and, if necessary, consult professional advising before making any investment decisions. Investing involves a high degree of risk, and financial losses may occur including the potential loss of principal.

Source Citation References:

+ Inspo