Understanding offsets is essential in financial management, especially when balancing debts and payments. Financial offsets balance one transaction with another, helping to reduce or eliminate a debt or obligation. Offsets apply to various contexts, including personal finances, business transactions, and investment strategies. Identifying and managing financial offsets can improve your health and simplify

Temporary checks, also known as starter checks or counter checks, are quick, bank-issued alternatives to personal checks. They are ideal when you’ve run out of personal checks or are waiting for new ones. You can obtain temporary checks quickly by visiting your local bank with valid identification. Not all businesses accept temporary checks,

Operating income and net income show how profitable a company is, but they are not the same. Operating income focuses on a company’s main activities. Net income considers all earnings and costs. To read income statements, you should look at different revenue streams, operating expenses, and the effects of taxes and interest. Understanding

Learn how to choose the best credit cards for beginners and start your credit journey. Understand how credit cards work and pick the one that fits your needs. Explore secured and unsecured cards, and discover the benefits of rewards programs. Follow a step-by-step guide to applying for your first credit card and building

Identity theft is when someone takes your personal or financial information without permission. It’s important to watch for signs, like strange bills or unusual activity in your accounts, to spot issues early. Keeping your Social Security number safe, sharing less personal information online, and securing your documents are great ways to prevent identity

Writing a check might seem outdated today, but it’s still an important skill. A check is a paper document that instructs your bank to pay someone from your bank account. Understanding the different parts of a check, like the routing number, account number, and payee line, is essential for writing checks correctly. Always

Gross pay is the total money you earn before any deductions. Net pay is the amount you get after taxes and other withholdings. Knowing your paycheck is essential for managing your finances effectively. Deductions may include taxes, insurance costs, and retirement savings. Calculating your gross and net pay helps you track your earnings.

Payment remittance refers to sending money to someone, often accompanied by remittance advice. Remittance advice details the transaction, including invoice numbers and payment amounts, helping to maintain accurate records. Remittance advice is essential for accurate financial records, preventing disputes, and managing cash flow for both parties. Safe methods for sending payment remittances include

Find the best bank to take care of your money. Understand the different banks and how they handle your funds. Consider important factors when choosing a bank, like fees, interest rates, and accessibility. Use this guide to help you choose the right bank for your needs. Learn how to open your first account

Checking accounts are designed for your daily money needs, allowing easy access to your funds through debit cards, checks, and online banking. Savings accounts are for saving money over time and often offer higher interest rates than checking accounts. The major differences between these accounts are how you access your money, the interest

Bank reconciliation is comparing a company’s bank statements with its financial records to ensure accuracy. It is essential to maintain accurate financial records, detecting fraud, and avoiding cash flow issues. Businesses can perform bank reconciliations manually or use software for greater efficiency. Regularly reviewing bank statements helps businesses identify errors, prevent fraud, and

It's important to know your tax due dates to avoid penalties and extra fees. Deadlines change depending on your filing status, type of income, and where you live. Collect your Social Security number, income statements, and past tax returns. Use online tools like the IRS website and state tax portals for deadline details.

Know Exchange Rates: Understand why the USD to MXN exchange rate is essential when handling money between the United States and Mexico. Check Current Data: Always look at up-to-date data. This helps you make correct conversions and avoid losing money from rate changes. Time Your Exchange: Find the best moments to change USD

To void a check, write “VOID” in bold, large letters across the front. This ensures it cannot be used fraudulently. Voiding a check is necessary to set up direct deposits, automatic bill payments, or securely share banking information. Always use black or blue ink and ensure “VOID” is visible. Keep a copy for

Data analytics has already become the backbone of business decision-making in the banking sector, and its importance only increases as the volume of data grows. The use of data and advanced analytics were the top priorities for banking executives in 2024, as revealed by the 2024 Retail Banking Trends and Priorities report. In this context,

Walmart MoneyCenter is open from 8 a.m. to 8 p.m. Monday to Saturday. On Sundays, it opens from 10 a.m. to 6 p.m. At Walmart MoneyCenter, you can use several services like check cashing, money orders, bill payment, and money transfers. This is convenient, but check your local store's hours because they may

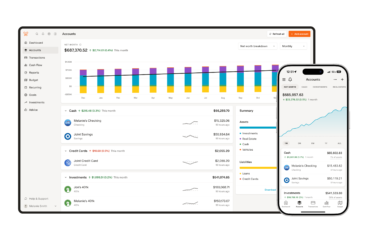

Monarch Money is an app for managing your finances. It helps with budgeting, setting goals, and tracking investments. You can link all your accounts to see a complete view of your finances. The app gives you insights that are personalized to improve your money management. Monarch Money is available through a subscription, and

Get cashback rewards: Earn cashback on every purchase and spending choice you make. Improve your financial wellness: Use tools and tips to manage your money, build credit, and achieve your goals. Special perks and discounts: Enjoy member-only savings, giveaways, and access to great financial products. Feel secure with insurance: Get protection from everyday

MoneyLion WOW is a special membership that offers extra money tools and perks. You can earn cashback rewards when you shop, take out loans, or invest in crypto. There are benefits like purchase protection and discounts at big stores. Signing up is simple and can be done in the MoneyLion app. You can

Moving money from your Apple Cash to your bank account is simple. You can do this with the Wallet app on your iPhone or iPad. There are two speed options for transfers: Instant Transfer and Standard Transfer. Instant Transfer is fast, while Standard Transfer takes 1-3 business days. To use Instant Transfer, you

The interest saving balance is the least you need to pay on a credit card. It adds any new purchases made in that billing time. Paying this balance can help you avoid more interest charges. It is important to understand interest rates and APY to boost your saving chances. Having clear money goals

SoFi integrates with Zelle® for fast and easy money transfers. You can send money using the recipient's email address or U.S. mobile number. Transfers typically happen within minutes, making it convenient for sending and receiving money. Zelle® is free to use with your SoFi Checking account. You can access Zelle® through your SoFi

In the world of financial services companies, referral bonuses are popular. These programs encourage current customers to tell others about products or services, such as a Bank of America checking account. So, does Bank of America have a referral bonus? Let’s take a look at the current program, how you might benefit, and what to keep in mind.

The MoneyLion virtual card is a digital payment solution linked to your RoarMoney account, offering convenience and enhanced security. You can activate your virtual card immediately upon opening a MoneyLion account, and start making purchases online or through mobile pay. Benefits include easy access through the MoneyLion app, instant card replacement, and compatibility

MoneyLion is a top financial technology company that provides smart financial services to help you. One of their main offerings is RoarMoney. This service lets you handle your banking needs in a simple and rewarding way.

In the evolving FinTech landscape, MoneyLion and Ally are prominent players offering a range of financial products. MoneyLion stands out for its comprehensive financial services ecosystem while Ally is recognized for essential customer acquisition strategies. Both platforms provide competitive savings account options with varying APY rates to cater to diverse user needs. Evaluating

MoneyLion is a financial technology company, not a bank, but it partners with banks to provide a wider array of financial products and services. Pathward, N.A., a Member FDIC, is the official bank of record for MoneyLion's RoarMoney accounts. This partnership allows MoneyLion to offer features like the MoneyLion Debit Mastercard and RoarMoney

MoneyLion is a financial technology company that offers a suite of financial products through its mobile app. Services include mobile banking, cash advances, loans, and investment options. MoneyLion targets consumers who desire help with credit building and financial management. The company operates on a subscription model with both free and paid tiers available.

MoneyLion uses Plaid Exchange to connect to various financial apps. You'll need your MoneyLion login and bank credentials to link your accounts. Connecting your bank account helps make transactions and managing your money easier. MoneyLion is focused on keeping your financial information safe during this process. Plaid acts as a secure link between

MoneyLion offers several financial tools, with some available for free. You can open a checking account with no fees. You can also have an investment account without paying a monthly membership fee. A credit builder loan and other special features require a paid “Credit Builder Plus” membership. With MoneyLion, you can get a