Leasing a car can be a worrisome task if you’re unaware of the financial implications involved. If you don’t know what you’re doing, you may cost yourself more money than necessary while trying to lease a car. You may also be asking yourself: When you lease a car, does it come with car insurance? Read

Opening a small business is no longer just a trend. Millions currently own a small business or work for themselves as freelancers. As an entrepreneur, your main goal is probably having financial independence. After all, working for yourself is supposed to be freeing, isn’t it? Well, the answer is yes and no. As a business

If you're always on the go, managing and earning money from your smartphone is a convenient way to keep track of your finances. Here, we will investigate three apps that let you receive and send money, invest money, and earn money. Venmo is a popular payment application that allows you to pay friends and family,

Those looking to save money, who are busy but conscientious, who realize the importance of diversifying their strategies, but lack the time to do so, are increasingly turning to technology to help them. A cashback app is one way to do this, along with automating your bill payments, investing in small stocks, or saving money

Though unemployment is not currently on the rise and most are returning to work at least part-time, the pandemic has cost many people their livelihoods. As we slowly work to rebuild our economy, no one can argue that in these times of uncertainty, paying bills is doubly hard. If you find yourself in a tough

Everyone has financial dreams, both big and small. Unfortunately, these dreams often run counter to the everyday realities people face with regard to housing costs, saving for college, or expensive vehicle maintenance. Sometimes financial burdens can feel so heavy that we can't imagine spending a sizable portion of our income on personal desires. But most

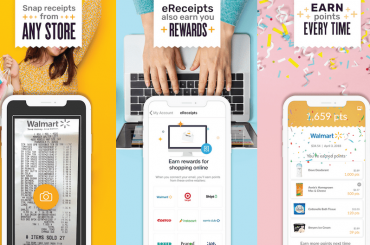

Can you really make money by spending money? In a way, yes – you can get rewards for snapping pictures of your receipts. Receipt apps have been growing in popularity for a while now, and they show no signs of slowing down. A lot of them focus on physical paper receipts, but the best options

Science is pleading with society to switch to clean and renewable energy before it has an irreversible impact on the environment, and it seems like a new dire warning about the environment is being issued almost daily. Homeowners who are concerned about the environmental impact of the energy they use may feel some guilt about

The main purpose of an automotive emergency fund is to cover unexpected car repairs. That way, you don't need to borrow loans at higher rates or dip into other savings. Plus, you reduce the stress that comes with a car emergency. According to an AAA study, about 64 million drivers can't afford emergency car repairs

The app Nextdoor was launched with the idea of connecting neighbors and communities behind it, and it has blossomed into its own social media experience for neighbors and citizens of a common city. Within the app, you can share information about local events, ask for information about local crime, and give your neighbors a heads-up

What are some of the most effective ways to achieve the age-old goal of having more money in your pocket? The good news is that as times change, so do tactics for enhancing personal wealth. Of course, there are no get rich overnight schemes, but there are many realistic, commonsense ways to earn a raise,

Have you spent too much and want money-saving tips? Or ever feel like you have tried hard and can't quote ways on money-saving? Let's understand it better through an example – the teenager needs a bicycle, the car needs new tires, the house needs improvement, be it a kitchen, roof, or painting your house –

Despite the stereotype of surviving on pizza, pre-packaged foods, and caffeine, it actually can be easy for college students to eat healthy even while on a budget. It just takes some planning and swapping out certain healthy foods for their inexpensive counterparts. We’ll discuss healthy and affordable eating tips for college students, as well as

Achieving Financial Independence: Steps to Freedom Imagine being able to travel the world, buy a new car, or build your dream home without worrying about money. It seems unreal, doesn't it? Even if you have a stable job, it's easy to run out of financial resources. With ongoing mortgage payments, credit card debt, and everyday

Having an emergency fund is a rule of thumb for any modern educated person. And nowadays, when the whole world struggles because of a pandemic, it's an incredibly hot topic. Should you start saving in times of crisis? How to accumulate savings when your income becomes lower? Let's analyze how the COVID outbreak affected usual

Do you sometimes wonder whether your monthly budget is getting the job done? Signs that your budget is falling short include things like missing payments on some bills, not being able to put planned amounts into a savings account, and more. The truth is that there are hundreds of budget-related mistakes people make regularly. Fortunately,

If you're under a lot of stress because you have to move, we hear you. Moving is often a stressful ordeal—physically, mentally, and financially—but it doesn't have to be as harrowing as it may seem at first glance. By setting yourself up for a successful move at the start, you'll breeze through your moving checklist

Though money cannot buy happiness, it certainly buys essential things you need for survival. You may want to enjoy your life, but it cannot be possible without good financial habits. Though you can easily get the critical financial resources from sites like Advisor World, changing your current financial practices is essential to living a balanced

For those unaware of the couponing space, the Fetch Rewards app is a game changer when it comes to earning rewards and gift cards in exchange for your grocery store receipts. The process is as simple as firing up the Fetch Rewards app and scanning the receipt into their database in order to earn Fetch

RebatesMe is an online coupon and cashback marketplace for online shoppers. Think of RebatesMe as a direct competitor of popular coupon and discount company with the likes of Rakuten and Honey. RebatesMe has a robust inventory of cashback opportunities for its 3,000 eligible storefronts worldwide. Apply promo code: 6KWTK1 for a $10 RebatesMe welcome sign-up bonus.

Merging finances and creating joint bank accounts may seem like the correct thing to do as a couple, especially when newlywed. Well, after surveying over 1,000 Americans this study discovered that 20% of people regret merging their finances with their partner. To make things worse, those same couples argue about money once a week on

Even though many people believe that college students are mature enough to understand the key life aspects and establish priorities, it is not always the case. If you watch the behavior of an average person in their 20s, you will see a kid who pretends to be an adult. Too many parents practice helicopter parenting,

The majority of students are from ordinary families so they may have some difficulties with money. To avoid them, students must learn budgeting tips and manage their money wisely. There are almost no students who don’t face money issues. But despite all this, college time is great because it’s a period when teens become adults.

Financial struggles come and go, and sometimes, even the most well-thought-out budget needs to be narrowed a bit. If you're finding yourself at a loss for how to pinch more pennies, these five tips will help you reduce spending, save more and find some wiggle room in your already tight budget. Although it's difficult making

There are lots of great ways to save money. Perhaps you are already implementing some of them such as not eating out as much, spending less on entertainment, or walking more to save on gas. You have got all the obvious money-saving tips covered. That's awesome! However, there are always more ideas you could try

Chances are you may have a pile of receipts sitting somewhere in a sock drawer waiting to be disposed of. But today, after reading this post, your view of receipts may change entirely. What if I told you that for almost every grocery store receipt, your receipt is eligible for monetary cash back rebate? Yes.

Your 30s are a pivotal decade in your life for various reasons. For many people, you're likely settling into your career, perhaps growing a family, or just trying to enjoy a fast-paced life. As it turns out, your 30s are just as critical to your financial journey as these other aspects. By making strong financial

Practicing frugal habits while shopping can be quite difficult. However, with some patience and online research, it can be accomplished. The internet is a great communication tool for making and increasing net worth. There are many different money making websites and apps on the market today. Take for example the new mobile receipt scanning apps.

When we step back and take an overall look at our finances, there’s a good chance you can see a fair bit of room for improvement. Many of us have a whole lot on our plate with regards to daily expenses and lack of free time to focus on finances, and so our bank accounts

Figuring out which is the best cashback shopping site may net you a substantial amount of cashback, especially if you are one to do a lot of shopping online. With many cashback shopping sites like Rakuten and BeFrugal offering cashback on over 2,000+ eligible store vendors, chances are you may be missing out on some